From pv magazine India

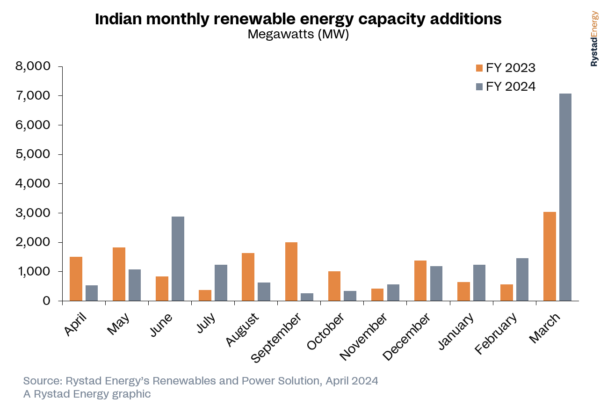

Rystad Energy’s latest figures show that India's monthly renewable energy installations surged to a record 7.1 GW in March 2024, from the previous record of 3.5 GW, set in March 2022. More than 6.2 GW of the March 2024 total was new solar capacity – a significant amount, given that the January-December 2023 period saw 7.5 GW of new solar installations.

The increase in renewables in March helped India to reach its highest-ever annual installed capacity of 18.5 GW for the fiscal year to March 31, 2024.

Rystad Energy said that the [annual] growth in renewables capacity was primarily driven by solar installations, which were up 23% on levels from the 2023 fiscal year, driven by the commissioning of numerous projects within India’s inter-state transmission system network and ultra-mega solar park schemes. In particular, states such as Gujarat, Rajasthan, Madhya Pradesh and Maharashtra have contributed to this expansion.

Adani Green, the renewable energy unit of Indian conglomerate Adani Group, made significant strides in the first quarter of 2024 by installing approximately 1.6 GW of solar capacity in the Kutch district of Gujarat. This initiative is part of a wider hybrid renewable energy park that will see up to 30 GW of combined solar and wind capacity installed in Khavda over the coming years.

While the recent increase in renewable capacity is encouraging, additional growth in annual deployment is key to meeting the nation’s aim to achieve 500 GW of non-fossil fuel capacity by 2031-32. To reach the 500 GW target, India must install around 30 GW of non-fossil fuel energy generation capacity per year, including solar, hydropower, onshore wind and nuclear energy.

“With the commencement of India’s general elections earlier this month, the country’s emphasis on renewable energy comes as no surprise. Despite ambitious climate goals to reduce carbon dioxide emissions, achieving them is only achievable if the country maintains the fervor witnessed in recent months,” says Rohit Pradeep Patel, vice president of renewables and power research at Rystad Energy. “However, critical challenges persist: ensuring grid stability alongside the higher integration costs that come with introducing more renewable capacity. A strategic solution lies in balancing this clean energy embrace with targeted exports, enabling India’s growth visions for the power sector, without compromising national climate goals.”

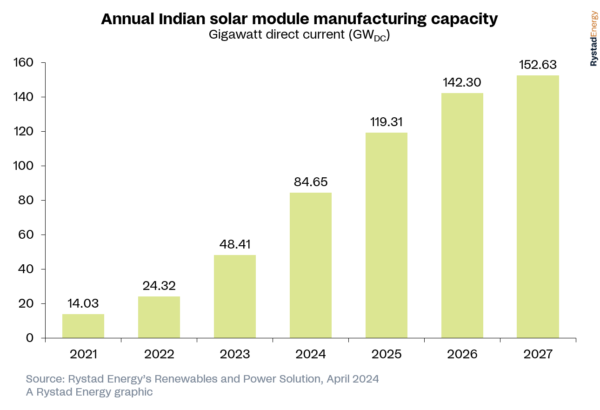

On the supply chain side, the ramp-up of solar installations in India has created substantial demand for solar equipment.

Historically, Indian developers have heavily relied on Chinese imports due to their competitive pricing over domestic manufacturers. In response, the Indian government has introduced initiatives such as the production-linked incentive (PLI) scheme to help domestic manufacturers to boost their production capabilities.

In addition, governmental support measures such as the Approved List of Models and Manufacturers (ALMM) mandate and the basic customs duty on imported solar modules have also helped to bolster the domestic solar industry. Supported by these measures, India’s solar panel production capacity hit 68 GW in March 2024, and the nation started expanding its reach by exporting panels.

The US market has emerged as a major export destination, due to its high demand for solar energy and the potential for strong profit margins. The Uyghur Forced Labor Prevention Act (UFLPA) in the United States has also played a role in this shift to Indian products.

Although millions of panels are being shipped from India to the US market, Indian manufacturers encounter stiff competition from their Southeast Asian counterparts, who are able to lower their production costs by using material inputs from China.

However, exports from India are expected to increase as the US imposes duties on panels from Southeast Asian manufacturers. They are expected to be as high as 254% and will likely be implemented from June 2024, making Southeast Asian panels significantly more expensive than ones from India.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.