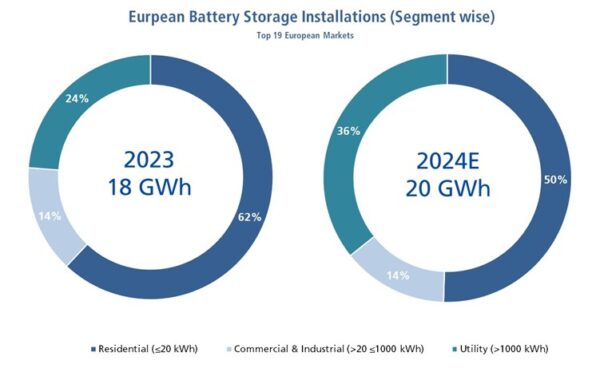

Europe’s photovoltaic (PV) and Electrical Energy Storage (EES) markets are undergoing a fundamental transformation. While small-scale PV and EES projects have historically driven market growth, there is a distinct and gradual shift toward commercial & industrial (C&I) and utility-scale projects.

The shift away from small-scale residential PV projects is driven by several macroeconomic and policy factors. First and foremost, the pull-forward effect of the war in Ukraine. The conflict accelerated demand as governments, businesses, and households rushed to secure energy independence amid soaring electricity prices and disrupted fossil fuel supplies. Emergency policy measures, expedited permitting, and high economic incentives further condensed expected growth into a short period. This in turn meant that fewer new customers were in the market in 2024, leading to slower demand for premium brands that rely on first-time buyers. Furthermore, with module prices dropping and markets becoming more price-competitive, many consumers opted for lower-cost alternatives rather than premium systems.

According to EUPD Research’s 2024/2025 Germany PV & EES InstallerMonitor© report, based on a survey conducted with 374 German installers, the decline in module prices affected installation companies, too: 18% declared that they were adversely affected by the price drop, while another 19% stated that they faced both negative and positive effects.

Among firms experiencing a negative impact, almost 80% said that it became more difficult to justify premium services or higher margins because of customer expectations for continually lower prices. This dynamic especially affected the installers specializing in residential installations: among them, the share increases to 83%, while it was slightly lower – 76%– among installers who are also active in the commercial segment.

Furthermore, in a survey of more than 6,000 participants by EUPD Research’s SolarProsumerMonitor© 2024/2025 in Germany, 28% of the PV owners stated that their PV system was installed in 2023 and 16% in 2024. With regard to storage, 36% of participants stated to have acquired a residential storage system in 2023 and a smaller percentage in 2024.

What increased the pressure on the residential segment was that economic pressures, including higher inflation and interest rates, have reduced the purchasing power of average residential consumers (as seen in Sweden). The pinch was felt more exclusively in the storage sector, where according to the above-mentioned survey by EUPD Research, the most mentioned reason for not (currently) being interested in installing a storage system was the lack of (economic) profitability of a storage system, followed by high storage prices.

To ease this burden, some governments have capped residential electricity tariffs. But not surprisingly manipulated residential electricity tariffs, made PV and storage investments less attractive (as in Poland and Hungary). Additionally, the PV boom of 2023 (as mentioned above), combined with low module prices, prompted certain governments to adjust their regulatory frameworks, causing residential consumers to lose confidence in their investments (as observed in Belgium and Sweden). Meanwhile, EU member states must meet their 2030 PV targets despite economic pressures and labor shortages, which pose challenges for the labor-intensive and relatively costly residential segment. As a result, many countries, including the top European markets known for their dominant residential segments (e.g. Germany, Italy, and France), are prioritizing larger-scale projects, particularly in the commercial & industrial (C&I) and utility-scale segments.

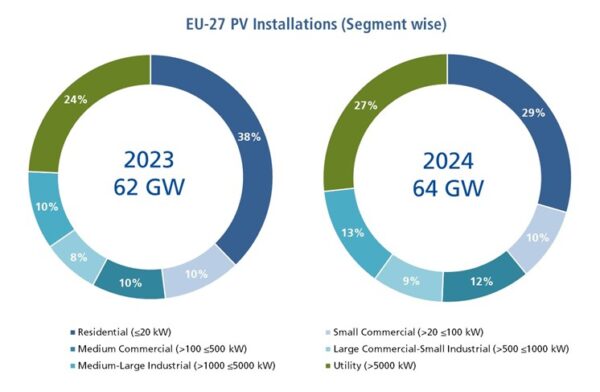

The overall impact of the above dynamics can be seen in the below charts, where between 2023-2024, the share of C&I rose from 38% to 44% and the utility-scale segment from 24% to 27%. Meanwhile, the share of the residential segment had a 9% decline.

