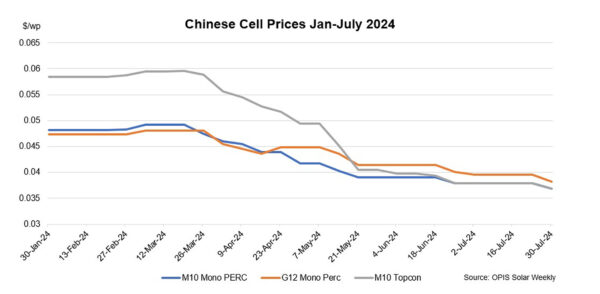

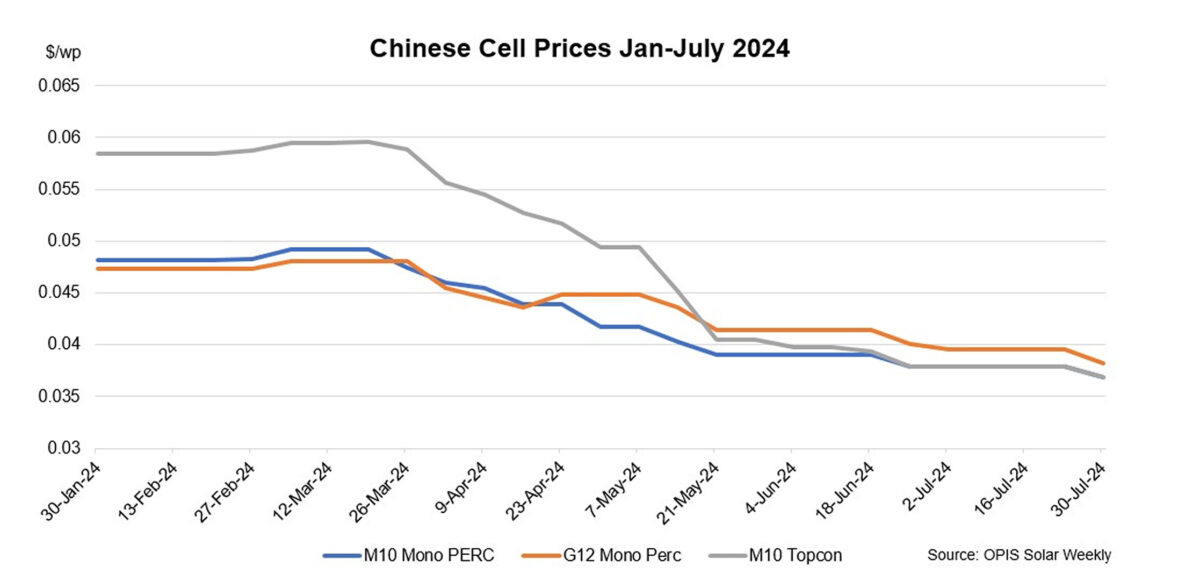

Prices in the Chinese cell market were assessed lower week-to-week reflecting buy-sell indications. The FOB China Mono PERC M10 cell and TOPCon M10 cell prices were assessed down 2.64% at $0.0369/WW while the FOB China Mono PERC G12 cell prices were assessed lower by 3.29% at $0.0382/W week-to-week.

Market activity remained quiet as the majority of market participants continued to stay on the sidelines, adopting a wait-and-see approach. While prices had already reached their lowest point, falling 59-63% year-to-year on July 30, according to OPIS data, expectations of further price declines kept most buyers away from the market.

In the domestic market, some sellers had reduced prices of Mono PERC M10 and TOPCon M10 to CNY0.29 ($0.040)/W while others kept prices stable at CNY0.30/W. The prices of Mono PERC M10 and TOPCon M10 cells were assessed at CNY 0.298/W, down 2.3% week-to-week. Prices of Mono PERC G12 prices were lower by 3.1% at CNY0.308/W.

China produced a total of 310 GW of cells in the first half of 2024, an increase of 37.8% year-to-year despite attempts by cell manufacturers to reduce cell production in June and July in a bid to curtail the oversupply situation in the market.

Although cell exports for the same period rose 26.2% to 142.16 GW, achieved sales prices were much lower compared to a year ago, resulting in tighter margins for cell manufacturers, an industry source said. The industry is experiencing a stage of persistent low prices throughout the solar value chain and if this should continue for long, the industry could be headed for a consolidation faster than expected.

Meanwhile, cell manufacturers continue to cut production rates in a bid to restore market supply and demand balance. China’s cell production in July was expected to reach 49-51 GW, down from 53 GW in June, according to the Silicon Industry of China Nonferrous Metals Industry Association.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.