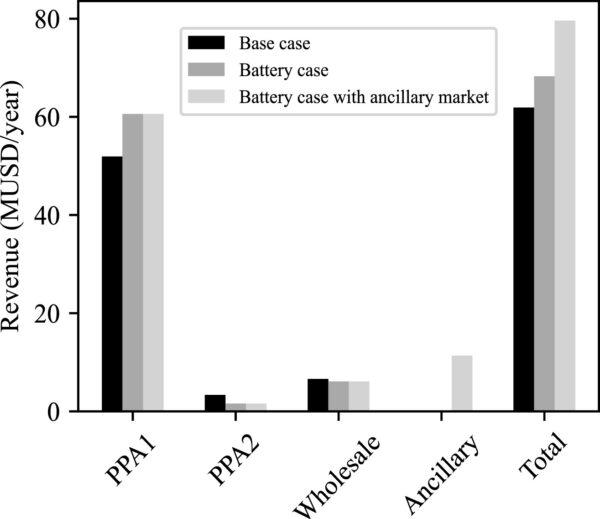

Scientists from Norway's Institute for Energy Technology have assessed the profitability of battery storage in hybrid hydropower and floating PV plants. They have found that the profitability of such facilities could be increased by up to 2%.

The scientists ran cost-optimal assessments for systems with and without batteries, and then compared their profitability in light of capacity markets, ancillary services, and energy arbitrage.

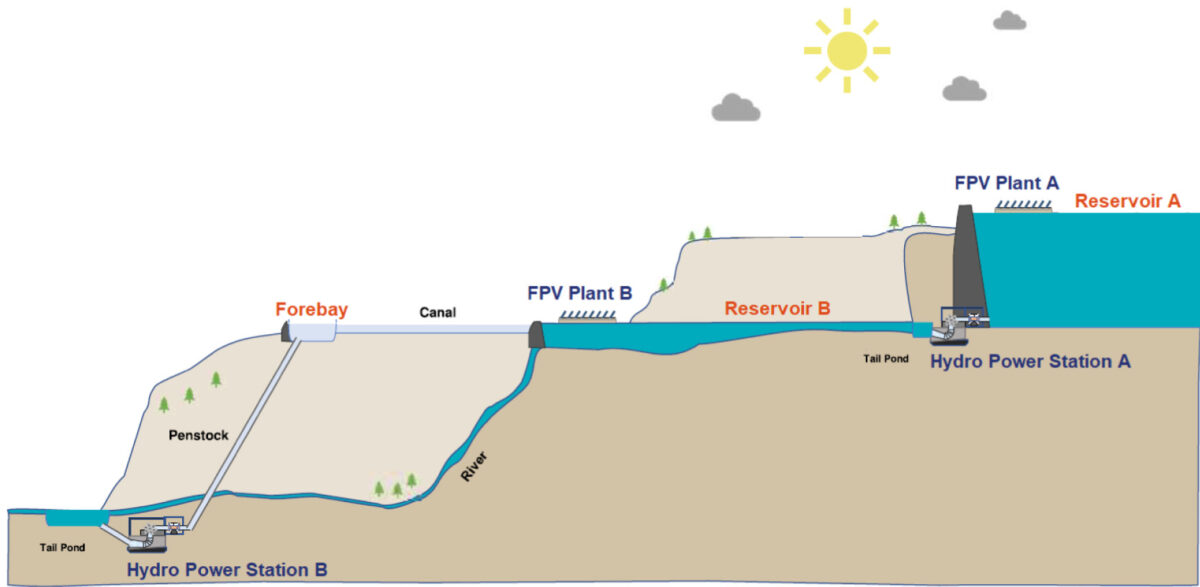

“This paper investigates the profitability potential for a viable business case for battery storage integration with utility-scale hybrid hydropower-solar photovoltaic plants,” they said. “It is based on a hypothetical, two-reservoir cascaded hydropower plant in Sub-Saharan Africa.”

“The co-optimized case, in which both battery and [floating PV] are optimized for cost-efficiency, increases profitability by 0.6% compared to the base case,” they said.

The academics presented their findings in “Profitability of battery storage in hybrid hydropower–solar photovoltaic plants,” which was recently published in the Journal of Energy Storage.

Image: Institute for Energy Technology, Journal of Energy Storage, CC BY 4.0 DEED

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.