From ESS News

Europe has been slow in recognizing the role of energy storage assets in the power markets. The current market conditions, in terms of frequent oversupply, increasing number of zero and low power prices, have all highlighted the limits of flexibility in the region.

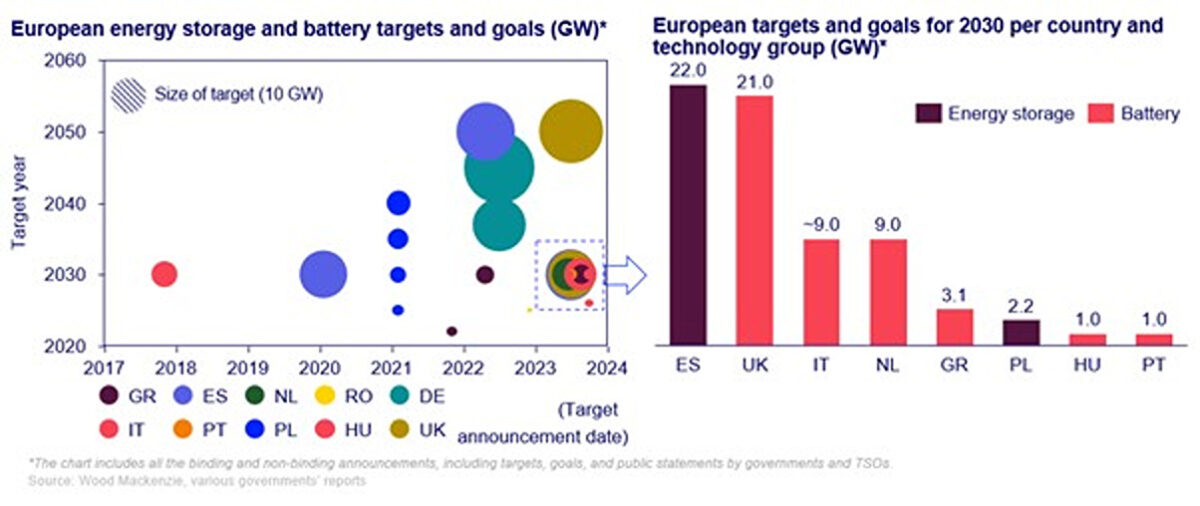

This limitation has now been acknowledged by the European government. More governments and Transmission System Operators (TSOs) are recognizing the crucial role of energy storage by incorporating energy storage targets in their National Energy and Climate Plan (NECPs) and national energy plans.

As a result of current market conditions, the industry is seeing a more diversified European energy storage market emerging. Developers are shifting interest from the UK to other European countries, where the urgent need for flexible resources is clear.

However, which market next to target always comes down to the accessibility of available revenue streams – both merchant and contracted. While in some markets the merchant revenues remain assuring and healthy, in others all eyes are on the next available storage-friendly auctions – in other words, contracted revenue.

Take Germany for example, which has recently been referred to as the new UK in the grid-scale storage segment. Here the energy storage market will pass in total 15 GW by 2033 from 1.4 GW today. The increasing demand in this country is driven by existing energy trading opportunities, topped up with revenues from ancillary markets and upcoming balancing services. In other words, Germany promises a healthy lifelong merchant revenue.

It’s a different story in Italy, where all players are awaiting the MACSE tender or the upcoming capacity market auction. Italy has set the highest energy storage target in terms of energy in Europe, which is to install 71 GWh by 2030. To help meet this target, Terna has decided to take the regulated approach to provide developers with fixed remuneration contracts for 12 to 14 years for lithium-ion batteries, and up to 30 years for pumped hydro. MACSE terms will be detrimental to the competition among technologies, players, as well as market prices.

Meanwhile, in Greece the government held two energy storage tenders in October 2023 and February 2024. Oversubscribed storage tenders show a rush for contracted revenue among active players in this country. Interestingly, the tender results show that the awarded capacity with lowest bid prices might have earned in fact more from the market going purely merchant.

