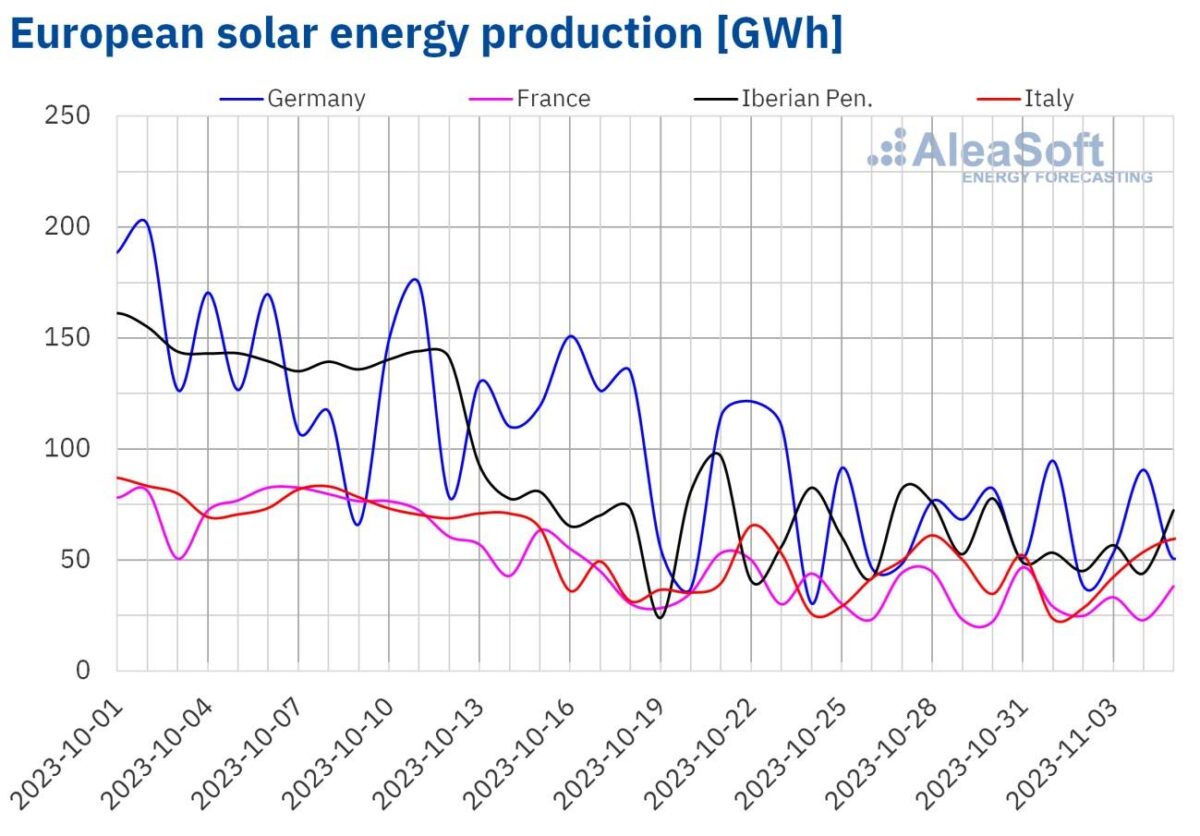

Solar photovoltaic, solar thermoelectric and wind energy production

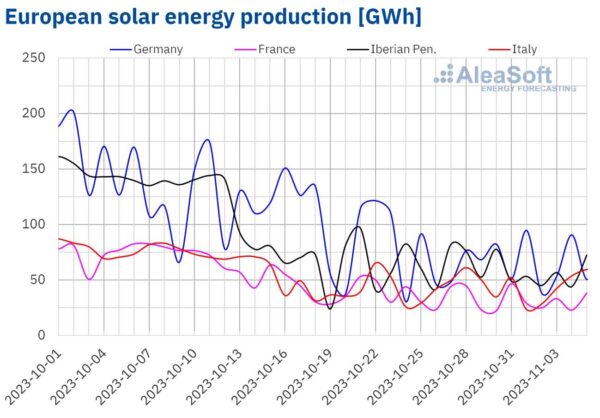

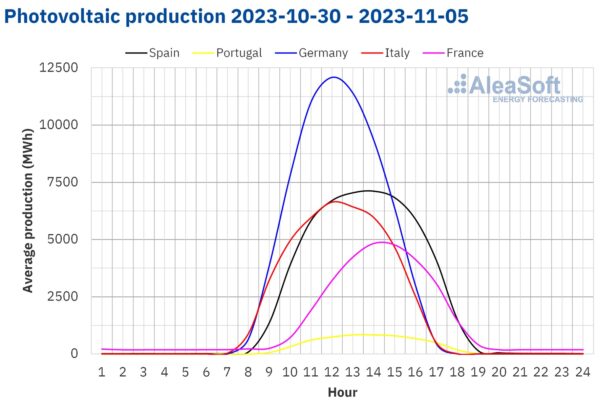

Most major European markets recorded less solar energy production in the week of Oct. 30 compared to the week prior. This is unsurprising as the fall progresses and the days are getting shorter. Compared to the major European markets, Spain's solar energy production dropped the most by 14%. The German market registered the smallest decline with 2.4%. The exception was the Portuguese market as solar energy production grew by 8.6%.

According to projections by AleaSoft Energy Forecasting, solar energy production will increase in Germany, Spain and Italy in the week of Nov. 6.

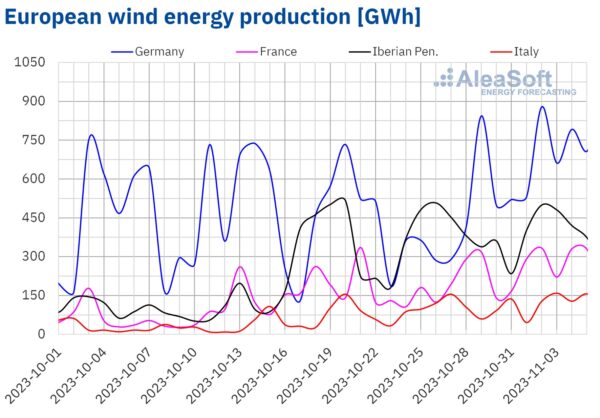

Wind energy production offset solar energy production losses in the week of Oct. 30. All major European markets recorded an increase in wind energy generation in the week of Oct. 30 compared to the previous seven days. Spain was the exception, however, as wind energy production was high, but there was almost no difference in the week-on-week total.

