Across the MENA region, solar installations saw a 23% increase in 2023, according to the Middle East Solar Industry Association (MESIA). Growth is set to accelerate, with MESIA forecasting today’s 32 GW will become 40 GW in 2024, and 180 GW by 2030. In December 2023, Saudi Arabia raised its 2030 solar target to 130 GW, which will require more than 20 GW of annual installations, going forward.

The region’s solar industry has so far focused on large-scale PV, with the United Arab Emirates, Egypt, and, more recently, Saudi Arabia now hosting several of the world’s largest solar installations. Though the region is no stranger to construction mega-projects, its local solar industry is young and hosts limited infrastructure to support the development and successful operation of these massive solar energy projects. When it comes to ensuring quality and long-term performance in a harsh desert environment, the MENA region has thus far seen limited development of the expertise to offer either lab-based product testing or on-site services such as drone thermography or electroluminescence (EL) imaging.

“If we look at the services provided, whether it’s related to commissioning, post-installation inspection, or any other on-site test, these all need much stronger local infrastructure,” said Mohamed Saady, head of technical services and product management for MENA at Chinese panel maker JinkoSolar. That limitation, he added, can lead to much longer response times and increased expense related to sourcing the required expertise from further afield.

Quality assurance

PV manufacturing has also, thus far, seen only limited development in the MENA region, and may be a prerequisite for further development of testing and other supportive industries. “Most reliability testing is done by the suppliers and in labs close to the production,” explained Jörg Althaus, director for quality assurance and engineering services at consultancy Clean Energy Associates (CEA). “Local testing makes sense because you need to build that expertise but it’s unlikely to happen until we see manufacturing really scale up in the region.”

At the same time, manufacturers already active in the MENA region confirm that localized infrastructure for product and system testing could save them a lot of time and money and encourage more manufacturing capacity in the region.

“We do full quality testing in-house but sometimes you need to work with third parties on extended testing or calibration,” said Mohammed Shehadeh, chief technology officer at Jordanian module manufacturer Philadelphia Solar. “And it costs us a lot to send modules out to Europe, China, or the US.”

The current lack of local testing infrastructure can also slow down manufacturers’ progress in adopting new technology, Shehadeh noted, since modules need to be shipped to far-off testing facilities for certification each time a change or upgrade is made. “There is the cost of all this shipping and also much longer lead times that can delay us in getting to market early with a strong new product. A regional facility could definitely speed up that process.”

Gulf Renewables Laboratory (GRL), based in Dammam on Saudi Arabia’s Gulf Coast, is a joint venture between US-based testing organization UL [Underwriters' Laboratories] and Saudi-headquartered GCC Lab, and is among the first in the region to be certified by the IECEE – a body of the International Electroctechnical Commission – to test PV modules and systems to various industry standards.

“With time, we expect more factories will come to Saudi Arabia, attracted by the huge number of projects and the local content program adopted by the Ministry of Energy,” said Saeed Balhaddad, general manager at GRL. “We are expecting more demand for indoor testing and certification.” He added that some developers are conducting sample testing of imported modules upon arrival in Saudi Arabia, which is recommended by regulators and other industry experts.

Though GRL offers lab testing services, Kamalakannan Jayachandran, a renewable energy engineer at GRL, confirmed that since its beginnings, in 2017, the lab’s business has been focused toward on-site testing. “Right now in Saudi Arabia, more than 4 GW of PV projects have been installed and we are getting repeated requests for power performance tests, performance ratio, EL testing, and drone thermography,” he said.

That demand is expected to increase, with project developers and owners adding more tests to ensure the long-term reliability of their assets.

“Some tests, like post-delivery inspection and planned capacity tests, are new to the market and have not been picked up yet but these are now being mandated by developers and may soon be implemented at all sites,” said Jayachandran.

Desert code

As well as localizing facilities, testing specific to the harsh desert environment is something that project developers increasingly require, both in lab testing used to certify modules and in on-site testing to identify weaknesses in the field. “Projects in Saudi Arabia or the MENA region usually ask for more extensive testing beyond the typical standards, whether that’s double or triple, or even different types of test,” said JinkoSolar’s Saady.

