Pexapark said in a new report that corporate PPAs soared across Europe last year, with a 14% year-on-year increase in long-term contracts, despite an overall decline in contracted volumes.

Corporate buyers drove this growth, contributing to a 26% rise in deal-making activity, according to the Switzerland-based research firm. It said that corporate PPA activity hit a record high, with 316 long-term contracts signed.

However, overall contracted volumes fell by 11% compared to 2023, largely due to a 59% year-on-year decline in utility-scale PPAs. Corporate offtake volumes fell by a marginal 1%, said Pexapark.

While net-zero goals remain a key demand driver, market risks such as price volatility, competition from contracts-for-difference (CfD) schemes, and higher costs weighed on corporate risk appetite. Despite these challenges, the market showed resilience, embracing innovative deal structures such as mixed-technology PPAs and battery storage agreements to adapt, according to Pexapark.

Pexapark recorded a total of 15.2 GW in disclosed contracted volumes in 2024, representing an 11% decline from 2023. The most significant trend affecting overall volumes was the plunge in publicly disclosed utility PPAs, down 59% year on year. In contrast, disclosed corporate offtake volumes fell by just 1%, according to Pexapark.

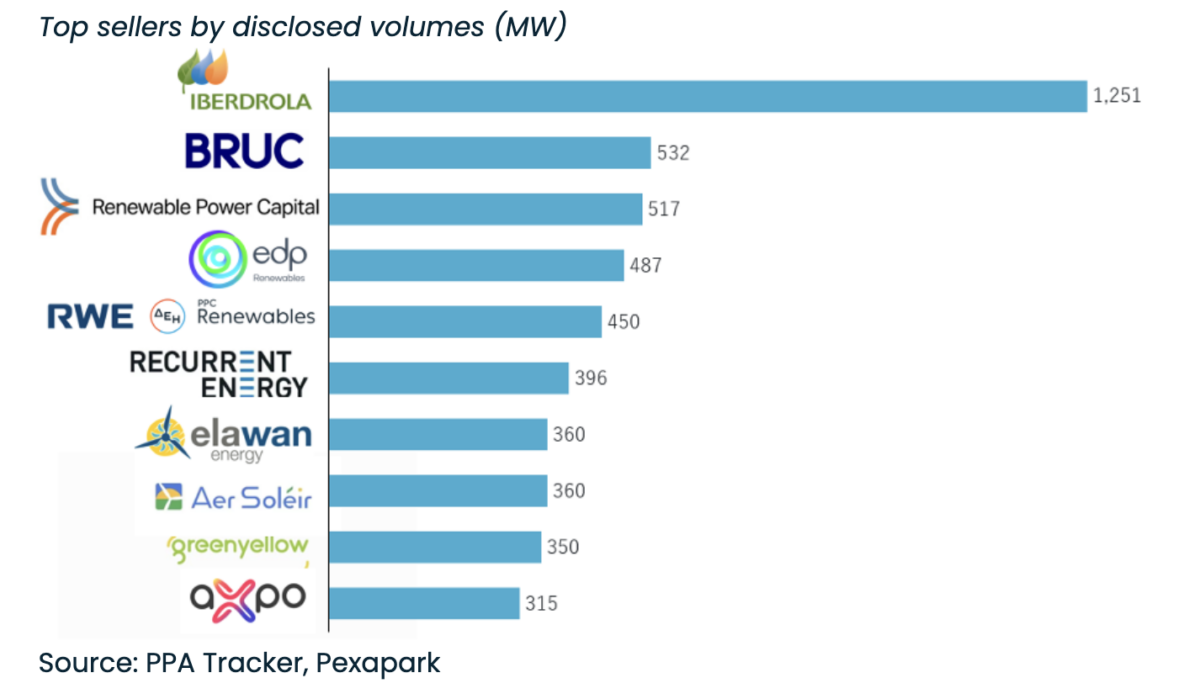

The research firm said that Spain led the European market with 4.66 GW of contracted volume. It was followed by Germany, which recorded the highest deal count, with 48 transactions totaling 2.04 GW. Iberdrola maintained its position as the top seller, while Amazon topped the corporate buyers list with 1.5 GW across six deals.

“In 2024, the PPA market proved its ability to innovate facing the new realities of increased renewables penetration, as the challenges of negative pricing and cannibalisation have forced a rethink of traditional approaches,” said Pexapark COO Luca Pedretti. “Multi-technology PPAs for firmer profiles, Multi-buyer models, and innovation in energy storage offtakes signal strong resilience. By adapting to these new realities, the industry can overcome obstacles and continue driving the energy transition forward.”

Last week, Pexapark said it recorded 27 European PPAs for 2.09 GW of capacity in December 2024, making it the second-strongest month of the calendar year. The month saw a 105% increase in disclosed volumes and a 50% rise in deal count compared to November 2024.

Earlier this month, Spain announced 820 MW of energy storage projects for applications in the fourth quarter of 2024, including several by Iberdrola.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.