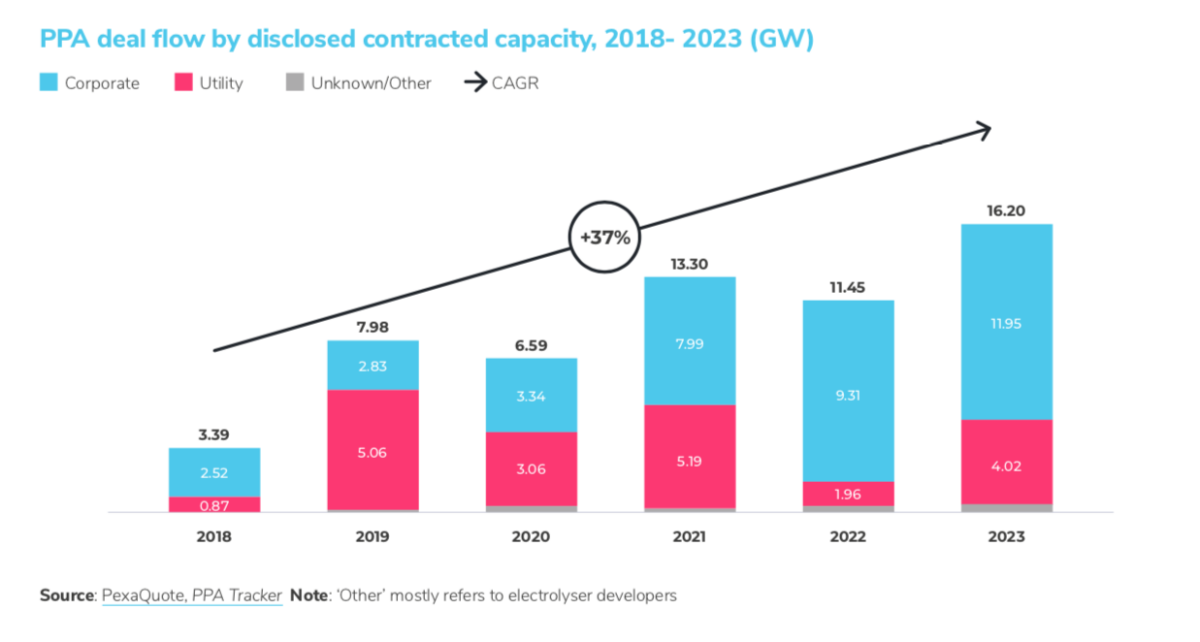

The European PPA market broke records for both the volume and number of deals signed in 2023.

According to a report from Swiss consulting firm Pexapark, 2023 saw 16.2 GW of disclosed contracted volumes, a 40% increase on the previous year. Deal count totalled 272 PPA announcements, a 65% increase from 2022.

Total solar PPA volumes were quadruple those of both onshore and offshore wind, accounting for 10.5 GW across 160 deals.

Pexapark says corporates played a significant role in driving the PPA market, securing 11.95 GW across 218 deals, a 28% increase in volume and a 66% year-on-year increase in deal count.

Utilities also saw a notable increase, securing 4.02 GW across 48 deals, more than double the 1.96 GW of 2022 and a 60% increase on last year’s 30 deals. Pexapark says utilities are evolving to address challenges like price volatility, intermittency and higher green standards.

Spain led the PPA market for the fifth consecutive year, totalling 4.67 GW, followed by Germany at 3.73 GW. Together, they accounted for 50% of the year’s volumes.

Italy (1.06 GW), United Kingdom (0.96 GW) and Greece (0.95 GW) rounded out the top five. Looking ahead, Germany is predicted to challenge Spain for the title of most active PPA market in 2024.

The consulting firm expects the PPA market to surpass 20 GW in 2024, as the market enjoys a stabilising pricing environment, decreased volatility, and growing maturity from both buyers and sellers in managing energy risks.

Pexapark expects new developments in hybrid PPAs, 24/7 green procurement approaches, PPAs for green hydrogen production, and multi-buyer PPAs to attract further attention in 2024.

It warns competition between contracts for differences (CfDs) and the PPA market could be a new challenge and says the introduction of new government credit guarantee schemes could expand the potential pool of offtakers entering the market.

“One of the main trends we see is the evolved role of utilities in the market, offering solutions to challenges posed by price volatility, intermittency and higher green standards,” said Luca Pedretti, Pexapark co-founder and COO. “Project owners, utilities and corporates are joining forces to leverage each other’s strengths, and the role of more structured PPAs will increase. Risk managers such as utilities have an opportunity to further evolve into ‘market integrators’ unlocking significant innovation in the market.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.