Rising hardware costs slow Covid recovery for off-grid solar sales

The global off-grid solar appliance market began an uneven recovery from the worst ravages of the global pandemic in the second half of last year, according to market body GOGLA, but more finance and policy support must be made available to have any chance of achieving universal electricity access this decade.

ESMC criticises lack of solar manufacturing in Euro recovery plans

The trade body has highlighted a lack of explicit PV industry support in EU member states which already host domestic manufacturers, such as Germany, France, Austria, Belgium and Lithuania, and says the focus on green hydrogen could exacerbate the solar trade deficit with Asia.

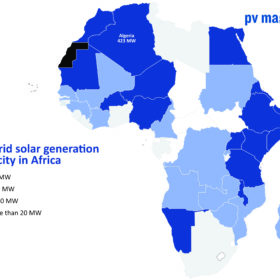

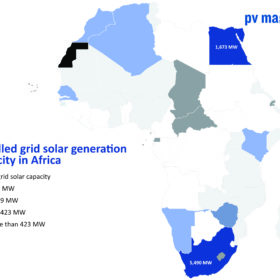

Solar dried up in North Africa during 2020

Politicians across the continent will have to decide between their heavily-indebted state utilities or embracing the energy transition, according to one energy analyst.

IEA highlights solar’s dependence on Chinese copper processing

The sheer volume of new power lines which will be required to accommodate the rising tide of solar installations ensures copper has been included by the International Energy Agency on its list of minerals which must keep flowing if the energy transition is to stay on course. And it’s not production that’s the potential bottleneck.

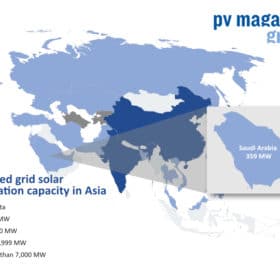

Saudi Arabia’s 1 GW solar tender invites bids by June 3

The 1.2 GW, Covid-delayed third round of the kingdom’s clean power program is back up and running, despite the fact the top news story on the relevant government department’s website is dated April 2020.

Eurostat figures confirm rise of renewables during Covid-hit 2020

While solar, wind and hydro generated 80 TWh more electricity last year than in 2019, coal and oil use fell in every EU member state, and Greek energy emissions fell almost 19%.

China’s Covid recovery saw green bond issuance rebound in second half of 2020

The $18bn worth of sustainable finance instruments floated in the nation last year marked a retreat from previous highs but, with most of the bonds issued from July onwards, the recovery is under way, according to the IFC, which is anticipating a more-than-$100 billion sector in emerging markets over the next three years.

African solar installers feel the pinch of rising panel prices

With Chinese manufacturers having warned they will pass on escalating component costs, and shipping expenses soaring since last summer, the rising price of solar is forcing some installers to redraft quotes, pv magazine has discovered.

India’s solar imports dipped 75% in ten months

Covid-19 disruption has been cited as the chief culprit as imports from China, Thailand and Vietnam slumped from April to January, but safeguarding duty also appears to have had an impact, with unaffected imports from nations such as Myanmar, Chad and Russia on the rise and Malaysian trade keeping steady.

Covid delays drove 20% dip in solar project revenue for Chinese developer last year

But new ventures into coal-fired steam and petrochemicals products helped state-owned China Shuifa Singyes towards a significantly healthier balance sheet in 2020.