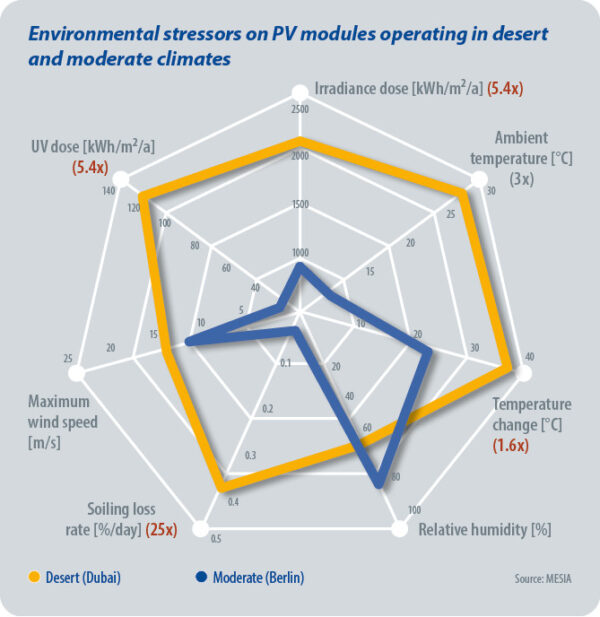

A study by MESIA compared the environmental stresses placed on a module installed in Dubai to one in Berlin (see chart to the left) and noted that the heat and high irradiance in Dubai increased the risk of module performance issues including encapsulant discoloration, interconnect oxidation, backsheet chalking, delamination, finger breakage, wafer cracks, and module anti-reflective coating removal. The trade association also recommends testing beyond the IEC 61215 standard used for most modules, to better simulate the harsh conditions modules installed in the MENA region will likely experience.

A study by MESIA compared the environmental stresses placed on a module installed in Dubai to one in Berlin (see chart to the left) and noted that the heat and high irradiance in Dubai increased the risk of module performance issues including encapsulant discoloration, interconnect oxidation, backsheet chalking, delamination, finger breakage, wafer cracks, and module anti-reflective coating removal. The trade association also recommends testing beyond the IEC 61215 standard used for most modules, to better simulate the harsh conditions modules installed in the MENA region will likely experience.

GRL has developed what it calls a “desert code” for module testing that is a modified version of IEC 61215 based on similar testing processes but conducted with harsher parameters. In thermal cycling, for example, where modules are repeatedly exposed to extreme temperature swings, IEC 61215 specifies 200 cycles from -40 C to a maximum temperature of 85 C. GRL will conduct 400 cycles and push the maximum temperature up to 105 C. The 1,000 hours of damp heat exposure specified in the IEC standard is also doubled, to 2,000 hours. “Within the IEC standard itself, there are clauses which state that to fulfil a specific requirement for the installation conditions, you can modify tests to a higher level,” said Jayachandran. “In the future, this is going to be a real game changer for the certification of PV modules.”

On top of raising the parameters of current tests in this way, many experts see the need for new tests entirely. “For every project in Saudi Arabia now, we do extensive testing for different bill-of-materials combinations, because the IEC standard is not enough and will not fulfil the requirements of the PPA [power purchase agreement],” said Jinko's Saady, noting in particular other standards such as IEC 62892:2019 and IEC TS 63126:2020 that specify guidelines for qualifying PV modules, components, and materials for operation at high temperatures.

In the desert, sand abrasion presents another potential issue that may not be adequately taken into account by current tests. CEA’s Althaus said that while most projects now use glass-glass modules that are generally less vulnerable to sand, there may still be a risk of loss of transparency in the glass or erosion of cables and junction boxes, and that a whole new standard may be necessary. “None of the tests for sand abrasion have a definition for products that will be installed outdoors in the desert for 20 years,” he explained. “That’s a problem that the solar industry has; modules are a long-living product and most standards that are initially borrowed from other industries are not intended for that type of operation.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.