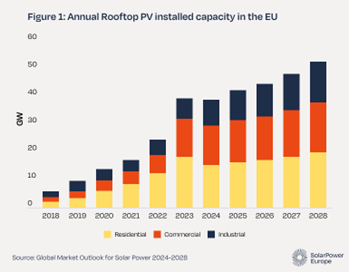

After two incredible years of growth in 2022 and 2023, rooftop photovoltaic (PV) systems are set to maintain a robust annual growth rate of 6-9% in the years ahead. However, despite this consistent rise, rooftop PV is grappling with major hurdles, including negative electricity prices and grid congestion. With these challenges expected to escalate, the evolution of rooftop solar into smart building solutions has never been more critical.

While policymakers play a crucial role in designing frameworks that ensure the financially sustainable rollout of smart buildings, significantly boosting grid flexibility, developers can also unlock diverse financial opportunities, solidifying the business case for smart solar buildings.

Exposure to fluctuating electricity prices challenges the traditional business case for rooftop solar

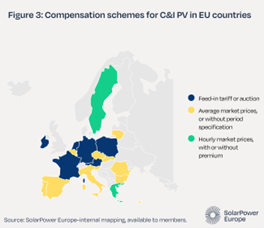

Across the EU, subsidies for grid injections, including net-metering and feed-in tariff schemes, are being gradually phased out. Belgium and Greece have already phased out net metering as of 2024, and the new Dutch coalition is following suit. Slovenia has transitioned from annual to monthly netting, while Germany and France are systematically reducing feed-in tariffs by 0.1 cents every six months. Italy is also gearing up to introduce a new scheme later this year reducing compensation for exported electricity.

This was expected as rooftop solar matures. It will soon be subject to compensation for injections at wholesale market prices in many EU countries, moving away from support schemes for injections. This change aligns with the technology's entry into the mainstream market, but it also means that solar injections could face low or even negative financial returns, especially during midday hours. This shift is consistent with the growing adoption of time-variant supply tariffs, which play a crucial role in reducing daily price fluctuations. Additionally, these tariffs offer a cost-effective alternative to rooftop PV for accessing low-cost electricity during the daytime.

This shift challenges the traditional business case for rooftop PV, which often relies on maximizing grid injections. This trend is particularly evident in countries like Portugal and Spain. In Spain, for instance, around 50% of consumers have already switched to time-variant electricity contracts.

The evolution of daily electricity price fluctuations by 2030 or 2040 heavily depends on the extent of flexible electrification. Compared to a scenario with limited flexibility, recent Mission Solar 2040 modeling from SolarPower Europe suggests that increased system flexibility and electrification can drive day-ahead energy costs down by 25% in 2030, and 33% in 2040, while simultaneously reinforcing solar capture prices by 71% in 2030 and 54% in 2040. Flexibility will insulate consumers from energy price volatility while strengthening the growth and business case of solar.

In addition, although profit margins from market sales may shrink for rooftop PV owners, the technology itself is expected to remain cost-competitive. According to IEA estimates, ongoing cost reductions are projected to decrease by 30% by 2030. Furthermore, rooftop solar can help customers save on-grid tariffs and electricity taxes, which collectively account for 69% of the electricity bill across the EU.

An opportunity to increase local self-consumption

The market is gearing up for the next era of smart solar buildings. Leading rooftop installers such as Enpal, Sunrock, IBC Solar, and others are transforming their business models to focus on smart building solutions integrating electric vehicle (EV) charging infrastructure, Battery Energy Storage Systems, and heat pumps. These integrated solutions broaden the business case for rooftop solar, even as profit margins tighten.

Installers can also capitalize on recent EU policy shifts promoting electromobility and electric heating. Beyond the debated phaseout of combustion engines by 2035, the Energy Performance of Buildings Directive (EPBD) introduces pivotal changes. It mandates the end of support for fossil-based heating and promotes smart building solutions, creating new opportunities for the rooftop solar industry.

The EPBD requires public authorities and building developers to:

- Install rooftop solar on new non-residential (public and commercial/industrial) buildings from 2027, on renovated non-residential buildings from 2028, and on new residential buildings and roofed car parks from 2030.

- Install interoperable energy management systems in non-residential buildings, starting with buildings with large electricity consumption, and in new and renovated residential buildings from mid-2026.

- Equip new and renovated non-residential buildings with one EV charging station for every five parking spots (with exceptions for very large parking spaces), and new residential buildings with more than three parking spots with at least one EV charging station, from 2026.

EU countries must develop an integrated approach when transposing the EPBD into national law, ensuring that regulatory frameworks for the different technologies are compatible and that technologies are remote-controllable and interoperable.

Lastly, energy sharing offers an exciting business opportunity by enabling the sale of excess electricity to local off-takers at rates often higher than standard injection compensation rates. This model is already in place in nine EU countries, with Portugal, Spain, and France leading the way in its implementation. By 2026, these frameworks are expected to spread across the entire EU, unlocking new potential for the rooftop solar market.

