History repeats as Iberian blackout demonstrates urgent need for battery storage

The vast blackout that gripped the Iberian Peninsula on April 28 has echoes of a similar event in an Australian state in 2016. The solution in both cases appears to be the same.

Tariff uncertainty grips US battery development

The Trump administration’s China tariffs have piled atop existing and developing trade barriers on battery energy storage systems, components, and materials – destabilizing the US energy storage industry. While existing inventories will allow project development to move forward in the short term, uncertainty extends across the supply chain, including to prospective manufacturers.

European utility-scale battery installations ‘ramping up’ as solar cannibalization bites, Rystad finds

With electricity market volatility increasing in many European countries, the opportunity for battery energy storage is expanding fast. Market analyst Rystad Energy expects battery installations to accelerate as project developers with falling solar capture prices and increasing frequency of negative price events.

U.S. solar manufacturing moving onshore and prospering

Efforts to establish solar manufacturing in the United States, on the back of generous Inflation Reduction Act subsidies, have had mixed results. While module assembly facilities appeared swiftly, cell production capacity trails far behind and current policy uncertainty is leaving more questions than answers for solar manufacturers of all sizes.

A 920% tariff on anode materials from China ‘would throw the economics of U.S. storage out of whack’

Battery installations in the U.S. are threatened by the imposition of anti-dumping, countervailing duties on active anode materials. The supply chain for Active Anode Materials (AAM) is dominated by Chinese producers, with attempts to establish the full supply chain outside of China years away.

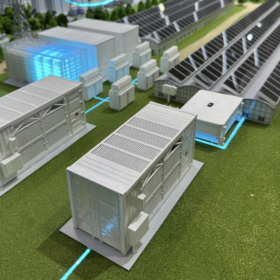

Australian utility-scale battery deployment surges

Big BESS battery energy storage systems (BESS) are booming in Australia, with almost 5 GW of projects under construction last year, according Rystad Energy. While encouraging, it reports that the volume remains insufficient to overcome growing rates of renewable curtailment.

TOPCon IP battle intensifies with Qcells launching infringement notices

Qcells has launched an intellectual property (IP) dispute over alleged unauthorized use of its patented laser-enhanced contact opening (LECO) tech in tunnel oxide passivated contact (TOPCon) solar cells. The case underscores rising tensions in the PV industry over TOPCon patents.

Stationary storage installations surge to 170 GWh in 2024

With expanding market opportunities and declining costs, stationary battery energy storage installations are surging. Battery makers are awake to the opportunity, says BloombergNEF, as stationary batteries account for an increasing amount of deployed capacity.

EV uptake helping drive increased demand for green steel

Emissions from steel production each year equal those of a major developed economy. Yet steel is a crucial material to support the energy transition, among its many other applications – making its supply essential. Enter green steel, the production of which interrelates with solar, wind, and green hydrogen in intriguing ways.

Australia has 7.8 GW of utility-scale batteries under construction

The volume of large-scale battery energy storage projects under construction in Australia passed that of solar and wind projects combined in 2023 and the trend has intensified this year, with batteries attracting federal support. As coal-fired power plants are shuttered, developers and suppliers are enjoying a battery bonanza.