ILB Group to acquire Malaysian solar business, assets

Malaysia’s ILB Group Bhd is acquiring Armani Sinar and its solar assets for MYR 98 million ($21 million) in cash. This deal will increase its PV capacity from 13 MW to 30 MW.

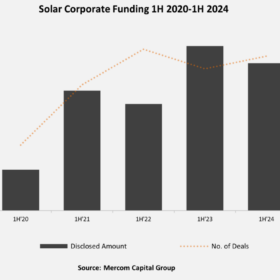

Solar corporate funding hits $16.6 billion in H1

Corporate funding in the solar sector reached $16.6 billion in the first half of this year, according to Mercom Capital Group. It says most funding came via debt financing, as venture capital and public market financing fell.

Hungary refinances rebate scheme for residential solar

The Hungarian government is investing an additional HUF 30 billion ($83.9 million) into its HUF 75.8 billion rebate program for residential solar and storage systems. The scheme, which launched in January, is now expected to support more than 25,000 households.

The Hydrogen Stream: Germany grants €4.6 billion to 23 green H2 projects

The German government has granted €4.6 billion ($5 billion) for 23 green hydrogen projects, while BP has revealed separate plans to develop a 100 MW green hydrogen installation in Germany.

Naked Energy secures GBP 17 million of new equity

Naked Energy has obtained GBP 17 million ($22 million) in new equity. The UK-based photovoltaic-thermal (PVT) system supplier says the investment, led by E.ON and supported by Barclays, will help “supercharge its global expansion.”

Brookfield acquires controlling stake in Leap Green Energy

Brookfield will initially invest more than $200 million in Leap Green Energy by subscribing to new shares and acquiring shares from current shareholders.

Grenergy secures financing for two phases of world’s biggest battery project

Madrid-headquartered independent power producer (IPP) Grenergy has reached financial close on the first two phases of its Oasis de Atacama solar and battery energy storage hybrid project in Chile.

Enfinity Global secures $162.4 million for 250 MW solar portfolio in Japan

Enfinity Global has closed $162.4 million in financing for a 250 MW solar portfolio in Japan. The seven utility-scale projects are expected to produce 300 GWh of clean energy per year.

Longi, Aiko Solar, TCL Zhonghuan, Tongwei to post H1 losses

Longi says it expects a net loss of CNY 4.8 billion ($660.2 million) for the first half of 2024, while Tongwei is bracing for a CNY 3 billion loss. Aiko Solar and TCL Zhonghuan, meanwhile, are predicting losses of CNY 2.9 billion and CNY 1.4 billion, respectively.

Candi Solar Secures $38 million to support clean energy in Africa, Asia

Philippe Flamand, the director and co-founder of Candi Solar, tells pv magazine about the company’s recent $38 million funding round and its plans to deploy renewables in emerging markets.