Solar supply, demand, and a foreign policy shakeup

As the solar market enters the busy season in September and October, module utilization rates are reaching 70% to 85%. However, structural shortages remain in the supply chain, with polysilicon supply running short in the face of high demand, writes PV InfoLink analyst Amy Fang. Prices, which were expected to stabilize, rose again in the second half. High module prices will cast a shadow on demand in the fourth quarter, prompting module manufacturers to postpone delivery for some orders from the second half into next year.

Large clusters of solar power stations

In the last of the series, solar pioneer Philip Wolfe looks at areas where solar generating stations are clustered together, without the coordination of organised solar parks.

China can ensure a 1.5C world – and continue to dominate the global clean energy supply chain

A report by the IEA laying out two routes for China to reach net zero attempts to persuade policymakers to gun for that goal by 2050, rather than ten years later, and dangles the prospect of continued global dominance as the main reward on offer.

Silicon metal and aluminum industries hit by China power shortages

A combination of booming demand for coal-fired power and a shortage of the black stuff – exacerbated by a political row with Australia – have forced up prices to the extent fossil fuel generators are making a loss on every unit of electricity they produce. pv magazine‘s Vincent Shaw considers the potential solutions.

REIPPP: One of the world’s best renewable energy tenders, but there’s room for improvement

South Africa’s Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) never ceases to amaze in terms of how different, exciting, competitive, and tough project bid submissions can be from one round to the next.

KPIs solar operators should be tracking to overcome the data deluge

The efficient and effective management of renewable energy generation assets relies on two critical pillars: trust in data, and the ability to consolidate data in ways that quickly and concisely communicates the information it contains.

The world’s largest solar parks

In the third of a series of four blogs, solar pioneer Philip Wolfe lists the world’s largest solar parks. In these articles, a “solar park” is defined as a group of co-located solar power plants.

Trolley car conundrum

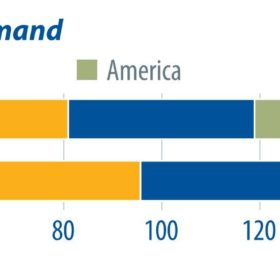

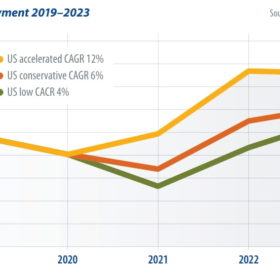

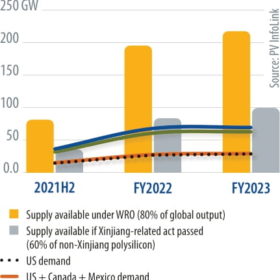

The U.S. solar industry faces a moral dilemma, writes Paula Mints of SPV Market Research. Either continue to deploy projects and set aside concerns about forced labor in China’s Xinjiang region, or source PV cells and modules from elsewhere, while bearing higher costs, in the pursuit of urgent action against climate change.

Polysilicon amid international trade disputes

Polysilicon capacity is unable to catch up with rapid capacity expansion in the mid and downstream segments, writes Corrine Lin, chief analyst for PV InfoLink. New polysilicon capacity requires big capex investment and a lead time of more than two years to complete construction and reach full operation. With unbalanced capacity between the upstream and downstream segments, polysilicon prices have been rising since the second half of 2020, with prices for mono-grade polysilicon surpassing CNY 200/kg ($27.40) in June 2021, up more than 250% year on year.

The world’s largest solar power plants

In his second article, Philip Wolfe founder of Wiki-Solar lists the world’s largest individual solar PV power plants. The biggest solar parks and other clusters of plants will be listed in subsequent blogs.