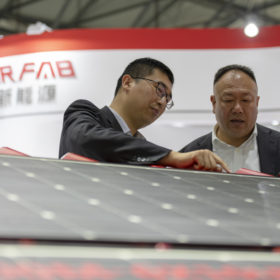

Chinese solar production juggernaut rumbles on

Three more PV manufacturers are jostling to announce plans to invest in an expansion of production capacities as the industry appears to make light of coronavirus fears.

Chinese solar giant steps in to acquire rival in $250m swoop

Longi Solar has dramatically stepped in to take over fellow Chinese manufacturer Zhejiang Yize New Energy Technology, which operates 7 GW of module production capacity and 3 GW of cell facilities in northern Vietnam.

Chinese giant doubles down on cell production expansion

The 5 GW of new production lines announced by JA Solar at the start of the year have now been doubled as the company also unveiled plans to rejig up to 3.6 GW of its existing facilities to accommodate bigger wafers.

Coronavirus could cause solar panel price spike

The coronavirus outbreak in China could raise solar module prices in the near term as manufacturers have already begun experiencing wafer and solar glass shortages. Production rates are also being affected by an extended new year holiday introduced by the authorities as a measure to deal with the virus, and the requirement workers from infected areas quarantine themselves for two weeks.

Change at the top of state grid could have ramifications for Chinese solar

The world’s largest utility has looked outside the energy industry for its new head for the first time in its history, apparently signalling a lack of patience in Beijing with the slow pace of implementing a lower electricity price and of guaranteeing purchase of all clean power generated in the nation.

Main shareholder of Chinese module maker ET Solar files for bankruptcy

The move, by Taitong Industry Ltd, will come as a fresh blow to the Chinese module manufacturer, which twice failed to go public – in the U.S. and China – and whose project development business suffered a battering in China when Beijing reined in subsidies in 2018.

The weekend read: The rise of M6

The shift to the larger M6 wafer format could occur faster than many have expected. Promoted heavily by mono giant Longi, the format is said to be a good fit for both cell and module production, while still allowing for relatively trouble-free integration into PV arrays. And it all began in China.

Breaking news: Zhonghuan Semiconductor up for sale

The body responsible for state-owned assets in the Chinese port city of Tianjin has approved plans to sell all or part of the solar manufacturer to outside investors – although the rumored beneficiary is thought to be partially state-owned itself.

China added 12 GW of solar last month for 30 GW annual figure

An insider at the China Photovoltaic Industry Association has told pv magazine there was an end-of-year rally after less than 18 GW of new capacity was installed to the end of November.

Newly re-listed JA Solar unveils production expansion plans

The Chinese manufacturer debuted on the Shenzhen exchange in mid December, after de-listing from New York’s NASDAQ in 2018. The company plans to roll out 10 GW of new module capacity and 5 GW of cell lines over four years.