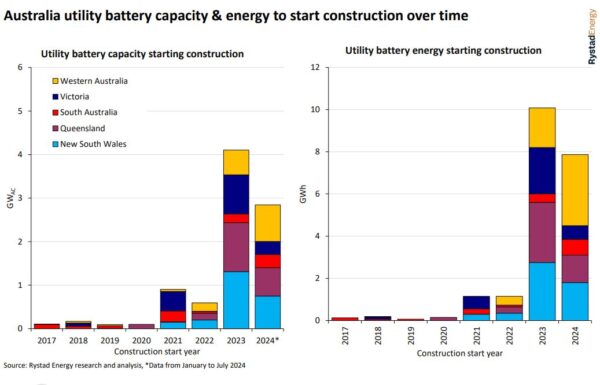

Rystad Energy said developers have begun building more than 2.8 GW of new battery energy storage capacity in Australia since the start of the year, laying the foundation for what is shaping to be another record year of new utility scale battery installs.

A record 4 GW/10 GWh of grid-scale battery energy storage projects commenced construction across Australia in 2023 but that mark is almost certain to be eclipsed this year.

“Just over halfway through the year and utility battery installations are on track to overtake what was a breakout year in 2023,” Rystad renewables and power team Vice President David Dixon said. “With five months of the year to go, it is possible that Australia could exceed 5 GW of capacity starting construction this year.”

Dixon said Australia is now the fourth-largest market globally for utility scale batteries with almost 9 GW of utility batteries either under construction or in operation. Mainland China, with 57 GW under construction or in operation, continues to set the pace ahead of the United States (34 GW) and the United Kingdom (12 GW).

New South Wales (NSW), Queensland and Western Australia dominate the construction activity in Australia with 80% of the new capacity housed in those states and more projects poised to enter the build phase.

Among the projects that will soon join the construction pipeline is the second stage of the Eraring battery being built by Origin in the NSW Hunter Valley. The $450 million project, announced just last week, will add 240 MW and more than four hours of storage (1,030 MWh) to the first stage. The initial stage, currently being constructed, comprises a 460 MW capacity battery with just over two hours (1,073 MWh) of storage.

The second stage will increase the facility’s total capacity to 700 MW/2,103 MWh and is due online in the March quarter of 2027. The first stage is expected to reach commercial operation at the end of 2025.

Dixon said the Eraring project continues the trend of storage durations getting longer for utility batteries in Australia.

“Four hours is now the new two hours,” he said, noting that prior to 2023 batteries were typically two hours or less in duration with the focus on grid services such as frequency control and network contracts rather than time shifting renewables.

Dixon also noted that battery costs have come down significantly over the past 12 months, pointing out that the project cost of about AUD437 ($283) per kWh for the Eraring battery is “the cheapest we’ve seen in the Australia market.”

The Eraring project does benefit from a mobilised engineering, procurement and construction contract, and approved site and available substation but Dixon said the project cost reflects a decline in battery storage project costs.

“It does reflect the fall in prices for utility scale batteries over the past 12 months, with greenfield project capex expected to near or below $600 per kWh, depending on size and hours of storage,” he said.

Rystad’s latest capital expenditure estimate for a utility battery in Australia is AUD480/kWh for a four-hour battery, to AUD590/kWh for a two-hour battery.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.