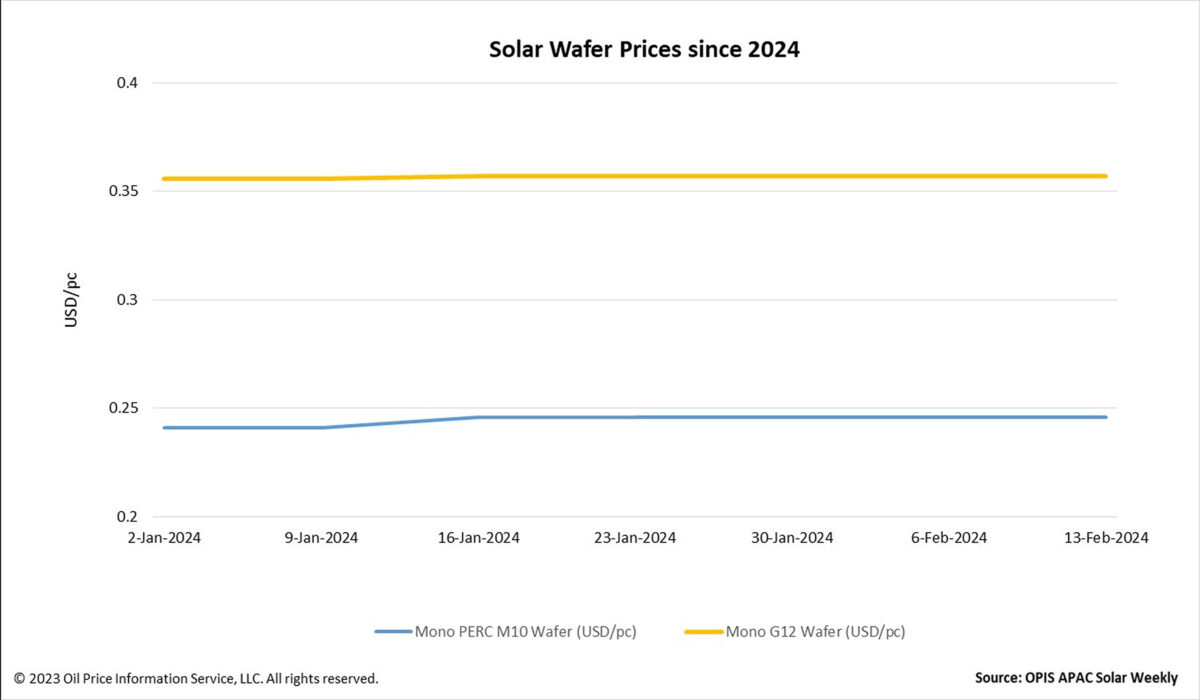

Wafer FOB China prices trended flat this week due to limited trading activity during the Lunar New Year holiday. Mono PERC M10 and G12 wafer prices remain steady at $0.246 per piece (pc) and $0.357/pc, respectively, without any change from last week.

The fact that the supply of wafers greatly outpaces downstream demand explains why prices for wafers have been steady for the past four weeks, even if the price of polysilicon in China has increased somewhat, an upstream source explained.

OPIS has learnt from its market survey that downstream manufacturers have made significant production cuts since February, and China’s cell production output in February is expected to be between 35 GW to 40 GW only. However, according to the Silicon Industry of China Nonferrous Metals Industry Association, February's wafer output in China would be roughly 55 GW. The trade body also noted that there hasn't been a noticeable decline in wafer market operating rates.

“In February, wafer inventory might quickly build up,” a market watcher told OPIS.

A market participant sees the outlook for the short-term wafer market as bleak, stating that the link between supply and demand will govern wafer prices. Given that wafer output has been consistently strong thus far, the insider advised that it is important to monitor if wafer manufacturers will have to significantly scale back production output in late February.

A polysilicon insider meanwhile offered a relatively optimistic signal: cell producers may accelerate their purchases of wafers because there is typically a pickup in end-user demand globally starting in March. The insider predicts that at that point, the price of wafers might rise or at least level off.

There have been several instances of cancellations or delays in the announced solar manufacturing projects in the past two months. China’s wafer producer, Beijing JYT Corporation, announced on December 26 that it would postpone the production time of a 22 GW ingots and wafering project at the Leshan base from the original plan of January 2024 to December 2024, partly due to intensified competition in the wafer manufacturing market and significant fluctuations in wafer prices.

Chinese solar manufacturer, Mubang High-tech Co., LTD., announced on February 8 that the implementation of its new 5 GW a year n-type wafers facility in Tongling, Anhui, carries a risk of project termination due to uncertain financing sources.

Although these developments may appear negative, they are a positive move for the industry as consolidation becomes necessary, according to a market observer. The companies with the best strategies will survive this round of industry consolidation and foster an improved solar manufacturing ecosystem, the source added.

Another source concurred, stating that the next phase in the solar manufacturing business, which is currently running at a loss overall, is to remove obsolete and redundant production capacity. “Any price hike or stability before this might only be temporary,” the source added.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.