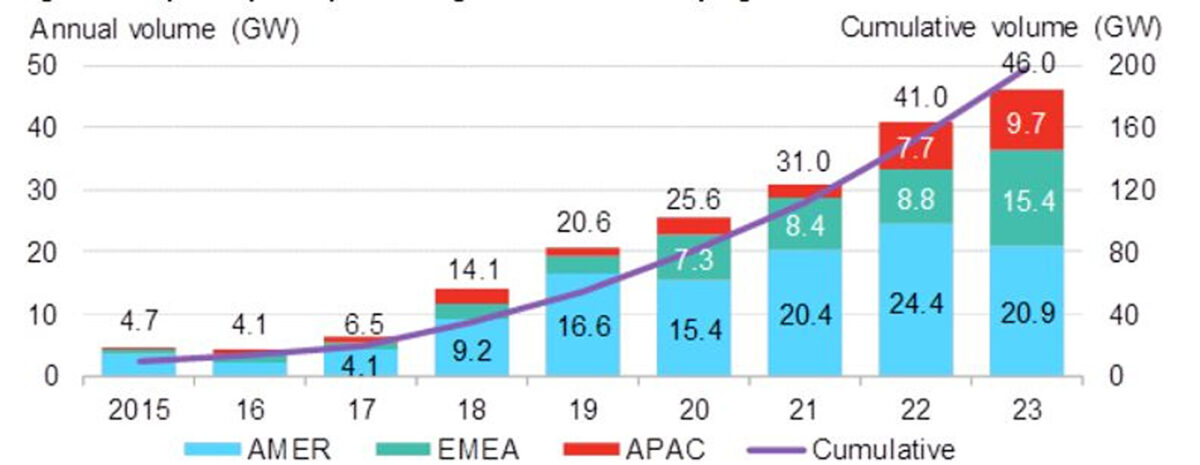

Corporations globally announced 46 GW of solar and wind PPAs in 2023, according to the latest report from BloombergNEF.

The figure represents a record high in a calendar year and a 12% year-on-year increase from 2022. The global PPA market has now grown by about one-third on average since 2015.

BloombergNEF said improving economics in key regions such as Europe, alongside imminent company clean energy goals, were the main drivers.

“It has never been easier to buy clean energy as a corporation,” said Kyle Harrison, head of sustainability for BloombergNEF. “For the first time, a variety of contracting structures are now widely available around the world to help companies decarbonize their energy consumption. These contracts are now the centerpiece in many companies’ sustainability strategies, rather than a nice-to-have.”

Between 2022 and 2023, Europe saw its corporate PPA volumes grow 74% to 15.4 GW – by far the largest growth of any region. BloombergNEF said that as “supply chain woes eased and gas balances normalised following the region’s energy crisis in 2022, corporate PPA prices in the region dropped, often faster than power prices.”

The United States remained the largest market for PPAs, with 17.3 GW of deals announced, but was 16% down year on year on the record 20.6 GW achieved in 2022.

BloombergNEF said that economics for signing PPAs were weaker in the United States than in Europe in 2023.

“Power prices didn’t rise at the same rates, resulting in buyers holding off on signing deals until the market recalibrates,” said BloombergNEF.

Amazon was the world’s largest corporate clean energy buyer for the fourth consecutive year. It announced 8.8 GW of PPAs across 16 countries, including 5.6 GW of solar PPAs. Amazon was followed by Meta, which announced 3.1 GW of PPAs, all in solar.

BloombergNEF said companies with 100% clean energy targets under the RE100 initiative will need an additional 105 GW of solar and wind by 2030.

“With the rise of artificial intelligence, electrification of transport and increased need for manufacturing, we expect power demand from the private sector to surge in the coming years,” said Harrison. “Clean energy, especially through PPAs, will likely be many companies’ first, best option.”

Companies signed deals with more than 150 developer counterparts in 2023. French utility Engie led the way, selling 2.4 GW of deals. It was the first time Engie topped the leaderboard since 2019.

Earlier this year, a report by Mercom Capital Group found that solar companies raised $34.3 billion in corporate funding in 2023 – the largest amount in a decade.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.