European PPA prices declined in February, reflecting a broader downturn in energy commodity prices, while transaction activity held steady despite a decrease in volume, according to Pexapark’s monthly PPA report for March 2025.

However, the Swiss energy research firm noted that a record-breaking 40-year solar PPA was signed in Wales last month. It also highlighted emerging trends in battery energy storage systems (BESS) from the recent Energy Storage Summit 2025 in London.

Pexapark’s EURO Composite, a benchmark for 10-year “pay-as-produced” PPA prices, closed February at €50.25 ($54.35)/MWh, down 4.3% from €52.53/MWh in January. The decline mirrored falling commodity prices, with Germany’s Cal26 power contract sliding to €84.57/MWh and the Dutch TTF Cal26 gas contract ending at €36.90/MWh, after peaking earlier in the month.

Mild weather after a February cold snap, combined with bearish gas market signals, drove the decline, said Pexapark. Portugal recorded the largest PPA price decline at 10.9%, due to reference price recalibration, while Nordic prices rose 0.6%.

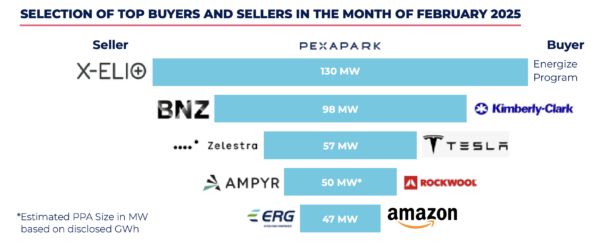

February PPA deal flow hit 679.8 MW across 24 agreements, a 14% drop in volume and 4% fewer deals than January, according to the consultancy. Compared to February 2024’s record 2,568 MW across 54 deals, this year’s figures reflect a 73.5% capacity decline. Notable deals included a 130 MW virtual multi-buyer PPA in Spain between X-Elio and the Energize Program, a 98 MW multi-country solar PPA between BNZ and Kimberly-Clark, and a 57 MW solar PPA in Spain linking Zelestra and Tesla.

Pexapark singled out UK developer Innova's 40-year, 15 MW solar PPA in Wales with Dŵr Cymru (Welsh Water) as a particularly notable deal, surpassing Europe’s previous 30-year tenor record. The agreement, tied to the Wrexham and Cefn solar farms, marks a shift toward longer-term agreements, with construction set for 2025.

“We have seen long-term PPAs in Europe ranging between five and 25 years, with the longest tenor recorded so far being 30 years,” Pexapark noted, describing the Welsh PPA as a “landmark” deal.

The research firm quoted one asset owner at Energy Storage Summit 2025 as saying that, unlike in the United States, Europe rewards operating solar and BESS assets separately, with AC-coupled setups preferred for their flexibility. However, valuation challenges persist, with one investor telling Pexapark that it can be difficult to precisely value co-location, “at least not more than standalone storage in a portfolio.” The discussions at the summit also reportedly focused on tolling deals and financing innovation as key drivers of deployment, said the company.

Pexapark also noted that Italy’s new Transitional FER X Decree, effective Feb. 28, 2025, is poised to accelerate renewable energy growth by offering incentives for 10 GW of solar, 4 GW of wind, and additional capacity for smaller hydro and biogas projects by the end of this year.

It said that February’s stable deal flow for smaller volumes reflects a maturing PPA market, while ongoing discussions in the BESS sector underscore how the industry is adapting to new challenges and opportunities.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.