From pv magazine USA

SolarReviews, a PV information site, has released its annual survey. It shares results gathered from a group mostly represented by residential solar installers, as well as commercial installers, equipment providers, and utility-scale installers. SolarReviews operates a Solar Calculator that enables prospective customers to have a snapshot of the benefits of adding solar to their rooftops, based on customized data for their area.

With higher financing costs industry-wide, 54% of US installers said customers were less likely to take a solar loan over the past year, while cash deals were up. About 49% of reported sales were cash deals, while 41% were loans. HELOC, PACE loans, power purchase agreements, and leases combined for 10% of reported solar sales.

The top financing providers used were Credithuman (15%), Mosaic (14%), Sunlight Financial (9%),Dividend (8%), and Clean Energy Credit Union (8%).

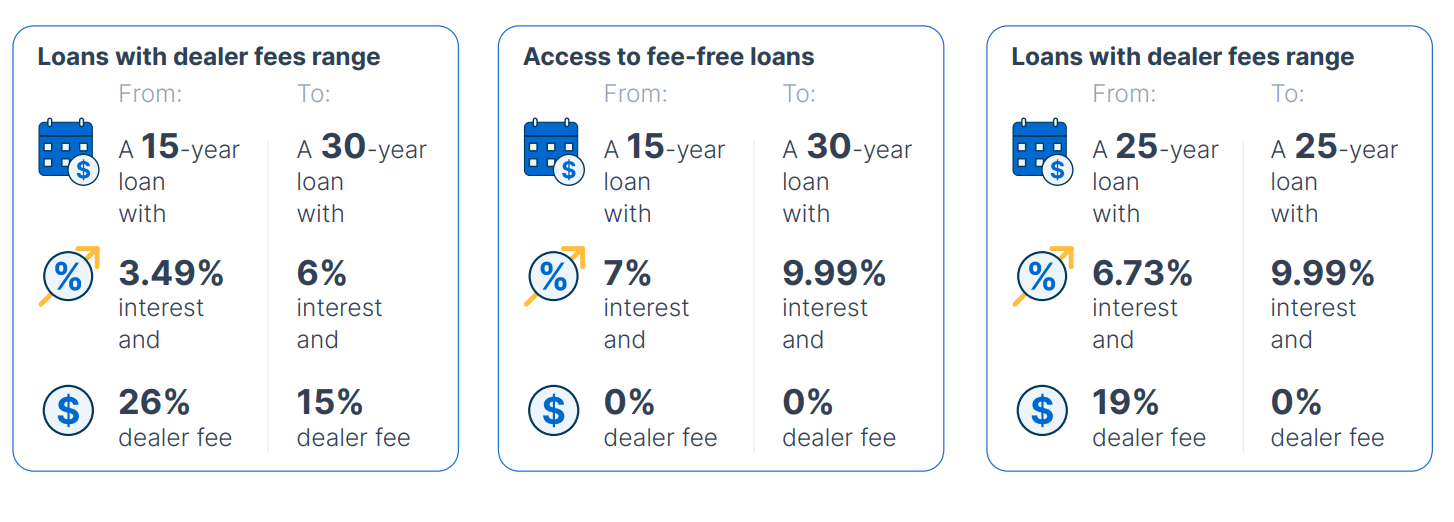

Typical loans for loaned systems varied widely depending on whether dealer fees were assigned. Average terms are seen below.

The higher cost of finance has pressured the residential solar industry. About 49% of installers said demand went down in 2023 compared to 2022.

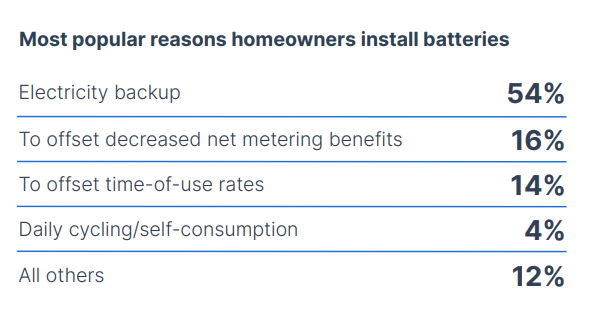

In California, where rates paid for exporting solar production to the grid were slashed by about 80%, about 69% of installers reported lower sales in California in 2023 versus 2022. However, 68% of installers reported including battery energy storage with their solar installation, about double the national average. Installers report a median payback period of eight years for solar systems with a battery, while standalone solar systems have a longer median payback period of about 10 years.

