Runergy plans another 6 GW of mono PERC manufacturing capacity by 2022

The fact solar manufacturers in China are still aggressively expanding output illustrates the strength of global demand for PV even as hopes for a rebound in Chinese installations appear to have been groundless.

China’s much-trailed second-half solar rebound has failed to materialize

The world’s solar superpower added only 16 GW of new generation capacity up to the end of last month, according to the head of the main industry association. Short of a ten-week miracle, the annual capacity figure seems set for a second consecutive steep annual decline.

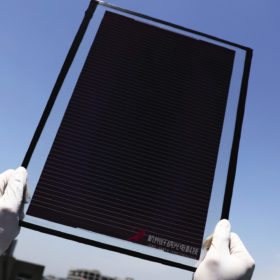

Microquanta achieves 14.24% efficiency with large-area perovskite solar module

The four-year-old Hangzhou-based business says it already has a 20 MW perovskite module pilot line and is working on a mass production facility in the city of Quzhou.

Tesla gigafactory orders see LG Chem supplant BYD as third biggest global battery supplier

The Chinese e-mobility company has been hammered since Beijing’s abrupt reduction of electric vehicle subsidies in the summer. Korean outfit LG Chem’s shipment volumes have gone in the opposite direction.

GCL wants a 1 GW perovskite cell production line in place by 2022

With the Chinese manufacturer claiming it has already hit 16% conversion efficiency on a large panel, a recent perovskite conference heard predictions the technology will make up the next generation of PV cells – provided it avoids the pitfalls experienced by thin-film devices.

How will China’s electricity price reform affect solar?

The nation’s plan for grid-parity solar – brought forward to ease a mounting public PV subsidy debt burden – could be left in ruins by a newly-announced scheme to part liberalize the electricity price, itself motivated by a need to bail out financially stricken state-owned power companies.

China set for 40 GW of pumped hydro storage next year

The showpiece 3.6 GW Fengning county project which will offer grid services and back-up power at the 2022 Winter Olympics is part of a 31.15 GW construction pipeline of projects, many of which are set to come into service next year.

Ukraine orders lift Risen up overseas module shipment rankings

The Ningbo-based manufacturer shipped more than a quarter of the panels it exported in the first six months of the year to the eastern European nation. All the big manufacturers posted rising shipment volumes as emerging markets made up for slow growth in their homeland.

China electric utility attracts record low module price in 3 GW procurement

The state-owned State Power Investment Corp Ltd has received a bid of 25 cents per watt for monocrystalline panels in a tender to procure 3.04 GW of PV module capacity.

Cell prices have tumbled again since early June

The latest figures show the solar policy vacuum, and related dearth of demand in China earlier this year accelerated price reductions for cell makers. Although prices are expected to rebound in line with renewed thirst for solar in China, cell makers such as Tongwei are feeling the pain.