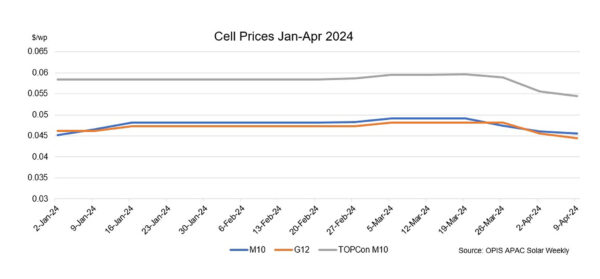

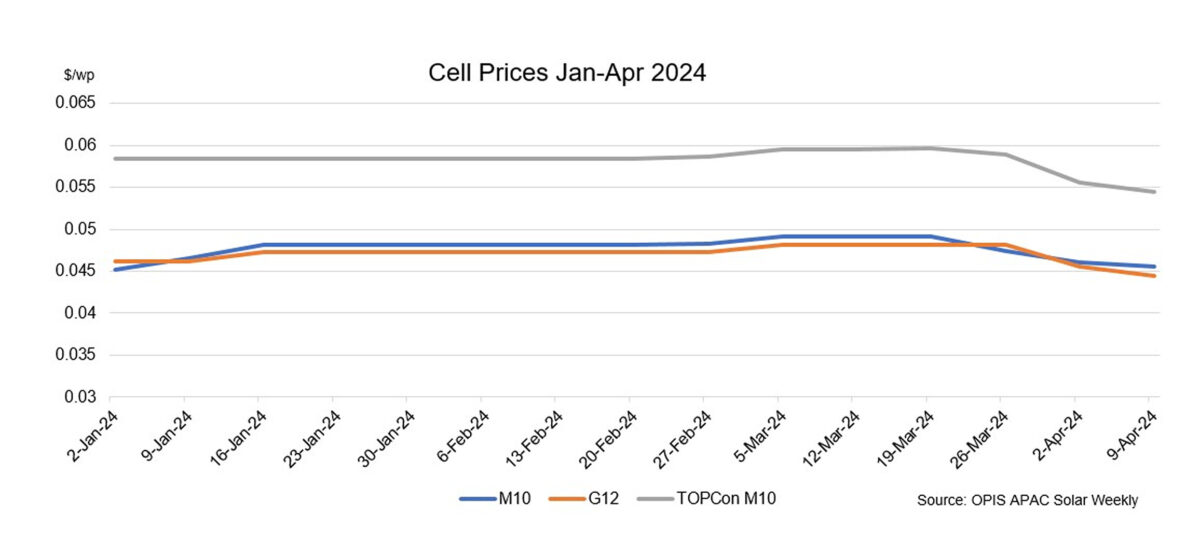

FOB China prices for cells faced another round of declines this week, continuing to be impacted by widespread price drops across the upstream segments.

The FOB China prices of Mono PERC and TOPCon M10 cells were assessed at $0.0455 per W and $0.0545/W, respectively, marking a decrease of 1.09% and 1.98% from the previous week. Similarly, the price of Mono PERC G12 cells dropped by 2.20% week to week, reaching $0.0445/W this week.

According to the OPIS market survey, the prices of Mono PERC M10 and TOPCon M10 cells in the Chinese domestic market have fallen to approximately CNY0.365 ($0.50)/W and CNY0.437/W, respectively. High-efficiency TOPCon M10 cell prices as low as CNY0.42/W have already been reported in the market, indicating a continued decline in prices.

Additionally, a market source noted that besides the effects of upstream price declines, the TOPCon cell market is experiencing an expansion in production, further intensifying the perception of declining cell prices. Some manufacturers are investing in additional TOPCon capacity, while others are upgrading their outdated Mono Perc production lines to TOPCon.

According to a major TOPCon cell producer, the implementation of ground-mounted solar projects in China during April and May might have a limited impact on driving up demand and prices, given the substantial capacity involved.

Some sources conveyed a pessimistic outlook on the local market in Turkey after attending The International SolarEX Istanbul Fair held from April 4-6, describing it as “tepid.” It is unclear how large Turkey’s manufacturing capacity is, and a review of data points to anything between 12 GW to 40 GW of manufacturing capacity across the value chain, against a local installation market of around 2GW per year. According to a major cell manufacturer, there remains a significant inventory of Mono PERC cells in this market, which continues to be dominated by p-type products. Expanding into new markets and business ventures here will take time, the source added.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.