California was not the only state to cut rates for solar exports – a process known as net metering. Georgia, Arizona, Kansas, Arkansas, and Wisconsin all noted an increase in installed systems not tied to net-metering agreements.

As for the top equipment brands in residential solar, SolarReviews surveyed installers based on five criteria of performance and quality, brand name reputation, product warranty, pricing, and product availability from distributors. Based on the five criteria, SolarReviews listed Qcells as the top panel brand.

Installers said the top five most-used panels were Qcells (53%), REC (41%), Canadian Solar (35%), Mission Solar (29%), and JinkoSolar (20%). About 19% of solar installers offer one panel brand, while most provide alternative options to meet the needs of their customers.

For inverters, the top five most-used brands were Enphase (62%), SolarEdge (43%), SMA (23%), Sol-Ark (21%), and Tesla (21%). Tesla made a notable leap up into the top five, gaining a larger market share than Fronius and Generac.

pv magazine

Enphase was also listed as the most commonly used battery energy storage provider, offered by 46% of installers. This was followed by Tesla (42%), SolarEdge (35%), FranklinWH (29%), and Fortress Power (18%). A sizeable market share was also held by SunPower, Generac, LG Energy Solution, and HomeGrid.

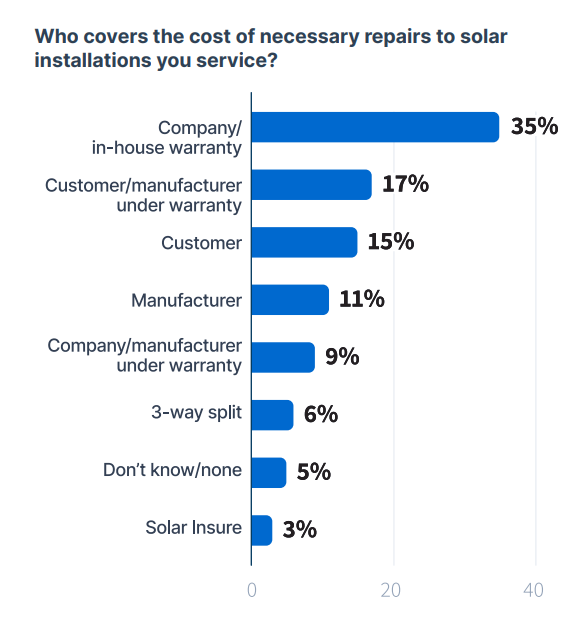

Given that solar is often a 25-year investment, post-installation services are a critical feature in a solar agreement. About 96% of installers have access to system monitoring, while 63% said they proactively check their customers’ installations at least once per quarter to ensure they are working.

The most common reasons for service, in order, were inverter hardware failures and replacement, inverter software and setup issues, battery software updates, communications and monitoring fixes, roof leaks, battery hardware failure or replacement, wiring issues, and broken or underperforming panels.

“Fortunately, when issues do occur, they are often covered by some type of warranty, leaving only 15% of cases where the customer is responsible for repair costs,” said SolarReviews.

The residential solar industry looks to recover from a rocky 2023, where growth was slowed by high finance costs and unfavorable policy changes like the reduction of net metering rates.

“Some solar businesses are still reeling from the events of 2023. 22% of solar businesses say they have concerns that make them unsure whether they can stay in business in the coming six months,” said SolarReviews.

Despite this uncertainty, residential solar installers appear to have a good outlook for 2024. About 54% of surveyed installers said they expect to sell more solar in 2024, and an additional 23% said they think they will be able to maintain the same level of business next year.

Notably, surveyed installers listed pv magazine as the top trusted media platform for solar news and analysis, with 52% responding that we are the preferred source. The marks our second year in a row as the most-trusted media source. We thank you for your continued readership.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.