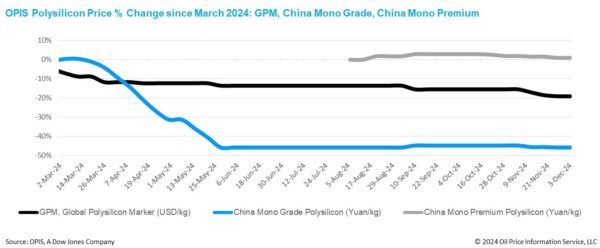

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was assessed at $21.130/kg, or $0.048/W this week, unchanged from the previous week.

The highly anticipated preliminary determinations in the antidumping duty (AD) investigations of cells and modules from four Southeast countries, which are considered a critical factor shaping global polysilicon sales, were announced by the U.S. on Nov. 29. The AD rates range from 0% to 271.28%, varying by country and manufacturer, with most enterprises assigned specific tariff rates falling within the 50% to 90% range.

Buyers and sellers in the global polysilicon market remain uncertain about their next steps amid upcoming developments. Several major buyers emphasize the need to monitor market conditions before revising their cautious approach to procurement, indicating the current sluggish state of the market is likely to extend.

Opportunities lie in the dynamics between module supply to the U.S. and the corresponding end users, as one buyer stated. While reduced imports and higher costs from four Southeast Asian countries could drive up U.S. module prices, a key question is how much of this price increase U.S. solar developers can absorb, and to what extent it can offset the 201, CVD, and AD tariffs.

Amid ongoing uncertainty, global polysilicon sellers have emphasized the importance of prioritizing extensive customer visits to gain firsthand insights into their current circumstances and future plans.

Nevertheless, the upcoming addition of new cell production capacities in countries such as Laos, Indonesia, Oman, India, and the U.S. over the next year could create a pathway for Southeast Asian wafers, thereby contributing to a more favorable outlook for global polysilicon.

China Mono Grade, OPIS' assessment for mono-grade polysilicon prices in the country, remained steady at CNY 33 ($4.55)/kg, or CNY 0.074/W this week. China Mono Premium, OPIS’ price assessment for mono-grade polysilicon used for N-type ingot production, likewise held steady at CNY 39.375/kg, or CNY 0.089/W, unchanged from the previous week.

While polysilicon transaction prices have remained stable this week, reports indicate the emergence of exceptionally low offers. Some Tier-2 and Tier-3 manufacturers, facing outstanding debts to raw material suppliers, are reportedly using polysilicon as repayment, causing the raw material suppliers to sell the received polysilicon at 5% to 10% below mainstream rates.

Chinese polysilicon manufacturers are further scaling back production, with total output for December projected to fall below 90,000 MT, a significant decrease from approximately 130,000 MT in November. Additionally, a leading manufacturer with a production capacity of 65,000 MT by the first half of 2024 is expected to produce only around 20,000 MT in December, reflecting an operating rate of less than 50%.

Insiders expect polysilicon prices to decline further in December, driven by year-end discounts that manufacturers typically offer to boost cash flow, particularly this year due to the significant downturn and sustained losses. These discounts help cover year-end financial obligations such as bank interest, supplier payments, and employee compensation.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.