From pv magazine print edition 12/24

Economic headwinds and changing policy have seen the global solar market slow during the second half of 2024. Discussion continues to focus on how to alleviate PV oversupply.

InfoLink has conservatively predicted 492 GW to 568 GW of solar demand in 2025, but it could be even weaker, possibly falling below the 469 GW to 533 GW expected of 2024.

Older production lines have begun to be phased out since July 2024 and new factories have adjusted and even postponed production, but negative profit margins have occurred, and the pace of profit recovery remains slow.

The Chinese solar industry has tried to address oversupply. Chinese industry associations have started actively coordinating prices and calling for self-regulation among manufacturers based on cost guidance. Regulations stipulating higher product quality standards are also possible. Such supply-side reforms, however, will take time to have effect and InfoLink will monitor developments.

Supply chain

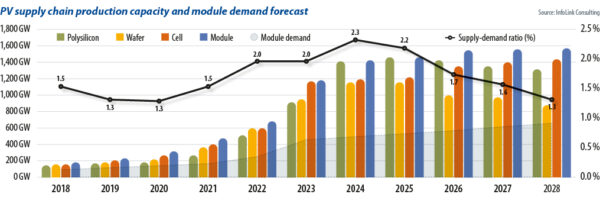

Wafer makers, the smallest segment of the solar supply chain, could produce 2.3 times more product than demand. Comparing production capacity across all of the supply chain with module demand shows the gap is closing but the pace of capacity shutdowns has been slow. Continuing oversupply has caused spot prices in some parts of the supply chain to fall below cash cost levels, resulting in a situation where prices are inverted.

The second half of 2024 is expected to see accelerated capacity elimination and phase-out across various segments. This will include capacities among new-entrant companies and those of tier 2 and tier 3 manufacturers.

Polysilicon production is highly consolidated and manufacturers are studying peers for fear of losing market share.

It is expected that capacity clearing in the polysilicon segment will not be completed quickly. On the ground, some tier 3 companies began shutting down in the third quarter of 2024. Tier 2 producers are struggling and new entrants are caught in a difficult position. Meanwhile, leading companies are also facing severe profitability pressures and the challenge of cash flow losses across the board. These factors are expected to accelerate larger-scale production capacity exits in 2025.

In the midstream segment of the supply chain, manufacturing capacity growth rate for the wafer segment has noticeably slowed as companies try to differentiate products by enhancing quality and changing product sizes. The output of positively doped, p-type wafers continues to decline, with fewer manufacturers producing 182 mm and 210 mm wafers. Some tier 2 and tier 3 manufacturers may face operational crises. As existing capacities are phased out more rapidly, gross profit margins are expected to return to healthier levels in 2025 and 2026.

Cell and module

The production capacity clearance rate for cells is faster than for other segments, primarily due to the impact of technological advances. From 2023 to 2024, the survival and phase-out timeline of p-type cell production capacity has become a key evaluation focus for companies. Older p-type capacity is unlikely to remain in the long term. In the third quarter of 2024, companies began shutting down p-type capacity in China, and overseas cell capacities, particularly in Southeast Asia, have also started to be phased out, due to tighter US trade policies.

Decision making in the module segment has been relatively slow. This has partly been because much of the module capacity was established in 2022 with low risk of modification and relatively low investment cost. In the meantime, market conditions have seen a significant decrease in factory utilisation rates, which in turn has led to rising costs, making it difficult for manufacturers to make decisions. It is possible that manufacturers will respond by trying to transfer secondhand equipment to set up factories overseas.

New entrants and tier 2 and tier 3 manufacturers have started to slow down capacity expansion, with some temporarily halting production. Shutdown plans for most tier 1 manufacturers, and the handling of capacity in Southeast Asia remain unclear. As of September 2024, an estimated 25 GW to 30 GW had been confirmed for shutdown and around 150 GW was confirmed temporarily halted or undergoing restructuring.

Continuing price declines will force more companies to exit the market. Considering manufacturer strategies, however, the decision-making process for capacity clearance is – again – slow, as market competition makes it difficult to see a significant large-scale capacity exit in the short term. That will lead to inventory issues becoming a normalized problem in the future.

As a result, factory utilisation rates may not return to previous highs. Nameplate production capacity across the solar supply chain has reached 1 TW, with projected utilisation levels expected to be around 50% to 70%. Tier 2 and tier 3 utilization rates may hit 20% to 40%. Lower utilisation will raise the amortisation of construction and equipment costs. When utilisation drops to 20%, the cost increase begins to multiply. Considering the long-term impact of operating below cost price, that will have a greater adverse effect on the wafer and cell segments. The supply-demand ratio is expected to return to around 1.7 by 2026, approaching the level seen in 2021 and 2022, leading to a more balanced market situation.

About the author: Amy Fang is an InfoLink senior analyst who focuses on the solar cell and module segment of the PV supply chain, working across price trend forecasting and production data.

About the author: Amy Fang is an InfoLink senior analyst who focuses on the solar cell and module segment of the PV supply chain, working across price trend forecasting and production data.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.