From pv magazine ESS News site

Europe’s BESS fleet continues to grow in leaps and bounds but projections still fall short of the estimated capacity needed to unlock the continent’s renewable energy potential.

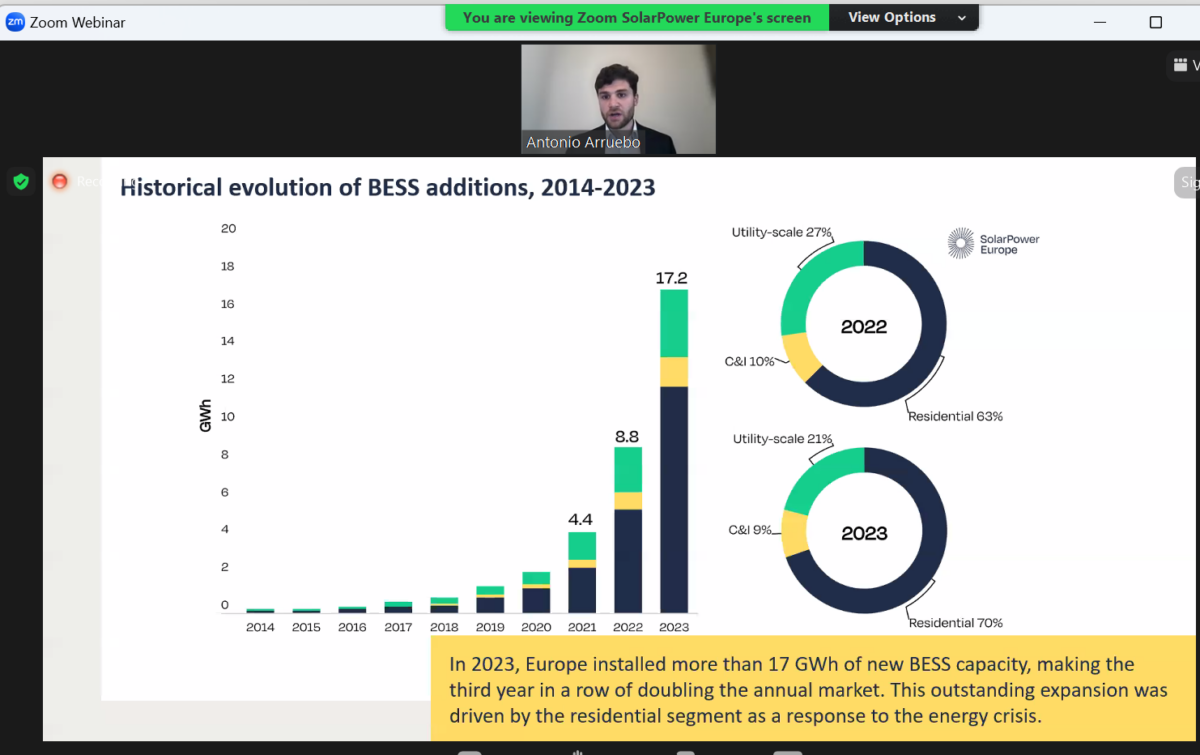

In its first analysis of the sector, PV industry association SolarPower Europe (SPE) found that 17.2 GWh of new BESS capacity was installed in Europe in 2023, experiencing an impressive 94% increase compared to 2022.

By the end of 2023, Europe’s total operating BESS fleet reached around 36 GWh. The residential segment accounted for 70% of this capacity, followed by large-scale battery systems (21%), and commercial & industrial systems (9%), the European Market Outlook for Battery Storage 2024-2028 report reads.

The dominance of home batteries came as a result of the energy crisis triggered by Russia’s invasion of Ukraine and disruptions to gas supply. However, as stated in Tuesday’s webinar hosted by SPE, this will change already this year as utility-scale batteries become the key driver behind deployment in Europe, accounting for almost 11 GWh of new additions, with 5 GWh in Italy alone.

In 2023, Germany led the market with 34% of the European market share, followed by Italy (22%), and the United Kingdom (15%). Specifically, Germany deployed 5.9 GWh last year, marking a significant increase of 152%. Italy followed, connecting a record-breaking 3.7 GWh (+86%), trailed by the United Kingdom with 2.7 GWh (+91%).

Furthermore, Austria exceeded the one-gigawatt-hour milestone, while the Czech Republic got close to it with around 900 MW installed. With the exception of the UK, all top five BESS markets in Europe were driven by the residential market segment.

To continue reading, please visit our new ESS News site.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.