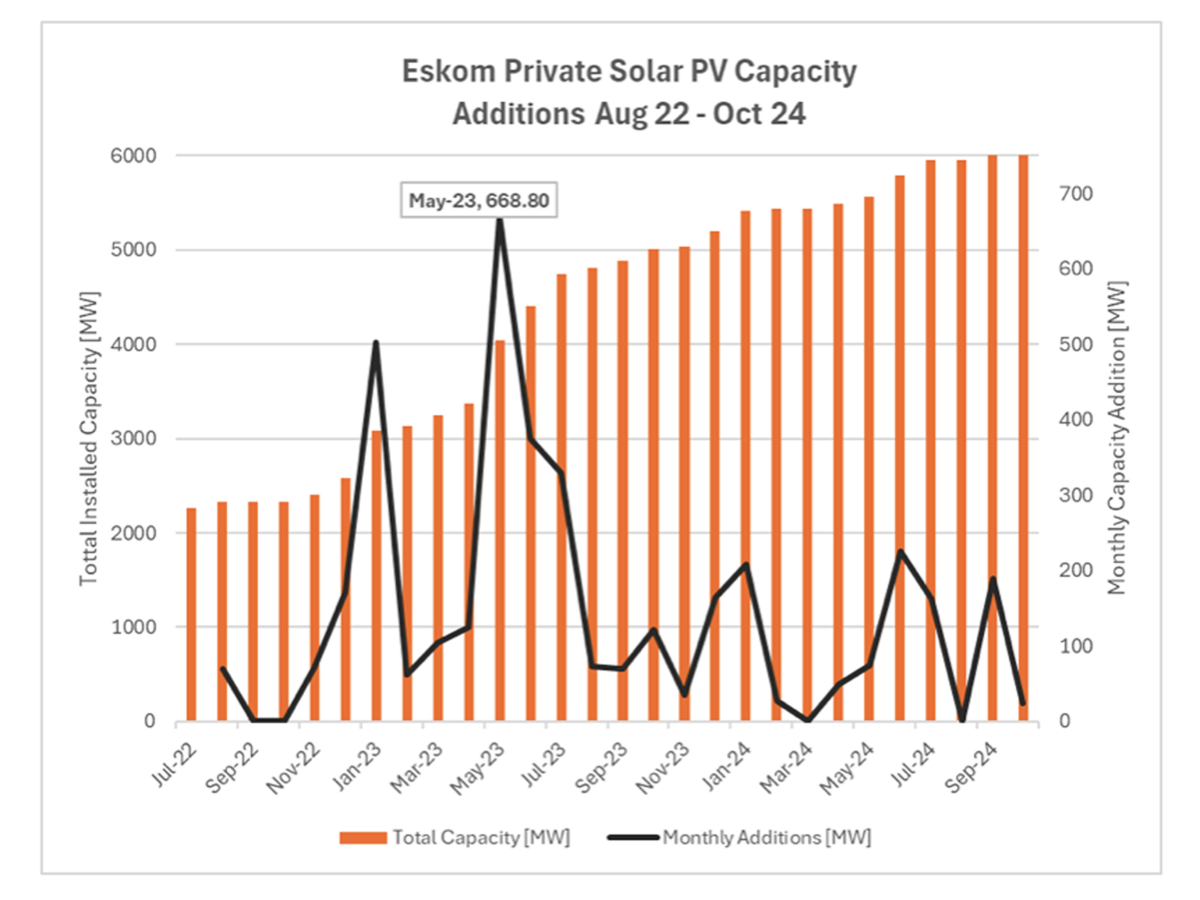

South Africa added 961 MW of solar capacity in the first 10 months of this year, according to data from SAPVIA. This compares to 2,430 MW of new installations during the same period of 2023.

This year’s new solar capacity consists solely of private-sector projects, SAPVIA said, noting that no publicly procured solar plants have been operational since 2019.

However, 495 MW of public utility-scale solar is boiw under construction, with 375 MW expected online in 2024 and 120 MW in early 2026. An additional 880 MW is in advanced development, with construction slated for 2025.

SAPVIA forecasts quarterly growth of 8% to 15% over the next two years in South Africa's small-scale commercial and industrial (C&I) solar market, defined as installations between 30 kW to 1 MW, as well as the utility-scale segment, based on private-sector registration trends.

It said that utility-scale public sector demand will be driven by the seventh bid window of the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP), which will connect 1.8 GW of new solar projects to the grid by the end of 2028.

SAPVIA told pv magazine installations in the large-scale C&I (1 MW to 50 MW) market declined between the fourth quarter of 2023 and third quarter of this year by 24%.

“One possible reason for the decline in 2024 is the emergence of new aggregators and traders, resulting in increased competition on the supply side,” the association explained. “This coupled with the suspension of load shedding since March 2024 has made bi-lateral power purchase agreements a viable option for larger C&I users.”

South Africa’s residential solar market has dropped by 60% to 80% compared to 2023, SAPVIA reported, attributing the decline to suspended load shedding and most household installations being geared toward solar-plus-battery setups for load-shedding protection.

The association said it expects economic factors to drive future residential demand, noting national discussions on demand-side incentives. Proposals include revitalizing the PV-related personal income tax benefit, overhauling the energy bounce-back scheme to make solar more accessible to middle-income households, and introducing competitive energy feed-in credit schemes.

“These supply and demand dynamics will hopefully result in a stable, sustainable growth rate in the residential market in South Africa in 2025 and 2026,” said the association.

SAPVIA CEO Dr Rethabile Melamu said South Africa’s installed solar capacity is expected to grow from 6.68 GW in 2024 to 11.03 GW by 2029, driven by rising demand for clean energy.

“The solar energy sector in South Africa is poised for significant growth, with strong support from both the government and private sector, making it an exciting space to watch in the coming year,” added Melamu.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.