European developers signed 21 PPAs for 916 MW of capacity in January 2024, according to a new report from Pexapark.

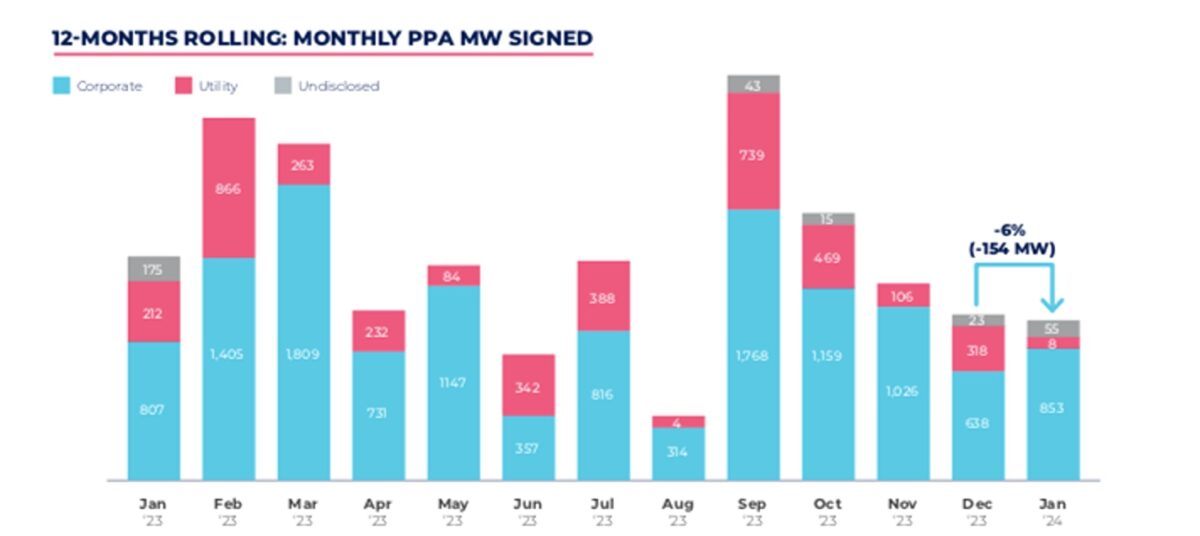

January’s deal count marked a drop from 26 PPA announcements in December, but was slightly higher than in January 2023. The total volume was 6% down month on month and lagged behind January 2023, when 1,194 MW were recorded. However, Pexapark said this was largely due to one big offshore PPA being signed in January 2023 that accounted for more than 580 MW.

Despite the fall in both volumes and deal count, Pexapark said the results for January 2024 mark continued momentum after a “golden year” for the European PPA market in 2023.

January saw all tracked PPA prices fall 12.8% month on month to end the month at €43.80 ($47,55)/MWh. Pexapark attributed this decline to lower power and commodity prices, which have fallen to multi-year lows. In particular, it said that German power contracts closed at two-year lows in January and predicted that they will continue to fall “amid bearish market fundamentals including mild weather, gas storage and carbon prices.”

Dutch and Polish PPA prices experienced the largest falls in January, down 16.3% and 15.7%, respectively, while French PPA prices saw the smallest movement, experiencing a 6.8% decline.

France announced more deals than any other country in January, with six totaling 179 MW. Pexapark said the majority were tied to solar assets, but the largest was a deal between Equinix and Wpd. Billed as one of the largest corporate PPAs in French history, the deal was for seven 20-year contracts representing more than 100 MW of capacity across five onshore wind projects.

Elsewhere, Germany saw a 15-year PPA linked to a 55 MW solar project between Lhyfe and EDPR Renewables. Set for launch in 2025 in the state of Thuringia, the agreement marks EDPR’s inaugural long-term corporate PPA venture in Germany, as well as its first collaboration with a green hydrogen producer.

Poland also had a strong January 2024. The country recorded two agreements, totaling 41 MW, including a 10-year deal revolving around a 21 MW solar asset between GoldenPeaks Capital Trading and Boryszew Green Energy & Gas, which is projected to generate 24 GWh of clean electricity per year.

Amazon was the lead buyer for the month, signing two deals with a collective capacity of more than 280 MW.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.