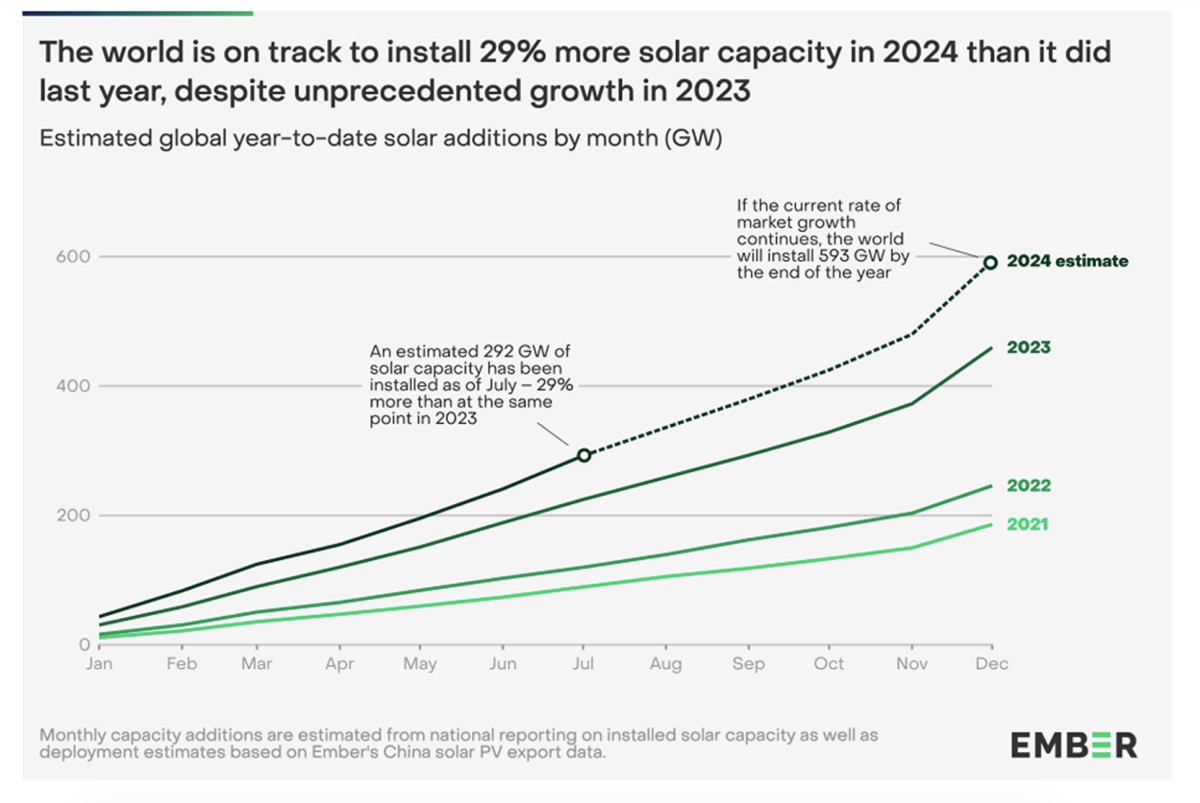

The world is on track to reach 593 GW of new solar installations by the end of 2024, according to a new report by energy think tank Ember.

This figure would be a 29% increase on last year’s installations. The report, which bases its estimates upon monthly solar capacity data from 15 countries and Chinese export data to remaining nations, says this would surpass most industry forecasts. It adds an estimated 292 GW of solar capacity was installed across the world by the end of July 2024.

China continues to dominate solar growth in 2024, with installations from January to June surpassing the country’s total solar additions for 2022 and marking a 28% increase over the same period in 2023. If this pace continues, Ember predicts that China will reach 334 GW of new capacity this year, accounting for 56% of global additions. In 2023, China accounted for 57% of new global installations.

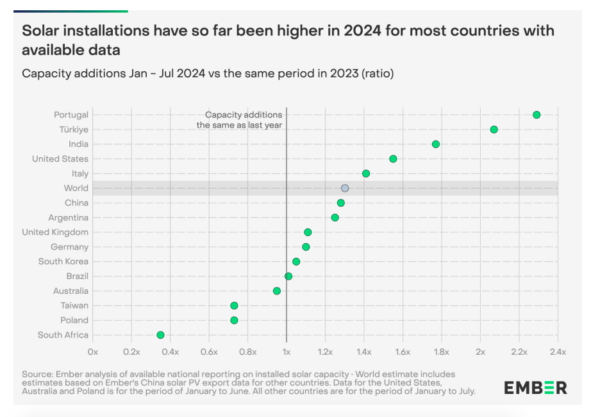

Ember said it expects China, the United States, India, Germany, and Brazil to account for three-quarters of all new solar capacity in 2024. By May, India had already installed more solar panels than in all of 2023. In the US market, new solar capacity from January to June 2024 was 55% higher than the same period in 2023.

Ember says that Argentina, Australia, Italy, Poland, Portugal, South Africa, South Korea, Taiwan, Turkey, and the United Kingdom will collectively account for about 5% of global solar installations in 2024. Among these countries, only Australia, Taiwan, Poland, and South Africa are installing solar at a slower pace compared to last year.

Ember derives the remaining 20% of its analysis from Chinese solar export figures. Pakistan and Saudi Arabia are leading in this metric, each having averaged monthly solar panel imports exceeding 1 GW throughout the year.

“If these panels are installed, it could put the two countries firmly in the company of established, large solar markets like Germany, Brazil and India,” the report says.

Ember also notes recent import pick-ups in Oman, Thailand, the Philippines and the United Arab Emirates. It says countries that are experiencing rapid solar growth “need to make sure they are planning for power systems with high levels of solar capacity.”

The report states that current manufacturing capacity is already double what is being utilized.

“The constraint for future market growth is unlikely to come from solar panel prices. The key will be to ensure that countries have sufficient grid capacity to transport power to where it is needed, as well as develop battery storage capacity to complement solar outside of the sunniest hours,” Ember says. “If these actions are taken, solar power could easily continue to surpass expectations throughout the rest of the decade.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

This is a significant leap for renewable energy. However, the growing demand for solar panels could put pressure on the silver supply, as silver is a key material in photovoltaic cells. With the solar industry’s rapid expansion, managing potential silver shortages will be crucial to maintaining this momentum in clean energy growth