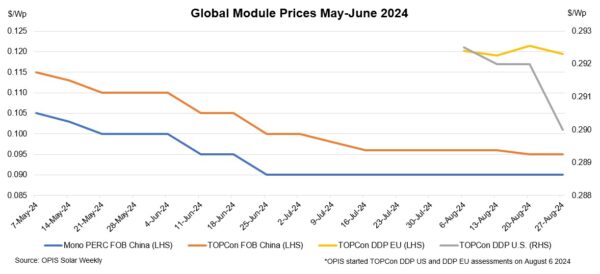

In the Chinese market, the Chinese Module Marker (CMM), the OPIS benchmark assessment for TOPCon modules from China, was assessed at $0.095/W, stable week-to-week amid unchanged market fundamentals. Market participants said that TOPCon prices below $0.09/W FOB China were still circulating in the market.

Cargoes below $0.09/W FOB China were sold at a loss to maintain market share and generate cash flow, an industry source said. For large module manufacturers, maintaining cash flow is more important than avoiding losses as they need to pay wages and loans on equipment, the industry source added.

In the U.S market, the spot price for U.S. delivered duty-paid (DDP) TOPCon modules fell to $0.290/W, with indications from $0.220/W to $0.330/W, while prices for Q1 2025 delivery averaged $0.301/W, ranging between $0.280/W and $0.325/W.

OPIS assessed the U.S. mono PERC Q4 delivery module prices at $0.249/W, with indications between $0.215/W to $0.310/W, while 2025 delivery cargoes were around $0.270 to $0.315/W.

According to a Southeast Asian producer, U.S. module prices are seeing a wide range due to the availability of alternative imports from countries not affected by the AD/CVD probe. The producer added that increased competition from various sources has “disrupted” U.S. domestic prices. Currently, Indonesian manufacturers are offering modules for late 2025 delivery at around $0.24/W, similar to the levels provided by suppliers in Vietnam, Thailand, Malaysia and Cambodia before the investigation began, a U.S. source told OPIS. The source also shared that Indian manufacturers quoted around $0.29/W for the same period.

Another market source noted that increased Customs and Border Protection (CBP) scrutiny over imported modules from India in the past few months will further fuel uncertainty and widen the price range. Almost a third of detained electronics goods from India have been rejected, compared to only 5.4% of rejections for goods detained from South East Asian producers.

In the European market, TOPCon module prices slipped a touch in the week ending August 27, with indications ranging between a low of €0.090 ($0.1)/W and a high of €0.122 ($0.14)/W, averaging an assessed price of €0.107 ($0.12)/W. On the freight side, the Asia-North Europe ocean freight rates fell 1% to $8,264 per forty-foot equivalent unit (FEU). This corresponds to $0.0196/W.

The market for imported Chinese TOPCon panels evolved from overstock in Q2 to nearly shortage during the summer months. In Q3, availability for Chinese solar modules is increasing, however this seems to go hand in hand with price pressure for the suppliers. In the high end technology panels, all stock is consumed.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.