The Australian Energy Market Operator’s (AEMO’s) latest connections scorecard shows the number of solar, wind and battery projects progressing through the end-to-end connection process in the National Electricity Market (NEM) surged from 30 GW to 43 GW in the past 12 months.

AEMO’s snapshot of connection activities shows that at the end of Q2 2024, there was 43 GW of new capacity progressing through the connection process from application to commissioning, a 50% increase compared to the previous 12 months.

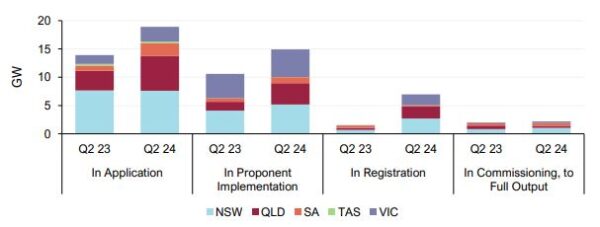

The market operator noted that 79% of the projects are in the early stages of development, in either application or proponent implementation stages. Just 700 MW of new plant was registered and connected to the NEM during Q2 2024, up from the 500 MW during the same period last year but well below what is needed to reach state and federal renewables targets.

Brian Innes, Director at Sydney-based consultancy outfit Partners in Performance, said moving projects from the early stages of development to the operational stage in a timely fashion is critical to Australia’s energy transition, warning unnecessary delays could negatively impact investor confidence.

“Uncertainties surrounding approval processes, including timing and the complexity of requirements, present significant challenges for investors who want clear timelines for when energy generation will start,” he said.

“Strict environmental and grid connection rules can often also make projects more complex, causing delays.”

Innes said the solar farm sector in Australia is already facing significant challenges, including high labor and installation costs that make it difficult for off-grid projects to compete financially.

He said on-grid solar farms are facing issues related to the high uptake of rooftop solar, especially in Queensland and Western Australia, which reduces the potential value generation of solar energy during peak production times.

Despite these challenges, Innes expects the growth of rooftop PV to continue strongly, further impacting the value and viability of large-scale on-grid solar farms.

Innes does however offer a positive, saying that advancements in battery storage will significantly enhance the overall efficiency, reliability, and economic viability of solar farms.

“Batteries will drive capacity and system stability, which is crucial as grids are required to support increased solar energy generation,” he said. “Improved battery technology also addresses concerns about solar availability during critical times, such as blackouts, by offering longer storage durations, easier installation, and lower prices, making them more accessible.”

Innes also expects advancements in direct current (DC) coupled solar systems will help reduce overall costs by requiring only one inverter to convert DC to alternating current (AC) for the grid.

“This enables batteries to perform load shifting, which is particularly beneficial for grid-connected solar assets,” he said.

The AEMO June connections scorecard shows battery energy storage systems make up 32% of all connection projects in the early stages of development. Solar projects account for 46% solar, with 14% wind and 8% hydro.

The total capacity of in-progress applications was 18.9 GW, compared with 13.9 GW at the same time last year. An additional 15.0 GW of new capacity projects are finalizing contracts and in the proponent implementation stage. This compares to 10.6 GW at the end of Q2 2023.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Luckily on average 3 Gw of rooftop solar is installed each year in Australia, and the number of solar installs including a battery is growing.