Brazil’s PV capacity hits 55 GW

Brazil has installed 37.4 GW of distributed solar and 17.6 GW of large-scale PV capacity to date.

Global battery industry enters new phase, says IEA

The industry will reach the 1 TWh demand milestone in 2024, with China producing more than three-quarters of the batteries sold globally. The concentration of the production chain in the country has led to a fall in costs and a possible technological shift with the focus on LFP batteries. Cooperation between countries can be strategic to diversify the battery production chain and create sustained demand, assesses the International Energy Agency.

Distributed generation surpasses 37 GW in Brazil amid concerns over curtailment

This type of generation could become the country’s second largest source of generation by 2029, according to the National Electric System Operator (ONS). Distributors should take a more active role in managing DG systems, which have been associated with centralized generation curtailment events, according to the ONS.

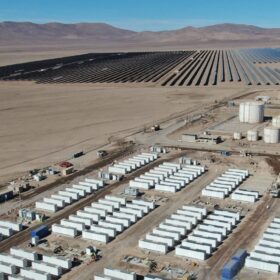

Brazil installed 269 MWh of energy storage in 2024

Consultancy Greener has estimated the state of Pará offers the most potential for battery rollout because of its high energy tariff. A report issued by the consultant also highlighted the big savings agribusiness could make by using batteries instead of diesel.

Problems with Brazil’s planned battery auction

A crippling tax burden; an inability to bank energy arbitrage income; and uncertainty about grid fees, network ancillary payments, and solar-plus-storage eligibility could all affect a procurement exercise planned for June.

Brazil approves six labs for solar module testing

Brazil’s national accreditation body, Inmetro, has authorized six labs across the country to test solar modules.

PV capacity reaches 52 GW in Brazil

According to the Brazilian Association of Photovoltaic Solar Energy (ABSolar), the PV sector has generated more than 1.5 million green jobs in the country since 2012. The recent increase in import taxes, however, is hampering that growth, the association warns.

‘Brazilian solar arrays will include energy storage by 2027’

Batteries will form part of the consumer picture within two to three years, according to Júlio Bortolini, from Brazilian conglomerate Soprano.

Solar hits 50 GW milestone in Brazil

Brazil reached the 50 GW solar mark by the end of October, with 33.5 GW of distributed solar and 16.5 GW of utility-scale PV, according to new data from Brazilian PV association ABSolar.

Brazil raises solar module import duty from 9.6% to 25%

Brazilian PV association ABSolar says the Brazilian government’s decision to raise the import duty on solar modules from 9.6% to 25% could slow the country’s energy transition and negatively affect ongoing projects.