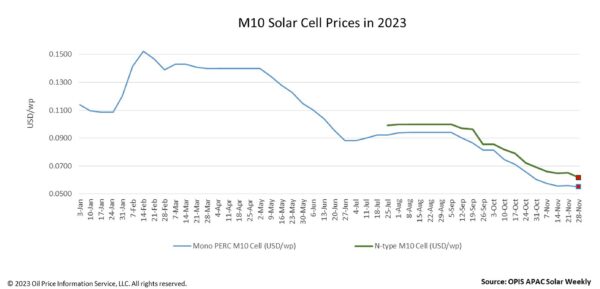

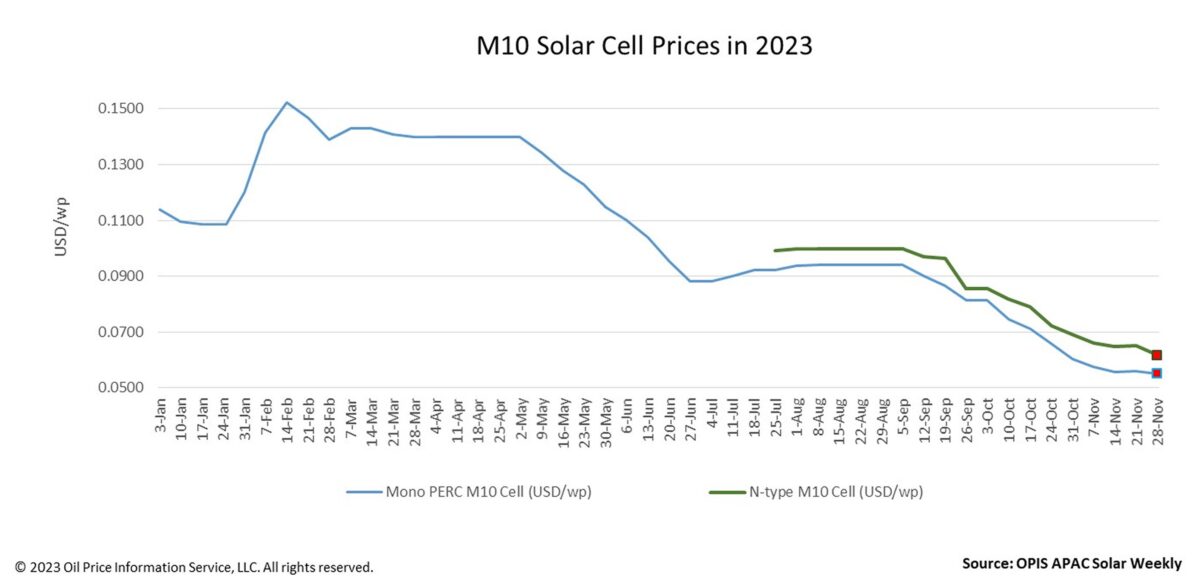

The FOB China prices of both PERC and TOPCon Mono M10 cells, the mainstream size of solar cells in the current solar market, continued their downward trajectory and were assessed at $0.0550 per W and $0.0616/W this week, respectively. This marks their lowest prices ever, according to OPIS data, amid falling prices of the entire supply chain and weak demand in China and its key export market.

Cell prices were negatively impacted by the ongoing price decline of the supply chain in China. Prices for China polysilicon and Mono PERC M10 wafers both decreased this week by 4.07% and 0.40%, respectively. The price of Mono PERC modules is approximately CNY1.011 ($0.14)/W, which is extremely close to the industry's psychologically low value of CNY1/W, while the prices of TOPCon modules are slightly higher at CNY1.077/W.

OPIS learnt from its market survey that cell manufacturers are making every effort to lower production costs as they are experiencing losses. One of the approaches is to buy wafers of reduced quality. According to a cell supplier, the Mono PERC M10 wafers with reduced quality are available on the China market for CNY1.7/pc while good quality wafers are still priced between CNY2.2/pc and CNY2.3/pc. This may resonate with a few downstream users who have been worried about the impact that this competition to cut production costs may have on module quality for 2024.

Another strategy for cell manufacturers to cut production costs is to outsource their production to original equipment manufacturers (OEMs). OPIS has learnt from the marketplace that a major cell manufacturer has an extremely high operating rate, as it has won numerous contracts from other cell companies that have outsourced their cell production.

According to OPIS’ market survey, manufacturers who outsource cell production benefit from the low cost brought by the high operating rates of OEMs, and could provide Mono PERC M10 cells at lower than CNY0.43/W in the China market. Those who continue to produce at low operating rates in their own production facilities are still offering it at around CNY0.45/W.

Sentiment in China remains bearish. According to the National Energy Administration, China deployed 13.62 gigawatts (GW) of solar in October, which presents a month-to-month decrease of 13.69%. This is the third straight month that China's newly installed solar capacity has declined.

China’s key export markets continue to offer little sunshine. A state-owned cell manufacturing enterprise claims that sales of its cells have been hindered since the second half of the year, especially in the cell export market. Purchasing Chinese cells has become a rare occurrence for their Southeast Asian consumers, although formerly they did so regularly.

“The module producers cannot use Chinese cells if they want to ship their products to the US market; the local Southeast Asian market has a very limited solar capacity to digest Chinese cells and modules,” this supplier explained.

Looking ahead, the industry anticipates that the price of Mono PERC M10 cells will continue to decrease, with industry discussions suggesting that it may drop to approximately CNY0.4/W very soon in the Chinese domestic market. This indicates that the sentiment in the cell market will remain subdued.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

This is a good sign for consumers. Bubbles burst at some point in time…

Adorable, I would like to get more skills on solar