Germany's wind energy generation increased the most with 67% and Portugal grew the least at 12%. The Italian market set a record high by generating 846 GWh of wind during the first week of November. Portugal ended the week generating a total of 567 GWh, which is the second-highest volume after the country recorded 587 GWh of wind generation on Feb. 8, 2016.

Wind energy production will decrease in all analyzed markets in the week of Nov. 6, according to AleaSoft Energy Forecasting’s wind energy production forecasts.

Electricity demand

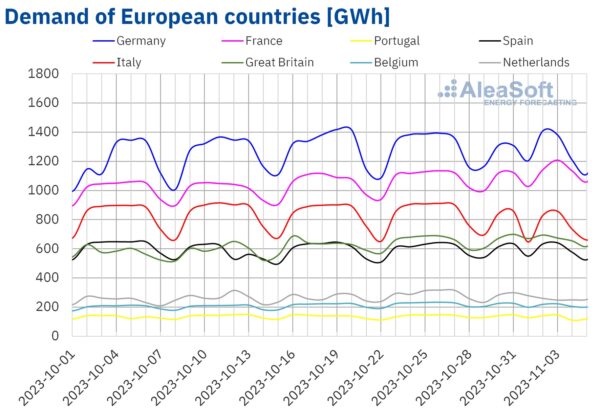

Most major European markets saw less electricity demand in the week of Oct. 30 compared to the previous week. All Saints’ Day on Nov. 1 was celebrated in most of Europe – except Great Britain – which contributed to declining demand. The Italian market dropped the most with 8.5%, while Spain dropped the least with 1.2%. Only France and Great Britain registered an increase in electricity demand with 2.5% and 2.2%, respectively.

During the same period, average temperatures slid in all analyzed markets, except in the Netherlands. These decreases ranged from 2.0 C in France to 0.5 C in Belgium.

Demand will increase in all analyzed markets in the week of Nov. 6 compared to the previous week, according to AleaSoft Energy Forecasting’s demand forecasts.

