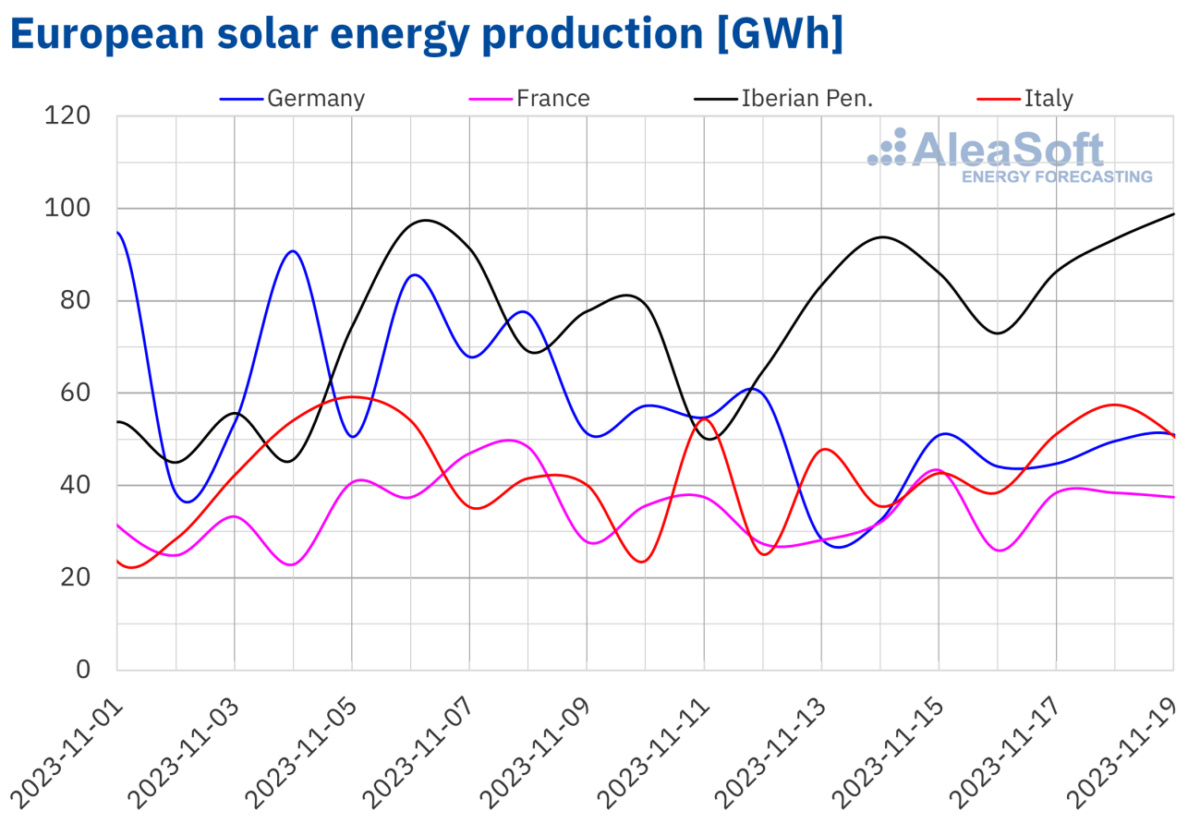

Solar photovoltaic, solar thermoelectric and wind energy production

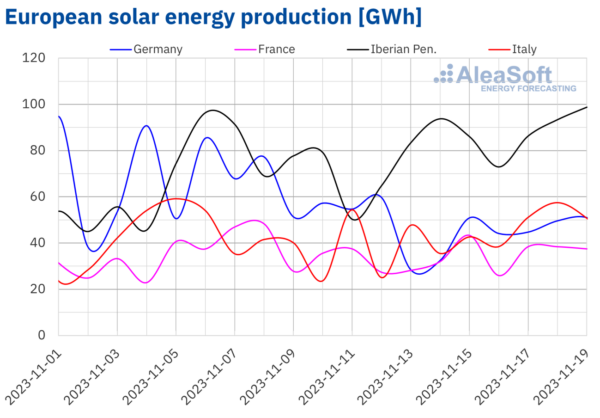

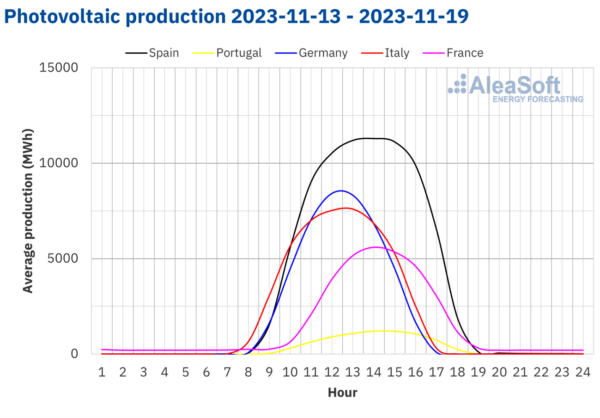

There was no homogeneous trending change in the main European electricity market's solar energy production in the week of Nov. 13 compared to the previous week. Solar energy production increased by 19% in Portugal, 18% in Italy and 16% in Spain. The opposite behavior occurred elsewhere, with German solar energy production falling 34% and the French solar energy production dipping 6.6%.

