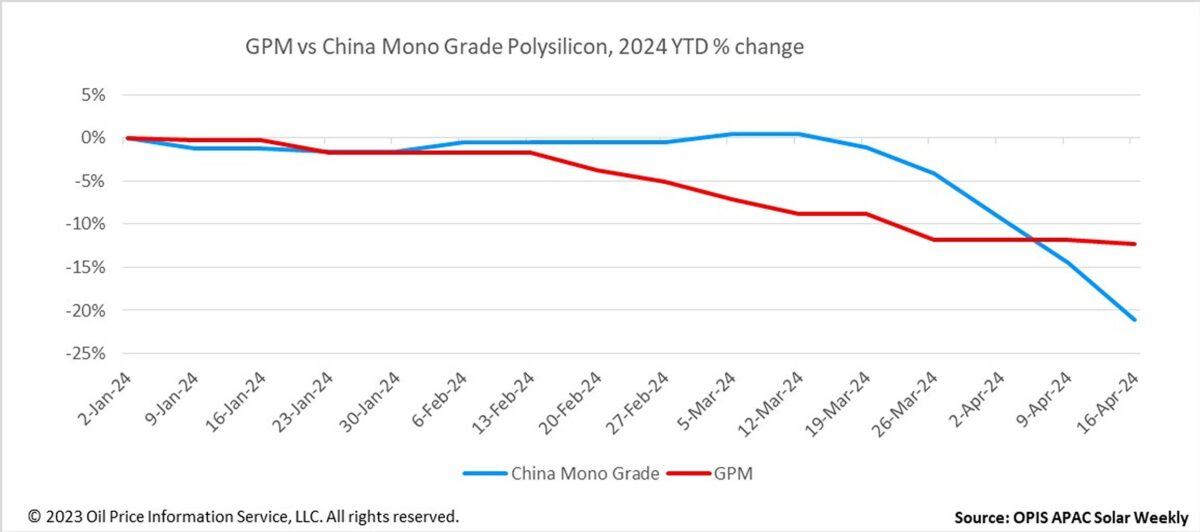

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was assessed at $22.90/kg this week, slightly down by $0.15/kg or 0.65% from the previous week on the back of buy-sell indications heard.

According to an upstream source, polysilicon prices outside of China remain relatively stable amidst the volatility in the Chinese market, with occasional minor declines possible. The source attributes this stability primarily to the short-term absence of an increase in global polysilicon supply. Additionally, products such as wafers, cells, and modules manufactured outside of China continue to fetch a premium compared to those made within the country, which further bolsters the premium of global polysilicon.

The long-term price trend of polysilicon outside of China largely hinges on the types of modules permitted to enter the US market, according to a market observer. The source highlighted that the further the supply chain of modules eligible for entry into the United States is detached from China, the greater the premium that polysilicon produced outside of China can uphold.

Recently, a leading solar company in India announced the initiation of ingot and wafer production with a planned capacity of 2 GW per year, garnering significant attention from market participants. According to a source in China, this development has inevitably sparked speculation, linking it to China's export of 990 MT of polysilicon to India in the fourth quarter of last year. Another individual familiar with the global polysilicon market emphasized the importance of monitoring the polysilicon source of this Indian manufacturer, as it could signify the potential establishment of another photovoltaic supply chain, parallel to China's and targeting the US market.

China Mono Grade, OPIS’ assessment for polysilicon prices in the country was assessed at CNY48.167 ($6.659/kg this week, down CNY4.00/kg, or 7.67% from the previous week. This signifies the most significant weekly decline since the start of the year, according to OPIS data.

Multiple sources attribute this current price decline primarily to the drop in prices of p-type polysilicon from Tier-2 and Tier-3 manufacturers. The low proportion of n-type polysilicon produced by these manufacturers, combined with weak downstream demand for p-type polysilicon, necessitates further price reductions to stimulate sales and recover funds.

Sources from the polysilicon market report that the price of n-type polysilicon, with total metal impurities not exceeding 0.5 parts per billion by weight (ppbw), is approximately CNY55/kg. Meanwhile, the price of P-type polysilicon ranges between CNY45/kg and CNY50/kg.

One source highlighted the significance of the current price of fluidized bed reactor (FBR) granular polysilicon utilized for n-type wafer production, which stands at CNY51 to CNY52/kg. This has surpassed the price of p-type Siemens polysilicon for rod-shaped ingot processing where FBR granular polysilicon prices were previously lower. This reversal indicates a pessimistic outlook for P-type polysilicon.

According to a market participant, there hasn't been any equipment maintenance or production reduction among polysilicon companies. Moreover, this month will witness the introduction of new production capacities from two leading manufacturers, each with annual production capacities of 100,000 MT and 200,000 MT, respectively.

As a result, it's anticipated that the price of polysilicon will continue to stay low for the foreseeable future. “Only when the supply of polysilicon decreases in the future might we see a halt to the decline and a stabilization in prices,” explained the insider.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.