Image: Greenvolt Comunidades

Distinct from Energy Communities, energy sharing facilitates local electricity trades exclusively through contractual agreements between participants. In Portugal, Greenvolt Communidades is leading the way with 10 energy-sharing frameworks and over 100 energy-sharing groups across different sectors. Professional energy companies play a key role by financing the installations and managing the associated administrative tasks.

Addressing grid congestion requires urgent policy solutions and can unlock additional rooftop PV value streams

Grid capacity constraints present immediate challenges for PV developers, resulting in delays in connecting rooftop PV installations to the grid, potential curtailments, or even fines for electricity injection. In the Netherlands, the C&I (commercial & Industrial) sector, along with large renewable generators, is experiencing significant delays or outright denials of grid connections, a trend also seen in Spain. To address grid strains, both countries have implemented peak shaving regimes among other measures. Additionally, Dutch electricity suppliers are now hitting residential rooftop PV owners with annual fees ranging from €100 to €600 to cover balancing costs. This situation creates substantial market uncertainty. In Belgium, the transmission grid operator ELIA is stepping in with innovative curtailment tools aimed at managing PV overproduction and easing grid pressures.

EU countries are increasingly adopting flexible grid connection agreements as interim solutions to address grid capacity issues. Under the recent EU Electricity Market Design reform, National Regulatory Agencies are tasked with setting up suitable regulatory frameworks by June 2026. These temporary agreements allow new installations to connect based on the currently available grid capacity, with a requirement for grid operators to expand capacity to accommodate full-generation output.

For example, Austria is leading the way with a new electricity law that introduces both static and dynamic flexible connection frameworks. The static framework offers limited capacity for up to three years, with a guaranteed increase thereafter. The dynamic framework offers additional, variable capacity during periods of limited grid availability, depending on actual congestion levels. SolarPower Europe supports extending these agreements across all voltage levels, advocating for compensation for curtailment and proposing them as alternatives to export penalties for electricity suppliers.

In addition to promoting flexible connection agreements, electrification, and local self-consumption, more structural and long-term solutions are vital to managing the expected 890 GW of installed solar capacity in the EU by 2028, along with the rapid expansion of wind power and electric vehicles (EVs). These solutions must encourage customers to adjust their electricity consumption patterns to align with grid requirements.

The initial step is enabling customers to adopt contracts with flexibility components. To mitigate customers’ concerns about high energy prices, particularly during peak demand periods in the evening, flexibility providers are introducing dynamic contracts tailored to specific devices rather than to the entire household consumption. For instance, they offer dynamic contracts specifically for EV charging, an area where customers can more easily adjust their usage. The recent reform of the EU electricity market design gives customers the right to contract services on individual devices and mandates EU countries to develop the necessary infrastructure.

Another major structural solution is the implementation of dynamic grid tariffs for electricity consumption. These tariffs can adjust returns for electricity injected into the grid based on grid usage levels, timing, and location enabling smart buildings to financially benefit from supporting grid needs. Austria is already pioneering the development of such grid tariffs.

Flexibility markets are also an essential structural solution. These markets allow grid operators to price grid capacity and grid services and allow market actors to trade them. In the Australian state of Victoria, the two utilities CitiPower and Powercor recently signed a contract with Piclo’s cloud-based platform, Piclo Flex, to procure flexibility. The EU is currently outlining the principles for operating such flexibility markets in the Network Code for Demand Response.

Increased flexibility requires advanced financing solutions

Banks are currently charging extra risk premiums on rooftop solar solutions due to some of the above-mentioned uncertainties, and the rising system flexibility will add even more uncertainty to them, particularly for customers with lower credit ratings (BB and below).

Addressing this challenge requires advanced financing solutions, such as financing for portfolios of bundled small installations or guarantees to address the often high counterparty risk of rooftop PV off-takers. Policymakers have a crucial role to play in this process. They must craft policies to finance green rooftop solar investments, such as de-risking mechanisms or off-taker guarantees, similar to those implemented in France. Governments can facilitate these solutions through national promotional banks, like the KfW in Germany.

Toward the future

By next year, the EU could be installing upward of 40 GW of rooftop solar a year – comparable to the total solar installations of 2022. The way we look at rooftop solar is changing. Previously a relatively simple ‘addition’ to particularly energy-conscious buildings, solar is now the foundation to empower businesses and households to take their energy management to the next level. With the implementation of the EPBD around the corner, smart solar buildings are the bricks and mortar of the energy systems of the future, critically shaping electricity markets and grid development for the benefit of consumers and businesses. We’ll be continuing our work with policymakers, system operators, and the finance community to deliver the regulatory blueprints for the solar building wave.

About the author

Jan Osenberg is the Senior Policy Advisor for Buildings and Prosumers at SolarPower Europe. This op-ed benefitted from the input of SolarPower Europe’s Buildings & Prosumers Workstream, based on their annual Rooftop PV Strategy Day held in Brussels in May. The event convened industry experts, alongside high-level policymakers, and selected external speakers for focused network sessions and four workshops.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.