The Spanish market produced 84 GWh using solar photovoltaic energy on Nov. 19 – the highest capacity since Oct. 21 when Spain generated 89 GWh. Production was also the highest in history for November.

AleaSoft Energy Forecasting's solar energy production forecasts estimate PV energy will increase in Germany and Spain, but it will decrease in Italy for the week of Nov. 20.

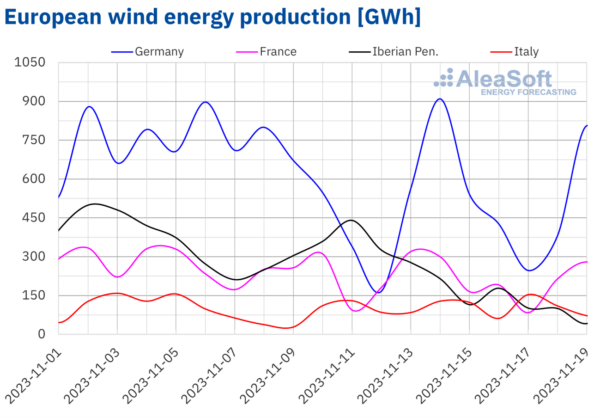

Wind energy production decreased in most of the analyzed European markets during the week of Nov. 13 compared to the previous week. The decrease ranged from 68% in the Portuguese market to 6.3% in the German market. Other markets saw an increase, however, with the Italian market recording a 33% wind energy generation increase and the French markets recording 3.5%.

Despite the inter‑week decline the German market produced 910 GWh using wind energy on Nov. 14 – the highest recorded capacity since mid‑March.

AleaSoft Energy Forecasting’s wind energy production forecasts indicate that wind production will increase in the Iberian Peninsula for the week of Nov. 20 and will decrease in the remaining markets.

Electricity demand

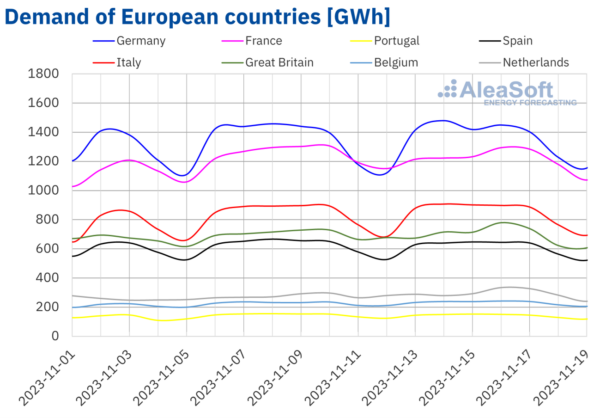

For the week of Nov. 13 there was no uniform change of trends for the main European markets when compared to the previous week. Electricity demand increased in Germany and Italy by 1%, 1.6% in Belgium and 5.5% in the Netherlands. Demand fell in the other markets, ranging from 2.7% in France and Portugal to 1.2% in Great Britain.

Most of the analyzed markets registered an increase in average temperatures in the third week of November compared to the week of Nov. 6. Increases ranged from 0.5 °C in the Netherlands to 1.9 °C in Spain. In Italy, average temperatures remained similar to those of the previous week. On the other hand, average temperatures decreased by 0.4 °C in Germany – the only market with decreases.

AleaSoft Energy Forecasting’s demand forecasts indicate that electricity demand will increase in most of the analyzed markets in the week of Nov. 20. Only the German and Dutch markets will register lower demand.

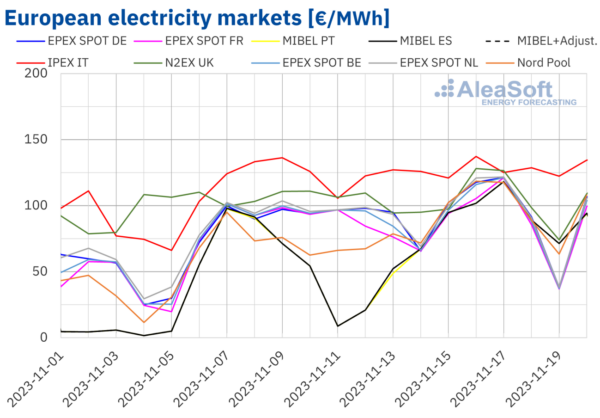

European electricity markets

Daily prices in the main European electricity markets progressively increased during the week of Nov. 13. On Friday, Nov. 17, prices exceeded €115/MWh in all markets analyzed by AleaSoft Energy Forecasting. Over the weekend prices dropped, however, resulting in lower weekly averages for some markets.