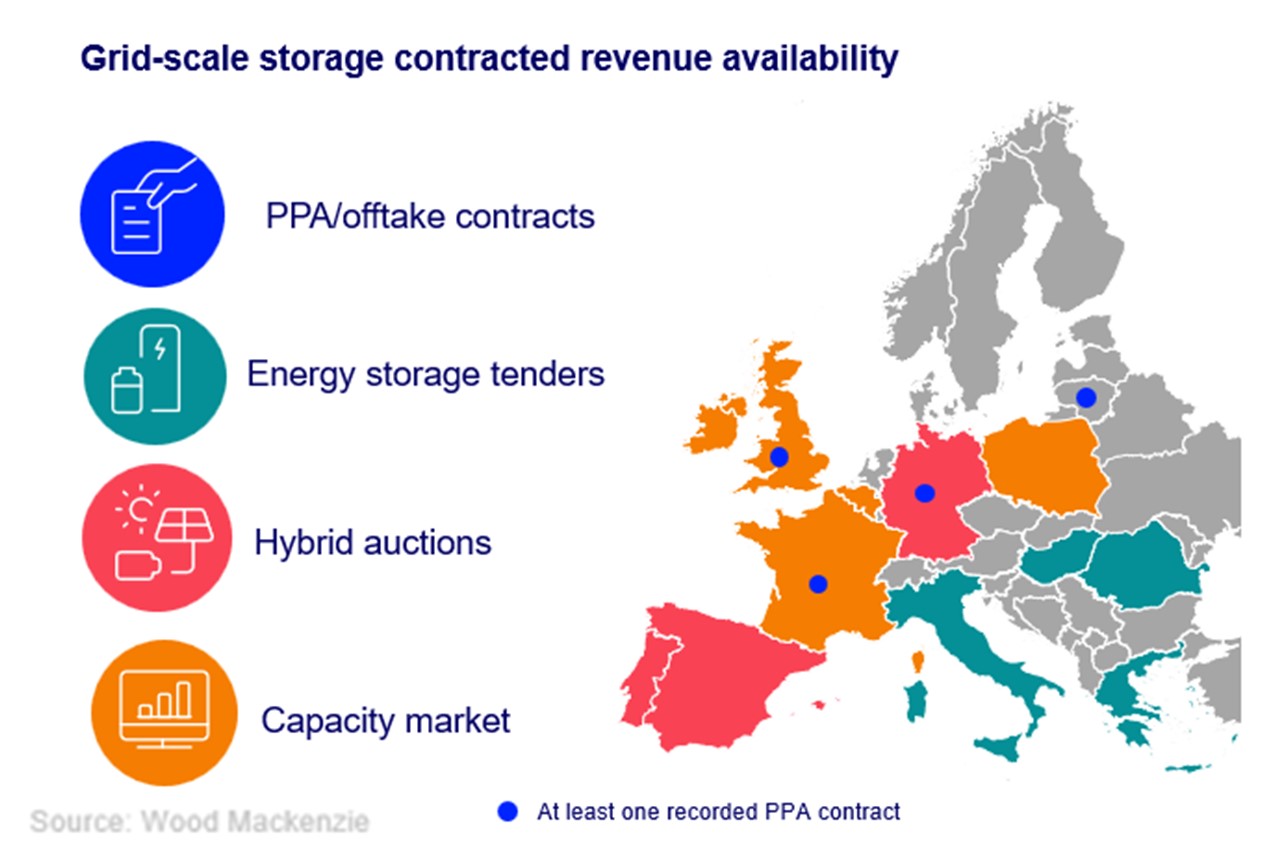

So, the shift in Europe’s grid-scale storage market is clear, with new opportunities opening up. Different European countries offer different types of support mechanisms in terms of contracted revenues, in the form of capacity markets, storage tenders or PPA contracts, depending on existing regulations and available funding. The European Commission has called the existing mechanisms insufficient and has proposed the introduction of a Europe-wide flexibility support scheme.

(Graphics 1 and 2 show the dominant type of available support schemes in Europe and awarded capacity per country and auction type).

Only since 2020, 16 GW of derated battery capacity has been awarded in different European auctions, which are due to come online in the next three to five years. But this is just a beginning, with more than EUR 2,5 billion expected to be invested in different types of storage auctions and tenders highlighting the role of energy storage as a flexible resource.

To continue reading, please visit our ESS News website.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.