Utility-scale renewables in Australia are in dire straits, with a new Clean Energy Council report saying that 2023 is shaping up as “the worst [year] for large-scale renewable energy investment” since it began tracking data in 2017.

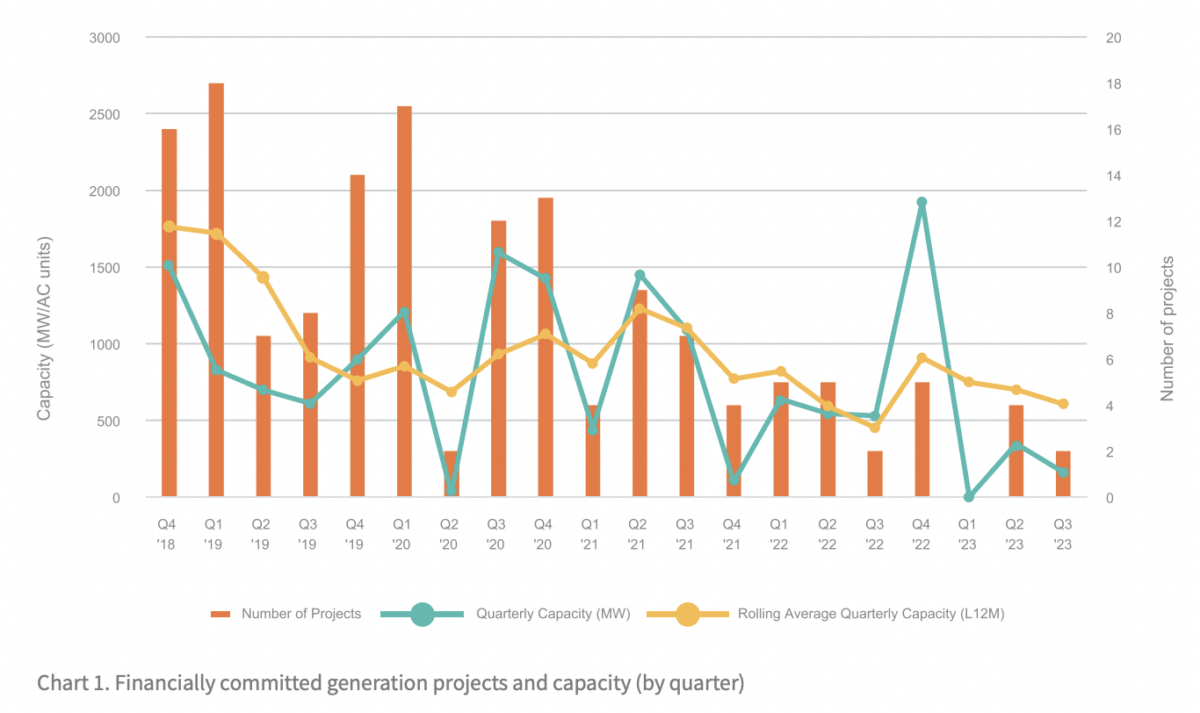

It seems that Australia’s large-scale segment is falling into a similar pattern to hydrogen of yesteryear – awash with grand announcements, but with very little getting off the ground. The Clean Energy Council said that just six large-scale projects, totalling 509 MW, have been financially committed so far this year. Between 5 GW and 7 GW would need to be financially committed every year to reach Australia’s target of 82% renewable penetration by 2030, it added.

Large-scale renewables in Australia have faced compounding issues in the years since 2020, when the nation’s Large-scale Renewable Energy Target (RET) scheme was achieved. The problems culminating this year include difficulties securing equipment due to high global demand, soaring insurance premiums and associated project costs, project planning and grid congestion, dropping margins as a result of ever-lowering midday wholesale energy prices, and staffing difficulties. Against this backdrop, project owners are struggling to secure offtake agreements that can properly reflect their costs.

While the third quarter has been particularly dismal, CEC said that all three quarters of 2023 so far rank in the bottom five for lowest new capacity commitments since 2017.

All of this exemplifies how badly needed the federal government’s Capacity Investment Scheme (CIS) is. While the scheme has been floating around for the last year, it initially looked to back just 6 GW of “dispatchable” renewable energy, largely storage. Last week, the scheme was massively broadened to encompass 9 GW of storage capacity and 23 GW of variable renewable generation, for a total of 32 GW nationally.

While the need for storage is acutely being felt in Australia as solar duck curves become so pronounced that balancing the grid is a precarious juggle, the stark downturn in investment of renewable energy generation projects are clearly also a problem for the nation’s transition. This probably factored into the federal governments decision to not just use the scheme to support storage, but also large-scale generation projects.

To continue reading, please visit our pv magazine Australia website.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.