From pv magazine India

ICRA said it expects the recent decline in battery costs to drive the adoption of battery energy storage system (BESS) projects in India. BESS and pumped hydro storage projects are now the dominant energy storage options in India.

ICRA said it expects the share of generation from renewable energy, including large hydro, to increase to around 40% of national generation by fiscal 2030, from less than 25% currently, driven by large capacity additions that are now underway. Achieving such a high share would require the development of energy storage systems to manage the intermittency associated with wind and solar power.

Energy storage systems also play a role in improving grid stability, providing ancillary support services and peak load shifting. Since the Ministry of Power has released bidding guidelines for BESS projects, there have been multiple bids called by central nodal agencies and state distribution utilities. The tariff under these bids is fixed and payable, based on the availability and round-trip efficiency.

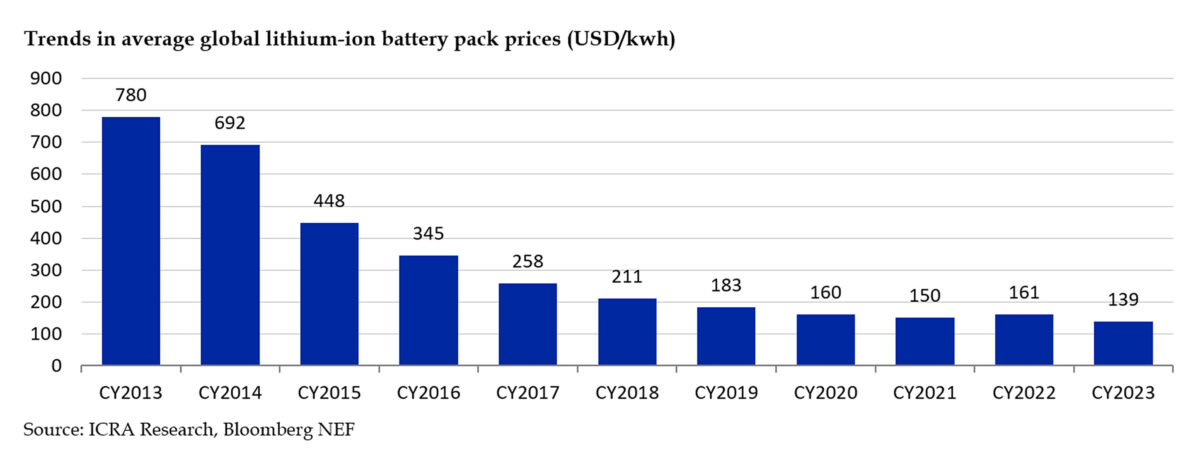

“The discovered tariff under the BESS tenders more than halved from INR 10.84 lakh ($12,987)/MW/month in the first Solar Energy Corp. of India (SECI) tender in August 2022 to INR 4.49 lakh/MW/month in the latest tender by Gujarat in March 2024, reflecting the decline in battery prices and improving competitiveness of such projects,” said Girishkumar Kadam, senior vice president and group head of corporate ratings for ICRA. “The viability of these projects remains pegged to the capital cost of the BESS. Based on the average battery cost of $140/kWh seen in 2023 along with associated taxes/duties and cost of the balance of plant, the capital cost is expected to be in the range of $220/kWh to $230/kWh.”

The decline in battery costs over the decade to 2021 helped reduce the cost of energy storage and adoption of BESS projects throughout the world. While prices went up in 2022, they declined in 2023 to an all-time low, led by a moderation in raw material prices. Cheaper battery prices are the key to higher adoption of BESS projects, said ICRA.

“The execution risks and gestation period for the BESS projects remain relatively low compared to PSP hydro,” said Kadam. “Overall, a sustained reduction in battery prices and relatively low gestation period for these projects is expected to support their greater adoption for energy storage, going forward.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.