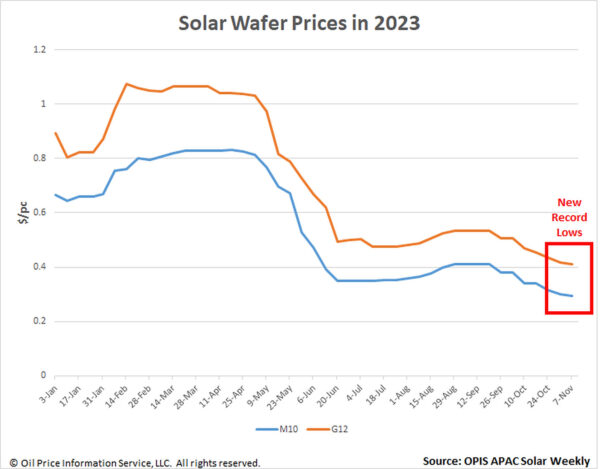

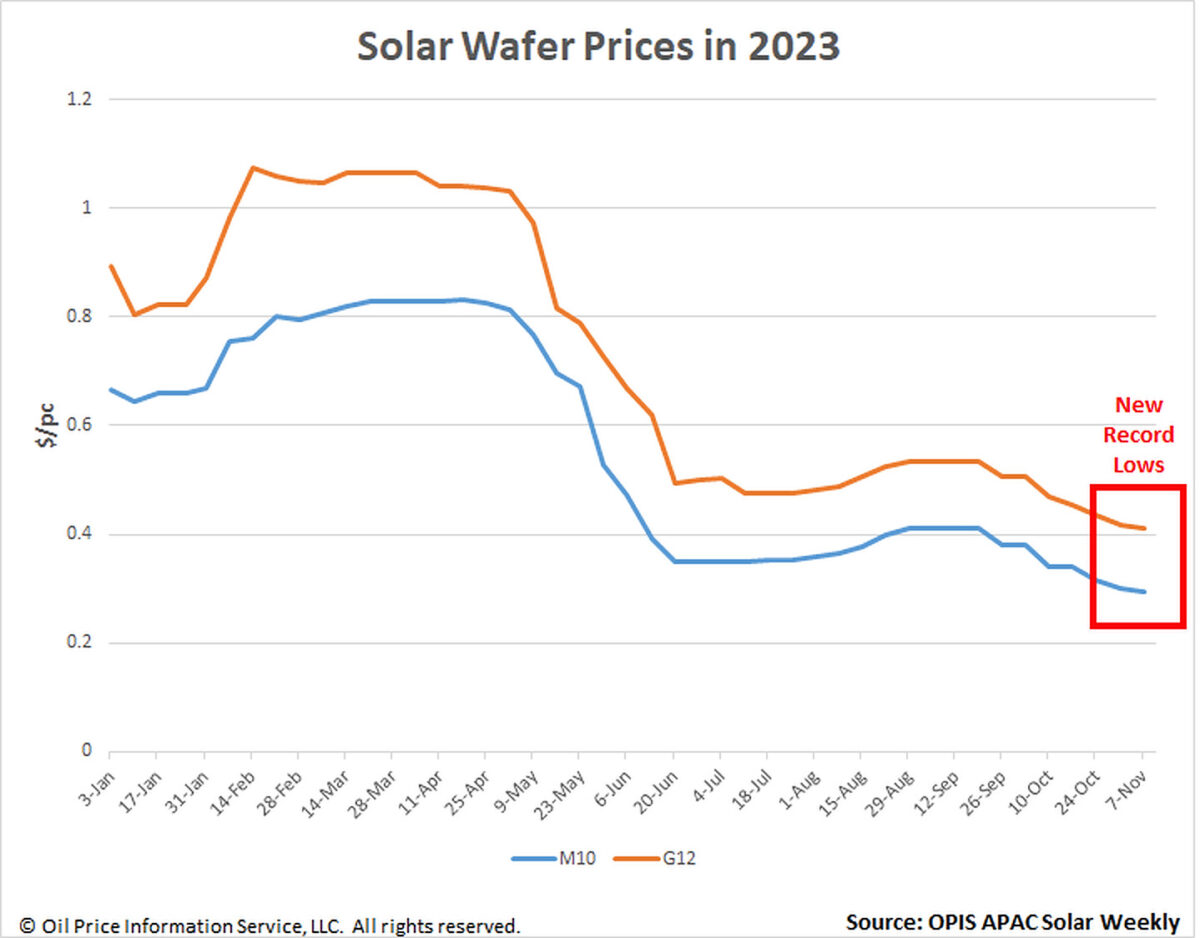

Mono M10 and G12 wafer prices could find soon find a bottom as they extended losses this week to new historic lows according to OPIS data, decreasing 2.33% and 1.44% to $0.293/pc and $0.410/pc, respectively.

While the wafer market remains sluggish, this week’s price drop was less dramatic than it was in the prior two weeks. This is because wafer prices are projected to bottom out soon, a source upstream said.

Even if polysilicon in China is priced at CNY50 ($6.86)/kg, the cost of M10 wafers made by major manufacturers would still be a little over CNY2/pc, according to a polysilicon seller. A CNY2/pc selling price won’t be reached until the price of high-purity quartz crucibles also plummets, he added, concluding therefore that the bottom selling price for M10 wafers could be around CNY2.1/pc and CNY2.2/pc.

The price difference between wafers offered by major producers and the rest is narrowing. Large and small producers alike have reduced M10 wafer prices to between CNY2.3/pc and CNY2.4/pc, after a Tier-2 wafer manufacturer took the initiative to cut prices, according to a veteran market observer.

Wafer companies are no longer profitable given the present pricing of polysilicon, a developer said. OPIS assessed that China polysilicon prices fell almost 5% to CNY65.875/kg this week. To minimize losses, wafer businesses would rather cut production output further than sell wafers at a significant loss, suggesting that wafer manufacturers are no longer able to afford additional price reductions, the source added.

The only encouraging news in the wafer market is that China polysilicon prices are currently falling more than wafer prices, which could help wafer makers make up for some of their losses, according to a downstream source. An end to the downtrend in wafer prices is within reach as polysilicon prices approach their cash cost, the source added.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.