Forced sale of Shunfeng projects will remove biggest overdue debt

Creditor Chongqing, which has been owed more than $100 million by the embattled developer for 14 months, will force through a sale of 180 MW of solar capacity to a third party. Shunfeng had originally wanted to sell the projects to Chongqing six years ago.

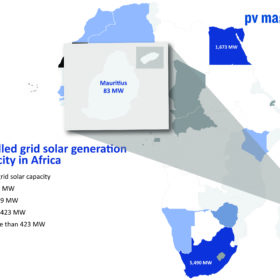

Mauritius unveils new home and business rooftop solar programs

One of the schemes is linked to household and commercial electricity customers who want to install a PV array to charge electric vehicles.

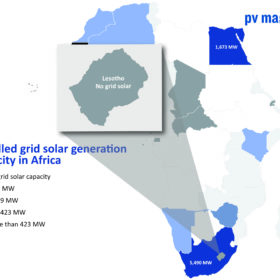

Scatec lands PPA for Lesotho’s first independently built solar plant

The nation’s first independently developed solar farm will have a generation capacity of 20 MW and will sell electricity to the national utility under a 25-year contract.

Chinese PV Industry Brief: Longi cuts wafer prices for first time in 18 months

The solar manufacturer has lowered the prices of its wafers by up to 9%. Elsewhere, Luoyang Glass wants to sell off three information display business units to focus its efforts on solar panel glass.

Chinese PV Industry Brief: Solar module prices drop for the first time in the past six months

Furthermore, polysilicon manufacturer Daqo will increase investments in its plans to expand capacity and Canadian Solar closed a strategic co-operation agreement with battery giant CATL.

A net-zero Canada would need 1.6 GW of solar per year from now on

Clean energy trade group the Canadian Renewable Energy Association has told policymakers CA$8 billion worth of solar and wind projects will be needed each year to decarbonize the electricity supply by 2035 and remove net emissions by mid century.

European Commission approves €2.3bn renewables incentive plan by Greece

Competitive bidding for onshore solar and wind will establish a clean-power strike price acceptable to successful developers under the contracts-for-difference approach. The incentive scheme is also applicable to biogas, biomass, landfill gas, hydropower, concentrated solar power, and geothermal plants.

Cheaper wholesale solar equipment through $10m group-buying fund in Nigeria

Two investors backed by the charitable foundations set up by energy giants have seed-funded the cash pot to lend to African solar companies, who will be able to buy solar kit cheaper thanks to the economies of scale offered by the aggregation of orders.

Belgian network to host 25 MW/100 MWh battery for grid services

The energy storage system, which is set to be up and running in around a year’s time, will be supplied by Finnish company Wärtsilä and will provide services including reserve power and frequency control response.

Germany will continue to dominate European home battery market – no matter who is in government

Industry association SolarPower Europe expects little change in the line-up of Europe’s biggest residential battery markets in four years’ time, with a rush of retrofits as turn-of-the-century solar feed-in tariffs begin to expire, set to keep Germany way ahead of the pack.