There’s something curious going on with PV market data. In July 2023, Rystad Energy first pointed out a gap in our understanding of module inventory in Europe but the numbers were arguably overestimated. So what’s going on? Before we dive into the data let’s introduce some nuance and recognize that the global PV sector is still experiencing growing pains, not least when it comes to accessible, reliable market intel.

For many years, the PV export numbers from China to Europe, and the installation numbers from government agencies and commercial market research organizations, revealed a large gap in our knowledge. For example, in 2022 around 86 GW of modules were imported into Europe. However, only 42 GW was installed in the same year. What explains this gap?

Some of it can be accounted for by the difference between European Union installations and those in non-EU countries such as Russia, Ukraine, Switzerland, Norway, and the United Kingdom. Looking at the numbers, though, this accounts for less than 10% of the gap between the supply to the European Union and the reported installation figures. More of the gap can be explained by a combination of original equipment manufacturer (OEM) modules and the stock that is being held in a growing market, as German PV industry veteran and pv magazine founder Karl-Heinz Remmers has argued in his online market commentary.

According to Remmers, normal inventory levels would comprise two to three months worth of solar module supply. For 2022, that would have been equivalent to around 8 GW, maybe more in a growing market but not much.

The reality is that distributors have already scaled up inventory tremendously, especially following the logistical chaos caused by the Suez Canal obstruction of 2021 and the commencement of Russia’s invasion of Ukraine in 2022. There’s been a scramble for warehousing, including from manufacturers holding stock, often in harbors. So, the big question is: Where is all the excess stock alluded to by Rystad?

Imaginary numbers

The short answer is that it doesn’t exist. Insiders know very well that the gap between primarily Chinese import and the official numbers is most likely explained by the fact that PV installation registration is lacking.

For example, let’s look at the Netherlands. Say the estimate for this market in 2022 is 4 GW of installed PV capacity. That number was first published at the beginning of 2023 as a temporary figure by government agency Statistics Netherlands. However, a revised number is usually published by the agency 18 months later, often with new data correcting the initially published figure.

That is the process in the Netherlands, a densely populated country with a sophisticated bureaucracy. If even in the Netherlands not all installations are registered, imagine what the situation is in many other countries.

The real figure for installed capacity is higher than official numbers suggest. Yet most commercial market-research organizations still rely heavily on official numbers, just like national solar trade associations. Therefore, the gap between import and official numbers, whether by government or commercial market-research agencies, is partly explained by EU27 and non-EU27 reporting, OEM imports, and growing stock in a growing market, but the predominant factor is non-registered systems.

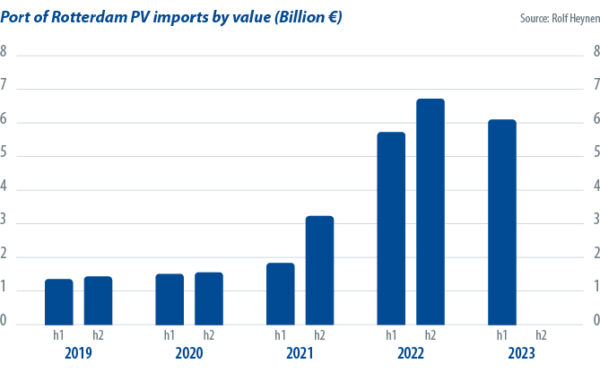

European imports

In 2022, data from Dutch customs showed Rotterdam harbor was responsible for 45% of European PV imports. That equated to a total import value of €11.6 billion ($12.3 billion), up from €5.1 billion a year before (see chart). For the first half of 2023, the total import value was €6.1 billion. That was less than in the second half of 2022 but higher than in the first half of 2022.

The PV industry needs to step up. With solar singled out as the leading climate change solution, alongside wind energy, and a paper published in the Oct. 17 edition of “Nature Communications” concluding that we may have already passed the tipping point where solar energy comes to dominate global electricity markets, more collaboration is required to maximize the PV sector’s potential.

A great step would be for all manufacturers and distributors to share their data, monthly, with an independent researcher or research organization. This is done in many other sectors and gives all parties great insights into market share and trends and forecasts, lowering risk for the market as a whole.

About the author: Rolf Heynen is an entrepreneur, writer, public speaker, and independent solar market researcher.

About the author: Rolf Heynen is an entrepreneur, writer, public speaker, and independent solar market researcher.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Pretty clear statement in the article on Rystad “poor work” or “poor work with a purpose”:

“Where is all the excess stock alluded to by Rystad? Imaginary numbers The short answer is that it doesn’t exist.”

Time to tell that to all politicians who habe been mislead by ESMC and there Members using the (with a purpose?) poor Rystad numbers.

And Rolf Heynen is right:

The data base of a our global industry and the associations is a desaster.

Which is only the lack of will or understanding of the massive impact wrong numbers have.

We had such data in Germany from 2003 on production of cells, etc. in Germany. Initiated by our former industry association DFS (I was part of the working group) and collected by an independant third party. That was pretty accurate but did go down with the industry after the bad descisions of the conservative-liberal goverment in 2012.

Allthough in Germany the data base for installed systems is getting better and better hugh impact are missing and always create higher number once data ist completed in the following year.

So- for example a 600 MWp (!) plant in Leipzig is nearly ready for grid connection (we feel in 2023), but those modules are already installed – among those GWp which are NOT IN RYSTADS “wet dreams” warehouses.