Another impact was that the installers found out that they should adjust their demand toward higher performance systems. As our PV & EES InstallerMonitor© report shows, modules above 450 W account for as much as 19% of the capacity installed in 2024 by installers active in the commercial segment, compared to only 9% for residential-only installers. The proportions are almost perfectly reversed for modules below 350 W, which account for only 9% of the capacity installed by C&I installers. Consistently, the average share of storage systems over 20 kWh out of the total systems installed in 2024 is 15% among commercial installers, more than twice as high as among purely residential installers – 7%.

As this segmental shift gains momentum, the scale of investment and the complexity of maintaining projects in the new segment demand specific risk mitigation strategies. Consequently, investors, developers, EPCs, and—most importantly—C&I and utility-scale customers must reassess the criteria they use to select the most valuable and sustainable brands.

Against such a background, EUPD Research has evidence that a brand’s long-term value and sustainability in the European market will be defined by:

- Financial Strength & Resilience: In an increasingly competitive and volatile market, consumers must ensure their maintenance. They need to make sure the brand they are opting for will not go bankrupt ideally within the lifespan of the product.

- Reputation & Consumer Trust: The best advertisement for a brand is what the installer and prosumers think about them. All brands are tier one and number one, but the real tier ones are those who have already won the hearts and minds of the installers and prosumers.

- Innovation & Market Adaptability: As the European markets are reaching maturity, competition is becoming more ferocious. Those brands with the highest innovation will be the most resilient.

- and ESG Performance & Compliance: Apart from the European ESG mandates, the consumers always need to make sure the brand they are opting for is in compliance with the European sustainability criteria.

Image: EUPD Research

With this transformation, the risks associated with selecting PV and storage brands have intensified. Manufacturers operate in a highly competitive market, where price pressures and supply chain volatility can lead to financial distress, if not outright bankruptcy. EUPD recognizes that a low-price strategy alone is unsustainable—not just for the solar sector as a whole, but also for suppliers. Major brands are facing financial losses, while smaller players risk bankruptcy, creating an unstable market. In a market of quasi-homogeneous goods, a price-driven approach may seem logical—but it is NOT A STRATEGY! It’s simply the blind leading the blind, driving the industry toward unsustainable margins and instability. True market leadership requires differentiation, innovation, and data-driven decision-making.

Investors and project developers must, therefore, go beyond traditional metrics and adopt a more holistic approach when evaluating potential suppliers. To ensure a win-win scenario for all stakeholders (manufacturers, intermediaries and consumers), EUPD offers the solution: pure, high-quality primary data from manufacturers, intermediaries, and customers, combined with precise secondary data.

EUPD Research Brand Leadership & Sustainability Rating: A Risk-Averse Approach

To aid stakeholders in this critical selection process, EUPD Research has developed the “Brand Leadership & Sustainability Rating – Europe”. This comprehensive rating system is designed to offer a multidimensional assessment of PV brands based on four weighted parameters:

- European Installer, EPC and Prosumer Monitor – Evaluating market perception, brand trust, and adoption trends among key industry stakeholders.

- Environmental, Social, and Governance (ESG) and Innovation Performance– Assessing manufacturers' ESG performance along with their commitment to R&D and technological advancement.

- Price Performance Ratio – Analysing the balance between pricing and performance to ensure cost-effective, high-quality solutions.

- Financial Health Analysis – Measuring financial stability and insolvency risk to determine the longevity and market presence of a brand.

By integrating these parameters, the rating provides a well-rounded perspective that helps investors mitigate risks associated with supplier insolvency and fluctuating market dynamics.

Navigating the Future with Confidence

For C&I and utility-scale investors, informed decision-making has never been more critical. The shift to larger-scale solar projects demands greater capital commitments and longer payback periods, making it essential to partner with financially stable and forward-thinking manufacturers. The Brand Leadership & Sustainability Rating provides a structured, data-driven approach to evaluating potential suppliers, helping stakeholders mitigate risks and navigate market uncertainties. By aligning the interests of both manufacturers and investors, this rating serves as a strategic safeguard—ensuring that every investment is backed by reliability, resilience, and long-term value. In a market where brand resilience can make or break an investment, this rating provides the clarity needed to mitigate risks and maximize returns. By embracing a holistic approach to brand evaluation, stakeholders can turn uncertainty into opportunity—ensuring that Europe's solar and storage future is not only bright but also secure. THAT’S THE WAY!

Authors: Markus A.W. Hoehner and Ali Arfa

Markus A.W. Hoehner is the Founder, President and Chief Executive Officer of Hoehner Research & Consulting Group and EUPD Research. He has been active in top-level research and consulting, focusing on cleantech, renewable energy, and sustainable management for more than three decades. He can be reached at m.hoehner@eupd-research.com.

Ali Arfa is a Senior Data Manager at EUPD Research. He is a graduate of the University of Bonn and with a background in European and North American politics. His expertise encompasses market research, policy development, and stakeholder analysis. His particular focus is on solar energy, energy storage, and strategic consultation. He can be reached at a.arfa@eupd-research.com.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.