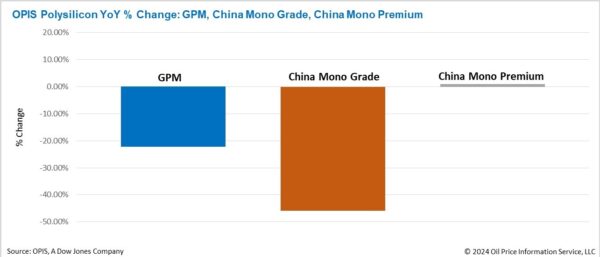

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was assessed at $20.360/kg, or $0.046/W this week, flat from the last assessed price on December 17 on the back of unchanged market fundamentals.

Some GPM manufacturers have reportedly resorted to production cuts, with operating rates dropping to approximately 30% during certain periods. However, demand remained sluggish and suppliers are reluctant to lower prices further, stifling market transactions and hindering any revitalization efforts.

Despite these challenges, optimism remains regarding the GPM market's prospects, given its close ties to trade policies. On the one hand, as modules made with traceability-compliant Chinese polysilicon are not entirely excluded from the U.S. market, China's low-cost products continue to weigh on GPM pricing. On the other hand, industry insiders view the potential implementation of clearer and stricter U.S. restrictions on Chinese solar products as a “critical pathway” for revitalizing the global polysilicon market and express confidence in the likelihood of such measures being introduced.

The China Mono Grade, OPIS' assessment for mono-grade polysilicon prices within the country, remained stable this week at 33 yuan/kg, equivalent to CNY 0.074 ($0.010)/W. Meanwhile, the China Mono Premium, OPIS’ price assessment for mono-grade polysilicon designated for n-type ingot production, experienced a slight uptick of 0.96%, reaching CNY 39.375/kg, or CNY 0.089/W, compared to the last assessed price on December 17.

In the final week of 2024, China's two leading polysilicon manufacturers, Tongwei and Daqo, issued official statements announcing production cuts. Both companies cited adherence to a previously signed “self-regulation agreement,” aimed at controlling production capacity and curbing harmful competition, as the rationale behind these reductions. While the specific scale of these production cuts was not disclosed, OPIS market surveys revealed that one of the manufacturers has fully halted operations at its facilities in Yunnan and Sichuan. Currently, only its Baotou production base in Inner Mongolia remains operational, with a monthly output of approximately 20,000 MT. Considering the company's annual production capacity of roughly 900,000 MT, this equates to an operating rate of approximately 26%.

The industry widely anticipates that the issue of overcapacity in polysilicon production will persist until 2025. China's polysilicon inventory of 400,000 MT by the end of 2024 could sustain wafer production for four months without new output. Furthermore, it was emphasized that administrative measures, such as “self-regulation” to maintain low operating rates, could become a standard practice in 2025.

The official launch of polysilicon futures trading in the final week of 2024 is believed to have contributed to this week's n-type polysilicon price increase. Experts see this initiative as a potential solution to alleviate inventory overhang, stabilize prices in 2025, and address excess capacity. However, no wafer producers have yet purchased polysilicon through the futures market, with most participants being traders. This suggests that futures trading is still in its early stages. At present, insiders estimate that the impact may be more financial than physical, with actual physical deliveries expected to account for only 30% to 50% of total trading volume.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.