From pv magazine India

Indian solar manufacturers must prepare for potential disruptions from Chinese price competition and possible US tariffs on Indian goods. To navigate shifting trade conditions, they need to diversify markets, expand domestic production, and improve product quality, said a new report by Rubix Data Sciences, a risk management and monitoring platform.

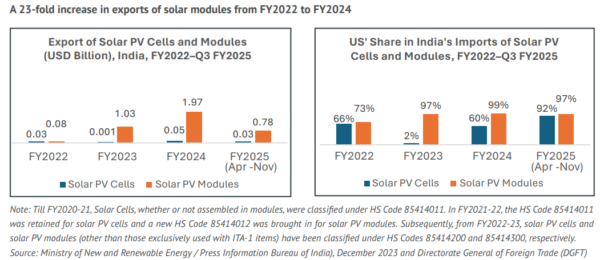

Recent US tariff hikes on Chinese solar-grade polysilicon, silicon wafers, and PV cells – now totaling 60% – present both opportunities and risks for India's solar industry, the report said. With the United States accounting for more than 90% of India's solar module exports in fiscal year 2024, manufacturers such as Waaree Energies, Adani Solar, and Vikram Solar could benefit as Chinese competitors face higher costs.

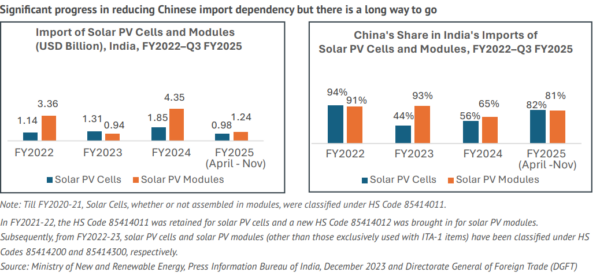

Stronger access to the US market could drive further export growth. However, India relies on China for more than half of its PV cell and module components, particularly polysilicon and wafers. If China diverts excess supply to India at lower prices to offset U.S. losses, domestic manufacturers may face margin pressures and intensified price competition.

The United States has also signaled potential reciprocal tariffs on Indian goods starting in April 2025, which could weigh on India's solar exports, the report said. Higher tariffs would erode the cost advantage of Indian solar modules in the US market, posing a challenge to the industry's rapid export expansion.

The United States remains India’s dominant export market, with its share of India’s solar cell and module exports rising from 66% and 73% in 2022 to more than 90% in fiscal year 2024, said Rubix Data Sciences.

India’s installed solar capacity has grown at a 38% compound annual growth rate (CAGR) over the past decade, surpassing 100 GW, said Rubix Data Sciences. The country added a record 24.5 GW of solar capacity in fiscal year 2024, more than doubling the previous year’s installations. Rubix Data Sciences pointed to a push for self-reliance, with solar module imports from China falling from more than 90% in fiscal year 2022 to 65% in fiscal year 2024, while exports surged 23-fold to nearly $2 billion.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.