Researchers at the Sichuan Normal University in China have introduced a real options-based framework to evaluate the investment in large-scale liquid air energy storage (LAES).

Their work builds on previous research, in which they presented a LAES system that stores electricity in the form of liquid air or nitrogen at cryogenic temperatures. “In our new analysis, we considered uncertain factors, such as investment cost and electricity price in China,” the research's corresponding author, Xiaoyuan Chen, told pv magazine. “We also investigated the impact of various incentives, including subsidies and preferential taxation policies, on the LAES investment.”

Their analysis was conducted on a 10 MW-80 MWh LAES system relying on a high-temperature thermal oil tank to store compression heat. During the energy storage process, the air is compressed by a three-stage compressor powered by off-peak electricity. Subsequently, the high-pressure air is cooled by intercoolers and further liquefied through a cold box and a low-temperature turbine expander.

The liquefied air is then depressurized to atmospheric pressure and stored in a liquid air tank. Within this process, the high-temperature air undergoes heat exchange with a heat exchange medium, and the resulting compressed heat is then captured by thermal oil and stored in a high-temperature heat storage tank (HTST) to facilitate air heating during the discharge process.

During the energy release process, the liquid air undergoes pressurization using a cryogenic pump, followed by vaporization in an evaporator. Subsequently, the high-pressure air produced is further heated by hot oil from the HTST using a reheater. It is then expanded into a three-stage air turbine unit to generate electricity. The thermal oil used in the reheater is reserved and stored in the low-temperature heat storage tank (LTST). The stored oil is utilized in the next charging cycle.

“In the multi-generation mode, the remaining high-temperature thermal oil serves as the heat source for the absorption refrigerator (AR), enabling the generation of cold energy,” Chen explained. “After releasing part of the heat in the AR, the discharged thermal oil is mixed with the low-temperature thermal oil. Following heat exchange through heat exchangers (HEXs), the mixed thermal oil is stored in the LTST. This process enables the supply of hot water to the user side.”

The simulations and calculations of the system were conducted using the Aspen HYSYS software. The power consumption during the compression process is 18.168 MW. The output power of the air turbine is 10.02 MW. Additionally, the multi-generation system is capable of providing 3,942.44 kW of heating and 2,114.26 kW of cooling. The roundtrip efficiency for the system is 65.71%.

Image: Sichuan Normal University

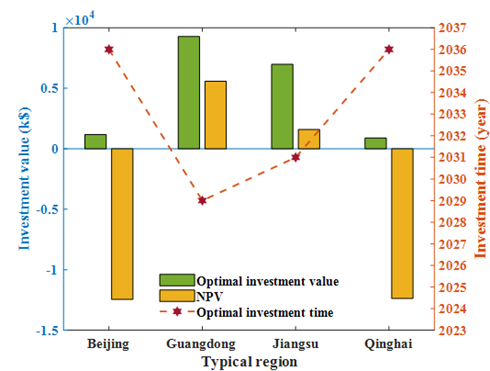

“Our economic analysis showed that, under current conditions of China's power market, it is almost impossible to trigger immediate investment in the multi-generation LAES system,” Chen said. “The recommended investment times are 2029 for Guangdong and 2031 for Jiangsu. For Beijing and Qinghai, the optimal investment time is 2036. At the optimal investment times, the specific capital expenditure is estimated to range from $882/kW to 1,177/kW, while the levelized cost of storage (LCOS) ranges from $0.105/kWh to $0.174/kWh. The optimal investment values are about $1,176/kW$ for Beijing, $926/kW for Guangdong, and $882/kW for Qinghai.”

For the impact of the incentive policies, results show that preferential taxation policies can increase the investment value of the LAES system, especially in regions with higher peak-valley electricity price differences. Increasing the investment subsidy and technology learning effects have a limited impact on stimulating investments. In contrast, the discharge subsidy policy can advance investment by at least one year and is preferable for promoting investments in LAES systems. “In Guangdong, it is recommended that investors take investment action immediately once the unit discharge subsidy reaches $0.133/kWh,” Chen said.

The researchers said that ensuring a suitable level of price volatility is a crucial factor in incentivizing the participation of LAES in the electricity market.

It is recommended to further improve time-of-use pricing mechanisms to create greater profit potential for LAES operations. Secondly, policymakers should prioritize the introduction of discharge subsidy policies due to the limited advancement in the optimal investment time and improvement of optimal investment value resulting from increasing investment subsidy and technology learning effects. Third, governments should actively enhance auxiliary service markets to provide diversified benefits for LAES projects as policies that focus on increasing revenues rather than solely reducing investment costs are more effective in promoting investments in LAES.

The details of their analysis can be found in the study “A real options-based framework for multi-generation liquid air energy storage investment decision under multiple uncertainties and policy incentives,” published in Energy.

LAES currently has a technology readiness level (TRL) of 8. The TRL measures the maturity of technology components for a system and is based on a scale from one to nine, with nine representing mature technologies for full commercial application.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.