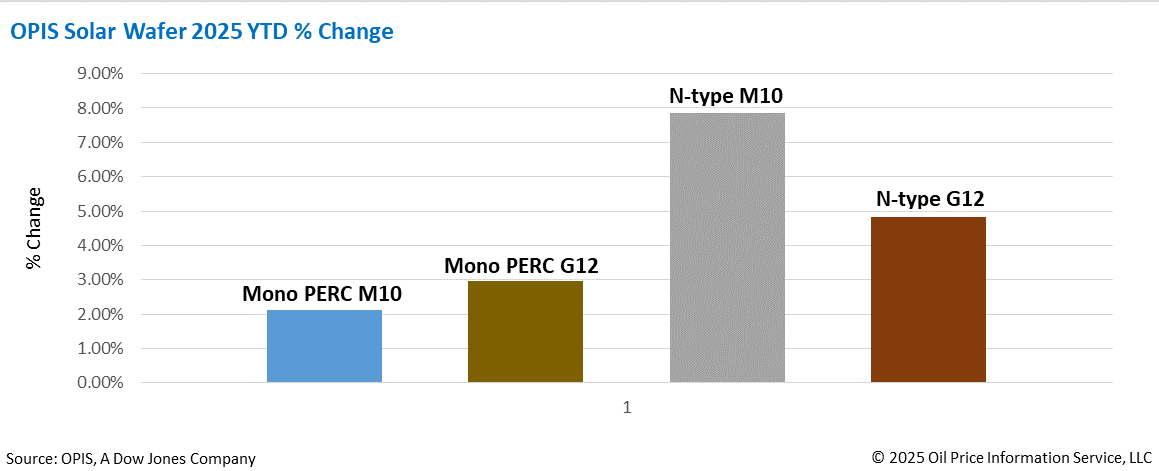

FOB China prices for G12 wafers remained stable this week, with Mono PERC G12 wafers priced at $0.208 per pc and n-type G12 wafers at $0.196/pc. In contrast, M10 wafer prices saw an increase, with Mono PERC M10 wafers rising to $0.145/pc and N-type M10 wafers reaching $0.151/pc, reflecting week-on-week increases of 0.69% and 1.34%, respectively.

The price increase in wafers is primarily driven by a surge in domestic solar installation projects in China, resulting in limited export availability. The heightened procurement activity, supported by two new solar power policies set to take effect in May and June, has extended to the wafer segment, significantly boosting wafer demand. Reports indicate a temporary, slight supply tightness, with certain cell manufacturers actively engaging with major wafer suppliers to secure supply commitments.

While the current price trend is expected to remain stable through the second quarter, industry sources cautioned that the implementation of the aforementioned new solar power policies could dampen end-user demand for photovoltaic products in the third quarter, exerting renewed pressure on wafer prices.

On the product side, a market participant observed an increase in Mono PERC wafer production, attributing this trend to patent-related challenges affecting TOPCon and BC cell production. These challenges have made Mono PERC cell production a lower-risk alternative.

In the global market, a company in Cambodia is reportedly set to launch a 2 GW ingot production facility in May. This facility currently operates a 2 GW wafer-slicing plant, relying on ingots sourced from China, according to trade sources.

Meanwhile, a Chinese manufacturer that recently established a new 3 GW wafer-slicing plant in Laos is facing challenges in securing customers. Following the inclusion of one of its factories in China on the U.S. non-traceability-compliant entity list in January, some customers have shifted to competitors to mitigate export risks to the U.S. market.

India's Ministry of New and Renewable Energy (MNRE) has tightened domestic content requirement (DCR) rules, restricting the use of imported diffused wafers (blue wafers) in locally manufactured solar photovoltaic cells, according to a March 11 notice.

Industry sources revealed that India's blue wafer imports primarily come from overseas cell manufacturers rather than wafer producers, as diffused wafers are considered partially manufactured solar cells. The policy aims to reduce reliance on semi-processed imports by encouraging Indian manufacturers to invest in texturing and diffusion equipment for in-house cell production. However, one source cautioned that while restricting undiffused wafer imports may lead to increased diffused wafer imports, scaling up domestic diffusion capabilities will take time.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.