The IPEX market of Italy increased by 4.3%, the Nord Pool market of the Nordic countries jumped by 26% and the MIBEL market of Portugal and Spain grew by 48% and 49%, respectively. In contrast in the remaining markets, prices declined between 2.5% in the EPEX SPOT market of Germany and 8.8% in the EPEX SPOT market of France.

Popular content

In the third week of November weekly averages were below €95/MWh in most of the analyzed European electricity markets. The exceptions were the N2EX market of the United Kingdom with prices of €101.97/MWh, and Italy at €126.73/MWh. In contrast, the French market registered the lowest average price of €83.48/MWh. In the rest of the analyzed markets, prices ranged from €84.35/MWh in the Portuguese market to €91.51/MWh in the Nordic market.

The Nordic market reached a price of €180.01/MWh from 17:00 to 18:00 on Thursday, Nov 16. This market price was the highest since the first half of March. On the other hand, the German, Belgian, French and Dutch markets registered hourly prices below €2/MWh on Nov. 14 and 19. In the case of the German market, on Tuesday, Nov. 14, there were three hours with negative prices.

During the week of Nov. 13, the increase in the average price of gas and CO2 emission rights had an upward influence on European market prices. Over the weekend, the combination of lower demand and high renewable energy production helped prices fall in most markets. In the case of the French market, wind energy production increased and demand fell for the week as a whole. This contributed to this market registering the lowest weekly average.

AleaSoft Energy Forecasting’s price forecasts indicate that in the fourth week of November prices in most European electricity markets might increase. Declining wind energy production and rising demand in most markets might contribute to this behavior. However, the increase in wind energy production in the Iberian Peninsula might lead to lower prices in the MIBEL market.

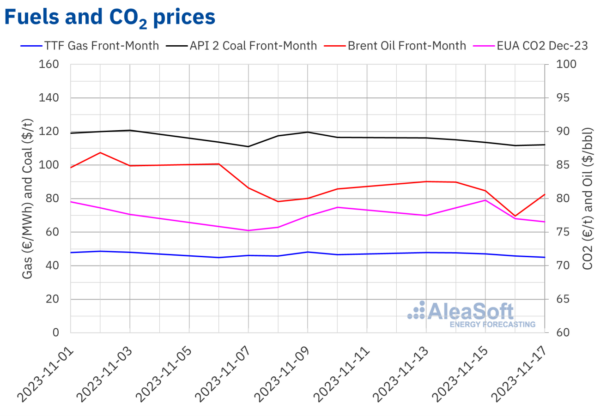

Brent, fuels and CO2

On Monday, Nov. 13, Brent oil futures for the Front‑Month in the ICE market registered their weekly maximum settlement price, $82.52/bbl. This price was 3.1% lower than the previous Monday. In the following days of the third week of Nov. prices declined to reach the weekly minimum settlement price, $77.42/bbl, on Thursday, Nov. 16. This price was 3.2% lower than the previous Thursday and the lowest since the first half of July. On Friday, prices increased again. On that day, the settlement price was $80.61/bbl. This settlement price was 1.0% lower than the previous Friday.

In the third week of November, high supply levels, rising US stockpiles and negative data on US economic evolution exerted their downward influence on Brent oil futures prices. Concerns about demand in China also contributed to the price decline. However, expectations of further production cuts by OPEC boosted prices in the last session of the third week of November.

On Monday, Nov. 13, TTF gas futures in the ICE market for the Front‑Month reached the weekly maximum settlement price, €47.87/MWh. This price was 6.8% higher than the previous Monday. However, according to data analyzed at AleaSoft Energy Forecasting, prices started to decline on Tuesday. As a result, on Friday, Nov. 17, they registered the weekly minimum settlement price of €45.06/MWh. This price was 3.4% lower than the previous Friday. For the week as a whole, the average was 0.9% above that of the previous week.

During the third week of November, high European reserve levels and mild temperatures in Europe contributed to the decline in these futures prices. However, fears of possible supply disruptions due to instability in the Middle East and lower temperatures might exert an upward influence on prices in the coming days.

As for CO2 emission rights futures in the EEX market for the reference contract of December 2023, on Monday, Nov. 13, they registered a settlement price of €77.48/t. This price was 1.6% lower than the last session of the previous week but 2.2% higher than the previous Monday. On Tuesday and Wednesday, prices increased. As a result, on Wednesday, Nov. 15, the settlement price, €79.74/t, was the weekly maximum. This price was 5.3% higher than the same day of the previous week. In the last sessions of the week, prices fell again. On Friday, Nov. 17, these futures registered their weekly minimum settlement price, €76.55/t. This price was 2.7% lower than the same day of the previous week. The weekly average was 1.7% higher than the previous week.

AleaSoft Energy Forecasting’s analysis is based on the potential for energy markets in Europe and the financing and valuation of renewable energy projects.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.