Germany recorded its highest hourly price for electricity in history during the fourth week of June, according to AleaSoft Energy Forecasting.

AleaSoft recorded an hourly price of €2,325.83/MWh in Germany on June 26, a day after the single European market decoupled, halting international electricity exchanges.

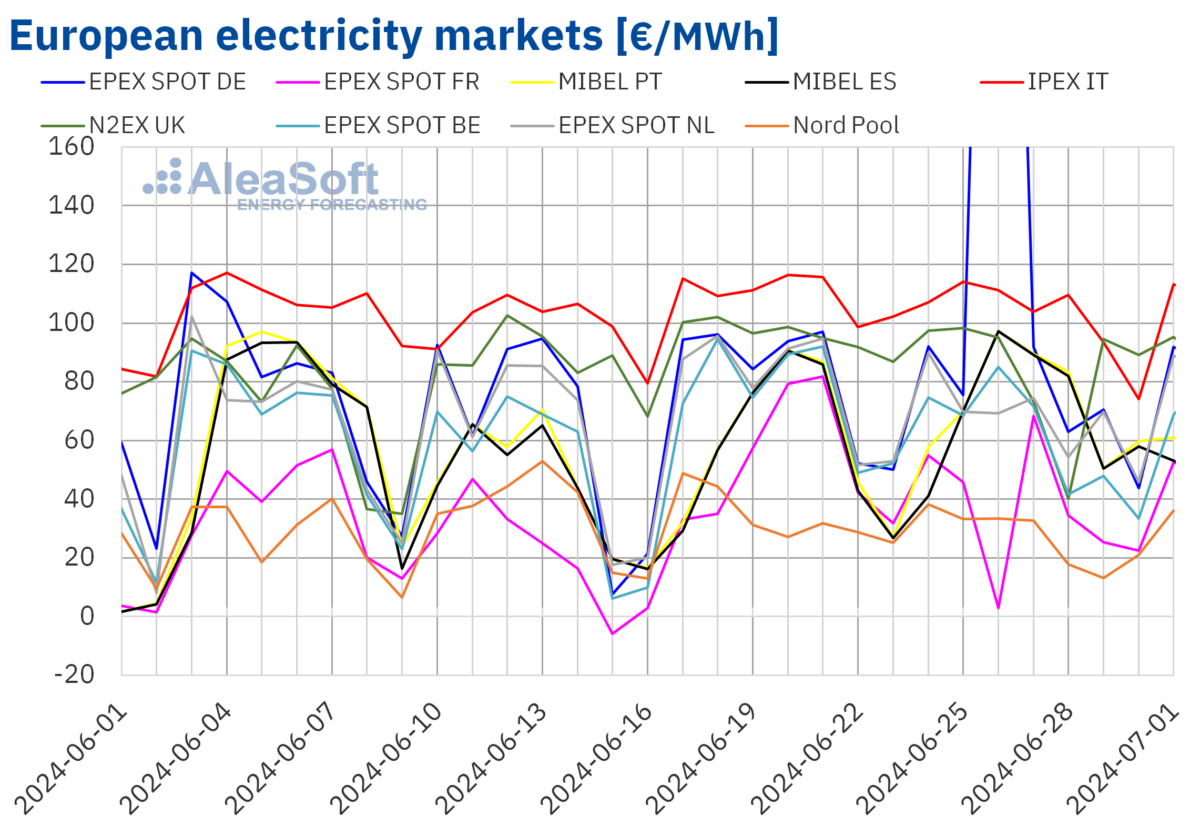

This peak contributed to a 64% increase in the average weekly electricity price in Germany when compared to the preceding week. Average weekly prices also increased in Portugal and Spain, by 22% and 19%, respectively.

Average weekly prices fell in the Belgian, British, Dutch, French, Italian, and Nordic markets last week, with the French market recording the largest percentage drop at 29%.

Weekly averages were below €75/MWh in most markets, except the British, Italian and German markets, which recorded averages of €83.98/MWh, €101.90/MWh, and €132.70/MWh, respectively. The Nordic market registered the lowest average, at €27.08/MWh.

AleaSoft said electricity prices in most markets fell due to a decline in weekly gas and CO2 emission allowance prices. For the first week of July, the consultancy expects electricity prices to rise again in most markets, but says they could fall in the German, Portuguese and Spanish markets.

The final week of June also saw solar energy production increase by 27% week-on-week in the French market, 23% in the German market and 1.6% in the Italian market, but fall in Spain and Portugal.

France recorded its highest daily solar energy production for a day in June on June 24, registering 122 GWh, while Germany recorded 433 GWh on June 25, which is an all-time production record in the country.

For the week of July 1, AleaSoft predicted that solar production will decrease in Germany and Italy, but increase in Spain.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The headline is misleading as the conclusion that German power prices rose 68% including the Price Peak.

Misleading as a system error which caused that decoupling is not a part of the normal pricing.

And the Headline need to include the „Trading System error“