From pv magazine print edition 12/24

The rationale for moving from 1.5 kV voltage to 2 kV in solar projects is grounded in electrical principles, particularly the relationship between electric power (P), current (I), and voltage (V) – expressed as P=IV. By increasing voltage while keeping current constant, power output can be increased without additional losses. This transition is expected to yield a 0.5% to 0.8% increase in energy yield for PV sites.

Higher voltages accommodate longer module strings. A 1.5 kV system can accommodate 33 modules rated at 45 V of direct current, while a 2 kV system can fit 44 modules – representing a 33% increase in power capacity. Longer string length means fewer strings. This helps decrease electrical balance of system expenditure, including costs for combiner boxes, connectors, and cabling, by 10% to 15%. The number of inverters needed should also decrease, as higher voltages accommodate more power-dense electronics.

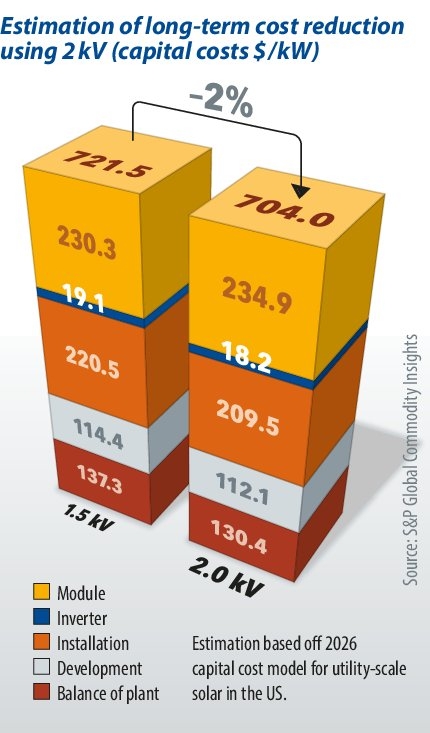

While 2 kV inverters cost more because of a smaller scale of manufacturing of some components and increased testing requirements – the long-term outlook is still positive. Switching to 2 kV will make inverters more power dense, saving on casings, fuses, and other components. Fewer solar project components should reduce labor costs and mean lower operation and maintenance (O&M) expenses. That could mean 1% to 2% lower capital costs, eventually, plus higher energy yield.

Key challenges

Several challenges must be addressed before widespread adoption can occur. The primary bottleneck is the availability of 2 kV inverters as numerous technical challenges must be solved. Currently, components capable of handling 2 kV are limited and inverter manufacturers have to contend with issues related to combiner boxes, external insulation, fuses, and switches. A substantial amount of hardware and software testing must be completed to ensure the reliability and safe operability of 2 kV inverters on the grid. There are also greater challenges related to adopting 2 kV for utility-scale string inverters than there are for central inverters, due to the former’s raised power density. This may slightly delay the adoption of 2 kV string inverters, compared to central devices.

Limited availability of standards is another significant barrier hindering the development and adoption of 2 kV products. Recently, JinkoSolar Holding Co. Ltd. became the first solar module company to receive certification from UL Solutions Inc. for its 2 kV modules. However, it will take time for fully formed certification processes to emerge and even longer for manufacturers to align their products with these standards. Convincing developers to invest in 2 kV projects poses another challenge, as these new sites will be inherently riskier than standard 1.5 kV projects, with higher costs and a smaller selection of suppliers.

For modules, the increased voltage necessitates a greater creepage distance between electrical parts, which can slightly reduce the efficiency of a module and increase its cost per watt. Additionally, module manufacturers are currently focused on the shift to n-type technology, coupled with squeezed margins due to panel oversupply, which diminishes their willingness to invest in new technology. However, the transition to 2 kV is not particularly difficult for modules, compared to the challenges faced by inverter manufacturers, as most large commercial and utility-scale PV modules already utilise a glass-glass structure, providing sufficient insulation and protection for higher voltages.

Technology forecast

China and the United States are likely to be the first regions to adopt 2 kV technology. China serves as a testing ground for the world’s largest utility-scale manufacturers and is expected to undertake numerous pilot projects to ensure the reliability of components before manufacturers expand into international markets. The quicker lead times in China will also facilitate faster market entry for 2 kV products. The United States is expected to follow suit, with GE Vernova recently launching a 2 kV inverter, marking a significant step in the market.

It will take time for developers and engineering, procurement, and construction services companies to become accustomed to 2 kV products, along with longer investment-decision timelines in the United States. Drawing from the historical precedent of the shift from 1 kV to 1.5 kV, where shipments of 1.5 kV inverters surged two years after the first pilot projects, the wider adoption of 2 kV technology is anticipated to take several years. S&P Global forecasts that 2 kV products will grow from less than 5 GW, in 2026, to 380 GW by 2030, accounting for 77% of utility-scale solar projects worldwide by that time.

The shift to 2 kV presents a promising opportunity for long-term reductions in balance-of-system, inverter, labor, and O&M costs, thanks to simpler site layouts and small increases in energy yield. Industry wide collaboration is essential to overcome technical challenges, establish standards, and drive adoption. Growing awareness of this technological leap is crucial for identifying additional cost savings across balance of systems. While technical challenges remain, particularly in the design of 2 kV inverter products, S&P predicts that utility scale solar will begin to transition to 2 kV between 2026 and 2027, particularly in the United States and China.

About the authors: Liam Coman is a solar research analyst at S&P Global Commodity Insights who covers the solar inverter, balance-of-system, and energy storage inverter supply chains. Coman works with suppliers to analyse trends, produce forecasts, and assess the solar inverter industry. He previously worked for an engineering consultancy specializing in environmental regulation and policy compliance.

About the authors: Liam Coman is a solar research analyst at S&P Global Commodity Insights who covers the solar inverter, balance-of-system, and energy storage inverter supply chains. Coman works with suppliers to analyse trends, produce forecasts, and assess the solar inverter industry. He previously worked for an engineering consultancy specializing in environmental regulation and policy compliance.

Siqi He is a principal analyst on S&P Global Commodity Insights’ clean energy technology team, responsible for PV, energy storage inverters, and solar supply chain research. She previously worked for Wood Mackenzie Power & Renewables in New York and spent four years as a financial analyst with PetroChina in Beijing.

Siqi He is a principal analyst on S&P Global Commodity Insights’ clean energy technology team, responsible for PV, energy storage inverters, and solar supply chain research. She previously worked for Wood Mackenzie Power & Renewables in New York and spent four years as a financial analyst with PetroChina in Beijing.

Karl Melkonyan is a principal analyst on the clean energy technology team, specializing in power and renewable energy market research and analysis, particularly for PV markets and solar companies. His focus includes financial analysis, manufacturing technology and materials, and the trends and requirements of the PV industry.

Karl Melkonyan is a principal analyst on the clean energy technology team, specializing in power and renewable energy market research and analysis, particularly for PV markets and solar companies. His focus includes financial analysis, manufacturing technology and materials, and the trends and requirements of the PV industry.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.