From pv magazine USA

California transitioned its rooftop solar policy on April 15, 2023, eliminated net energy metering (NEM) and moving toward a net-billing tariff (NBT) structure. The change cut the rate paid to customers for exporting their excess solar production to the grid by about 80%. One year later, Lawerence Berkeley National Laboratory (LNBL) has released a report evaluating changes in the state’s rooftop solar market.

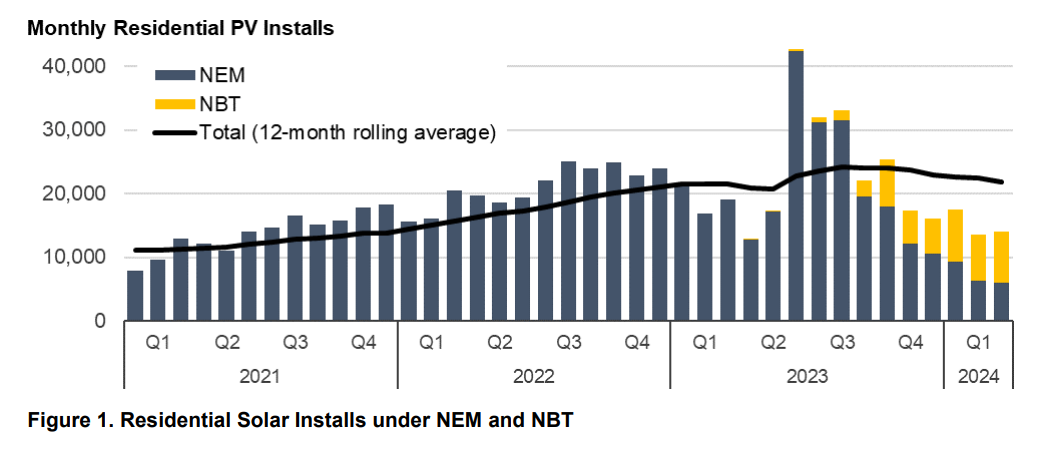

LNBL found that rooftop solar installations in California were roughly equal in 2023 to 2022. However, 80% of the systems installed were NEM 2.0 installations rushing into interconnection queues before the April 15, 2023 deadline to secure the more lucrative rate structure. To date, about 50,000 systems have been interconnected under the new NBT structure, in addition to 200,000 NEM systems interconnected over the same period.

Data from EnergySage, operator of the largest residential solar quote site in the United States, are “suggestive of a more sustained downturn,” said the report.

Quote requests spiked during the December 2022-April 2023 window between announcement and implementation of NBT. Since then, monthly quote requests have averaged roughly 60% of historical (2019-21) levels.

A 40% drop in historical quote requests is a “leading indicator” for market activity and “is perhaps the clearest signal yet of a substantial and sustained market contraction,” said LNBL.

A significant contraction of the rooftop solar market is not an ideal outcome for California, a state with ambitious clean energy goals and an electricity affordability crisis. Trade association leaders have warned that California is unlikely to reach its clean energy targets without robust contributions from the rooftop solar industry.

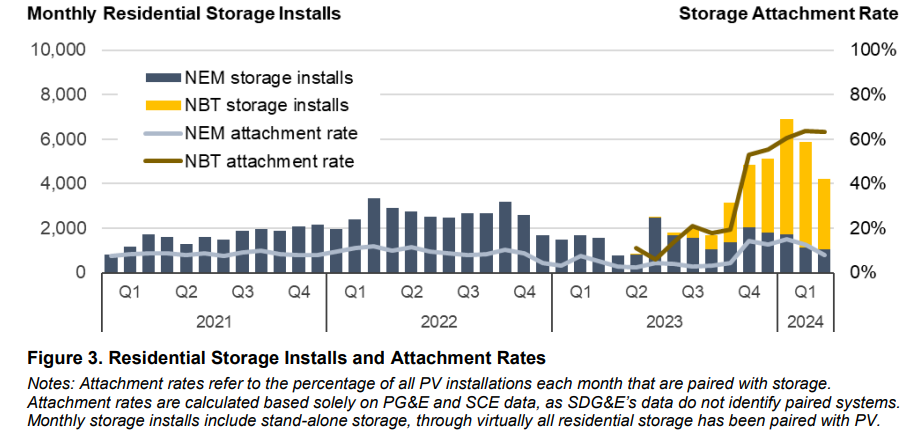

However, the transition to NBT has created some outcomes in California that may be desirable. The profile of an installed system has changed considerably. Pre-NBT, customers attached battery energy storage with their rooftop array in roughly 10% of installations. Now, post-NBT installations include batteries 60% of the time.

This is important for California’s grid operators, that seek to smooth out the mismatch between solar generated electricity supply and demands on the grid. This mismatch, often represented by the “duck curve,” has been deepening in California, causing pricing and grid maintenance issues, and creating a need for inefficient natural gas “peaker” plants to serve times of high demand and low generation.

The high battery attachment rate offers customers some benefits, too. While the overall sticker price goes up with a battery-attached system, the return on investment has improved relative to a solar-only installation.

Installers report a median payback period of eight years for solar systems with a battery, while standalone solar systems have a longer median payback period of about 10 years. Battery storage enables customers to store their solar production and use it when grid prices are at their highest, rather than selling it to the grid at pennies on the dollar on sunny afternoons. Solar-battery owners also have the option to be compensated for exporting power during peak demand events or emergencies, potentially creating a new stream of revenue.

Customers with batteries also benefit from having backup power during grid outages, which remains the number one reason for including batteries nationwide, according to an installer survey by SolarReviews.

“Since November 2023, residential storage installs have averaged roughly 5,000 systems per month, more than double the monthly pace over the preceding three years,” said the report from LNBL.

The Berkeley Labs report noted a change in financing options for residential solar customers. Over the final 12-months of NEM, third party ownership rates, including leased and power purchase agreement systems, averaged 26% for stand-alone solar and 11% for solar and storage systems. This jumped up to 39% for standalone solar and 52% for solar plus storage under the NBT system. Some of this change may be attributed to increased interest rates creating loan terms for customers that are more difficult to digest.

Finally, the Berkeley Labs report noted an increase in consolidation in the California rooftop solar market. The market share of the top five installers in the state rose from 40% during the last year of NEM to 51% during the first year of NBT.

One year in, it is clear that the change to NBT has drastically altered the California rooftop solar industry. However, the backlog of NEM orders being served in 2023 has made it unclear what the total effect of this policy change will bring. This sets the stage for 2024 being a critical proving ground for the health of this industry.

“These trends, and others, will no doubt come into sharper focus over the next year or so, once the NEM backlog is fully cleared and a ‘new normal’ under NBT sets in,” concluded Galen Barbose, staff scientist, LNBL.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.