Despite 2023 thus far demonstrating that end demand in the PV market continues to be strong, spot prices per watt have been anything but. The first half of this year has shown what the consequences can be when supply and demand fall out of balance.

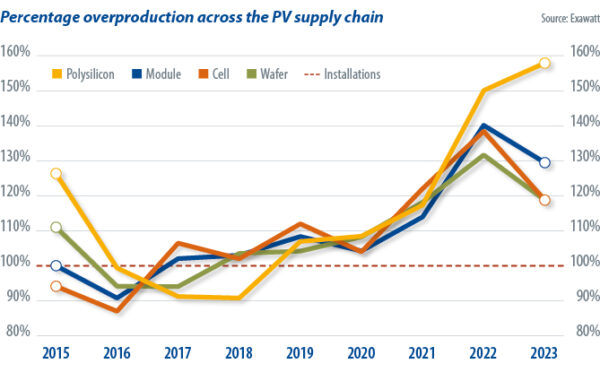

For many years, Exawatt’s production estimates across the PV supply chain have sat broadly within 10% of our global PV installation estimates. This began to change in 2021, when we saw production begin to pull ahead of installations by about 15%. In 2022, the gap grew significantly, to between 30% and 40% for wafers, cells, and modules.

Overproduction didn’t end in 2022. In 2023, comparing the initial production targets announced by manufacturers and Exawatt’s own installations forecast revealed that overproduction not only continued but was on course to increase.

It’s safe to say that the growing gap between production and installations has not been a reflection of weak end demand. Exawatt currently expects global PV installations to exceed 400 GW in 2023, an increase of approximately 60% compared with 2022 figures. Rather, the growing gap between production and installation is a consequence of the exceptional speed at which production has increased, even when compared to hugely impressive installation growth.

Cause for concern

Based on our discussions with other PV industry analysts, we believe our figures, that suggest unsustainable levels of overproduction, are not unique. The same trend has also been observed by many of our peers. This leads us to question whether manufacturers’ initial production targets will prove to have been excessively optimistic.

When production levels significantly exceeded installations in 2022 and the first half of 2023, inventories built up throughout the supply chain, leading to an inevitable price crash. In the first half of 2023, spot prices, from wafers to modules, dropped to record lows, with polysilicon prices also taking a substantial hit. This has left limited room for further price declines. Any lower, and even the lowest-cost manufacturers will struggle to turn a profit.

In an attempt to avoid further inventory build-up across the supply chain, some manufacturers scaled back their production plans for 2023. This trend, combined with continued strong end-demand growth, and bolstered by the number of installations in China exceeding expectations, leads Exawatt to project that overproduction in 2023 will likely fall back to within a 20% to 30% range for wafers, cells, and modules.

As a result of the scaling back of production, we believe that current challenges around high inventory levels should prove to be temporary, with production volumes in the second half of 2023 somewhat dependent on how quickly inventory levels can be reduced. Note that we expect that when manufacturers release final production numbers for 2023, our final estimates for wafers, cells, and modules will converge somewhat.

Despite hitting levels higher than those seen before 2022, continued overproduction within the 20% to 30% range might not be so unreasonable in a rapidly growing market – especially when accounting for the delay between production and installation. To put this into perspective, Exawatt estimates the compound annual growth rate in PV installations to have been in the region of 25% in the 10-year period to 2023.

Here to stay

Although overproduction looks likely to return to a more stable level this year, substantial overcapacity seems set to remain throughout the supply chain. Existing major players and new, smaller entrants to the market continue to announce ambitious capacity expansion plans. With these plans far outstripping even the most optimistic forecasts for end demand, substantial overcapacity is unlikely to diminish over the coming years, making unsustainable levels of overproduction an ongoing risk. In 2022, annual module capacity stood at approximately 2.8 times greater than installations. Exawatt’s forecast, based on the expansion plans that have been announced so far, sees manufacturing capacity increasing to nearly four times that of forecast installations by 2025, assuming all announced capacity expansions come to fruition.

Taking a longer-term view, in Exawatt’s high-case scenario, we currently forecast that 1 TW of annual solar installations will be achieved shortly before 2030. Beyond this, a number of possible net-zero scenarios can be achieved with different energy generation mixes, and in most scenarios we model solar demand flattening off in the 2030s.

No matter what route is taken to decarbonization, solar will be key. The industry is well on track to deliver what is necessary, from a manufacturing point of view. Within just a couple of years, manufacturers will be capable of delivering production of the scale required in the 2030s onwards. Unless new capacity is replacing obsolete manufacturing lines, further capacity expansions will only exacerbate the overcapacity that already exists.

About the author: Molly Morgan is a research analyst at Exawatt. Her areas of focus include tracking and forecasting evolution in solar module efficiency and architecture. She analyzes solar manufacturing capacity, production, and financial data.

About the author: Molly Morgan is a research analyst at Exawatt. Her areas of focus include tracking and forecasting evolution in solar module efficiency and architecture. She analyzes solar manufacturing capacity, production, and financial data.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

In general your article makes sense. But there are an other two factors that it seems you didn’t mention, one is geopolitical factor, the other is cost competitiveness. If you are available, we could find a time to discuss. Thanks. Samuel