Scientists from Ben-Gurion University of the Negev analyzed Israel's PV market through three large tenders. They examined it in terms of economic welfare, focusing on inefficiencies caused by market concentration and technological inefficiencies from less competitive companies winning tenders.

“The results are not entirely specific to Israel, as other countries with competitive PV tender systems may experience similar dynamics,” corresponding authors Professor Ofir Rubin and Dr. Chen Cohen told pv magazine. “For instance, countries with small energy markets, high population density, or limited land for solar installations—like South Korea or Japan—might see similar trends of market concentration and the exit of smaller firms.”

The Israel Electricity Authority (IEA) held three tenders in 2016, 2017, and 2019 using the clearing price method. In this approach, bidders submit generation capacities and fixed-tariff offers per kilowatt-hour without knowing the final capacity the regulator will select.

“The tender quota ultimately determines the market-clearing price. Multiple companies submit bids offering varying prices for producing different output quantities, yet the final price awarded to all winning companies is uniform, irrespective of the individual prices they initially proposed,” the researchers said. “Bids are ranked, and the firms offering the lowest tariffs are selected until the quota is met.”

The clearing price method set a production quota of 235 MW with a tariff of ILS 0.199 ($0.053)/kWh in the first tender, 105 MW with ILS 0.1978/kWh in the second, and 220 MW with ILS 0.188/kWh in the third. Twelve firms won in the first tender, while only six participated in the second and third. The largest firm received 33.83% of the total quota across the three tenders.

“After the third tender, Firm A received 190 MW in quotas, Firm B 110 MW, Firm C 101 MW, and the other winners up to 55 MW,” the academics said. “These findings may imply that if future tenders continue to use the same method, the result will be an oligopolistic market, meaning a more concentrated market. According to the economic literature, this market may be more efficient in production but would prove costly to the country’s economic welfare.”

Image: Ben-Gurion University of the Negev

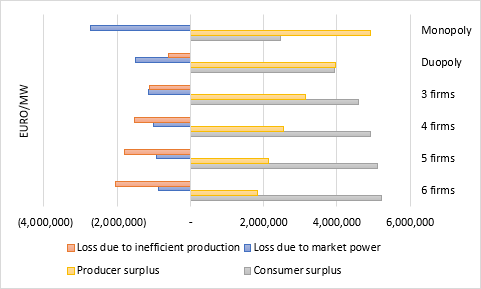

Using the tender outcomes and a fitted demand curve, the scientists applied the Cournot oligopoly model to calculate the economic welfare loss rate and simulate future scenarios in Israel's market. The Cournot model assumes firms' products are perfect substitutes, and each firm's strategy involves selecting production quantities simultaneously.

“The equilibrium obtained from the Cournot model allowed us to calculate measures of economic welfare, including consumer surplus in the electricity sector, producer surplus, and the loss attributed to maintaining competition by allowing less efficient firms to win the tender (i.e., technological inefficiencies),” the group said. “Additionally, we assessed the decrease in economic welfare due to market power resulting from the lack of competition (i.e., the calculated economic welfare loss relative to the most efficient outcome).”

The results showed that economic welfare loss from market power abuse was lower than that from technological inefficiencies. In the first tender, market power caused about 9% welfare loss, 14% in the second, and 12% in the third. In contrast, technological inefficiencies led to welfare losses of about 41%, 37%, and 28% in each tender, respectively.

The scientists used the results of the most recent tender to assess the impact of further market downsizing, from the current six companies to a monopoly.

“The comparison shows that as the market shrinks in terms of the number of firms, the cost of maintaining competition (that is, production by less efficient firms) imposes a decreasing economic burden,” said the scientists. “Surprisingly, economic welfare loss is minimal with only two winning firms. If we are left with only one firm, electricity production will cost less, but the monopolistic player will install approximately 31% less capacity than that obtained in the third tender. Thus, the monopoly company will maximize its profits at the expense of the consumer and society’s overall welfare.”

To conclude, Professor Rubin and Dr. Cohen said that Israeli policymakers should be aware that while lowering production costs, thier tenders have also led to increased market concentration, which diminishes competition. “To avoid this, policymakers should refrain from imposing firm capacity limits in tenders, as these may allow less competitive firms to secure contracts, ultimately reducing sector efficiency and raising the economic burden on the public,” they said. “Instead, tenders should aim to foster competition by offering temporary support to smaller firms, without compromising overall efficiency.”

They presented their results in “Preserving competition and economic welfare in Israel’s PV market,” which was recently published in Utilities Policy. The research was conducted at the Faculty of Management at Ben-Gurion University of the Negev, based on the doctoral thesis of Miriam Tourgeman.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.