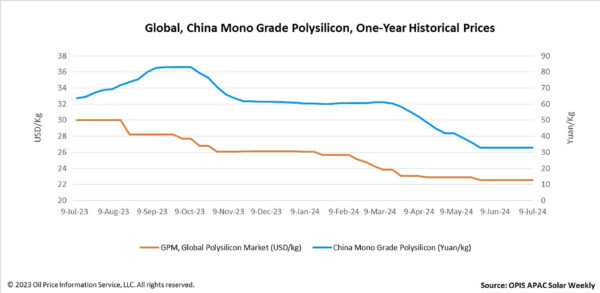

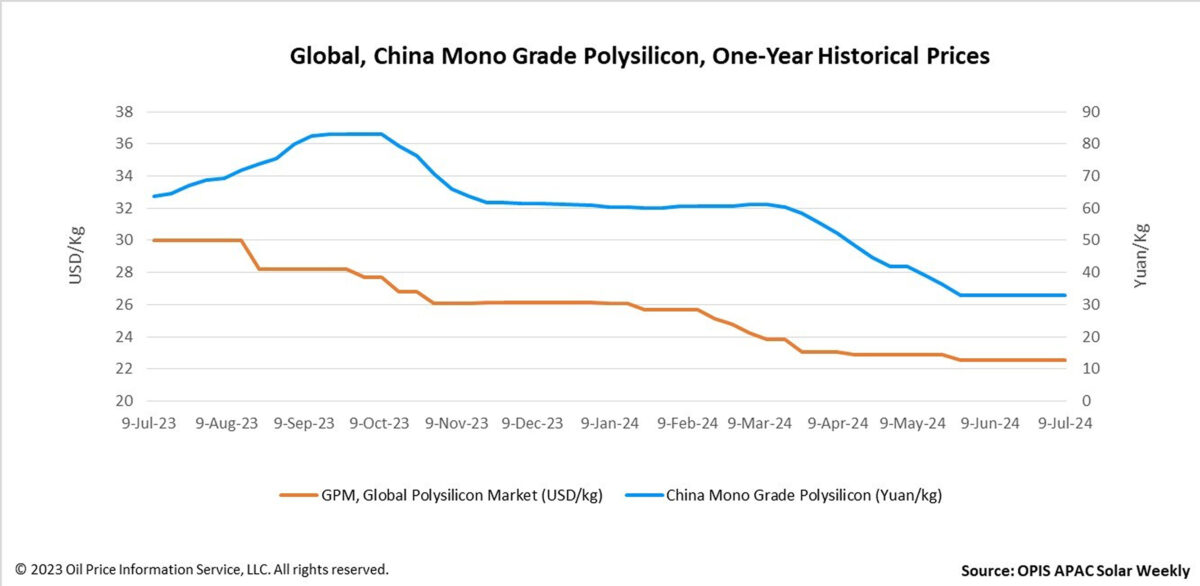

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was assessed at $22.567/kg this week, unchanged from the previous week on the back of buy-sell indications heard.

A source familiar with the global polysilicon market noted that the spot polysilicon has been largely unsold for two months, with downgraded materials faring worse.

However, global polysilicon suppliers report no reduction in production so far, and customers who have a long-term agreement with the suppliers are still under some pressure and have taken goods at relatively stable prices. “Signing a long-term agreement is meant to protect the interests of both parties. Shifting all risks onto one party to completely avoid risks is a practice that lacks the spirit of a contract,” a source from one supplier commented.

According to a China-based source, a Chinese wafer manufacturer maintaining a low 30% operating rate domestically is sending wafer slicing equipment to Laos and may consider adding ingot capacity there in the future. This development suggests potential new sales channels for global polysilicon.

Due to reduced production rates of solar products in four Southeast Asian countries, the current ingot production requiring global polysilicon can only consume less than 1,500 MT of these materials per month, according to a source. The source also noted that the production capacity of newly constructed ingot plants outside of these countries is insufficient to fully stimulate demand for global polysilicon.

“We believe that in the coming years, ingot production capacity outside of China and the four Southeast Asian countries will flourish, introducing new factors that will influence global polysilicon prices,” stated a market observer. However, the source also noted that over the next two years, U.S. trade policy will remain a crucial determinant of global polysilicon price trends.

China Mono Grade, OPIS' assessment for polysilicon prices in the country, remained steady at CNY33 ($4.54)/kg this week, marking the sixth consecutive week of stability.

According to a market source, major polysilicon manufacturers halting price reductions have contributed to stabilizing mainstream market prices. The source added, “There's a strong likelihood that polysilicon prices will stabilize at this current low point in the near future.”

According to an upstream source, a major manufacturer with strong financial backing and a high operating rate is actively ramping up its new annual polysilicon production capacity of 200,000 MT in Yunnan. Furthermore, their new 200,000 MT polysilicon plant in Inner Mongolia is currently under construction and expected to be operational by the fourth quarter of this year.

“However, we may expect some obstacles to the progress of this Inner Mongolia project due to the current market downturn,” a market veteran commented.

Another market observer noted that despite lower production costs for fluidized bed reactor (FBR) granular polysilicon, manufacturers are currently unable to maintain high operating rates due to the product's market share constraints. “There are two FBR granular polysilicon manufacturers in China that engage in production and sales, with another manufacturer operating a research and development trial production line,” the source added.

A market participant concluded that based on the current downstream operating rates, an effective reduction in polysilicon inventory by the year's end appears challenging. Further decreases in polysilicon production are expected in the second half of the year.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Dear author/analyst, thanks for your report, it’s insightful but lacks assessment on two important features of the polysilicon supply chain, which are its carbon intensity and modern slavery risks. It sounds like there is little diversity, what is the energy supply and labour supply for the new plants in Yunnan and Inner Mongolia, how reliable is the reporting regime? We need to be up front about these issues to support procurement policies in much of the world.