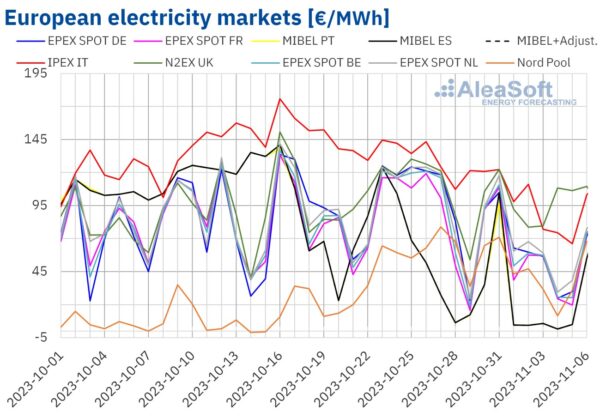

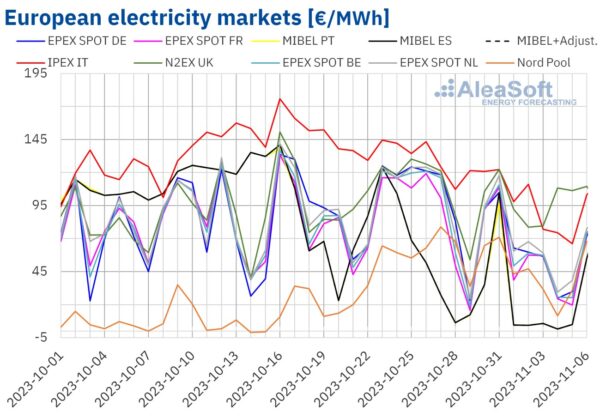

European electricity markets

Europe's main electricity market prices fell in the week of Oct. 30 compared to the previous week. The MIBEL market of Spain and Portugal dropped by 59% and 61%, respectively. The N2EX market of the United Kingdom decreased the least by 9.1%. In the other markets, prices fell, such as 27% in Italy's IPEX market to 39% in Germany's EPEX SPOT market.

Most analyzed European electricity markets recorded weekly averages below €70/MWh in the first week of November. The Italian and British markets were the exceptions, where prices averaged €95.72/MWh and €99.08/MWh, respectively.

The Portuguese and Spanish markets registered the lowest average prices of €21.77/MWh and €23.02/MWh, respectively. In the other remaining markets, prices ranged from €42.87/MWh in the Nord Pool market of the Nordic countries to €66.77/MWh in the Dutch market.

The MIBEL market recorded the lowest hourly prices in the first week of November. This market registered 19 hours of €0.00/MWh from Nov. 3 to 5. The MIBEL market also recorded the lowest daily prices of the main European markets from Oct. 26 to Nov. 6, except for Oct. 31.

The Italian market registered a minimum hourly price of €2.46/MWh. This price, registered from 14:00 to 15:00 on Nov. 5, was Italy's lowest since May. The Nordic market recorded €142.69/MWh from 18:00 to 19:00 on Nov. 6, which is the highest price since April.

Falling gas prices and CO2 emission rights, declining market demand, and increased wind energy generation led to lower prices in European electricity markets during the week of Oct. 30. Solar energy production increased in Portugal, which contributed to the country registering the lowest weekly average.

According to AleaSoft Energy Forecasting’s price forecasts, prices will increase in most European electricity markets analyzed in the second week of November. An increase in demand and a decrease in wind energy production will influence this behavior.

Brent, fuels and CO2

The ICE market, Brent oil futures for the Front‑Month registered their weekly maximum settlement price of $87.45/bbl on Oct. 30. This price was 2.6% lower than the previous Monday. On Wednesday, Nov. 1, they registered their weekly minimum settlement price of $84.63/bbl. This price was 6.1% lower than the previous Wednesday. Despite recovering slightly on Thursday, in the last session of the first week of November settlement price fell below $85/bbl again to reach $84.89/bbl. This price was 6.2% lower than the previous Friday.

During the first week of November, prices fell due to diminishing fears that the conflict in the Middle East would affect supply. At the beginning of the folllwing week, confirmation that Russia and Saudi Arabia will maintain planned production cuts until the end of 2023 influenced Brent oil futures prices upwards.

As for TTF gas futures in the ICE market for the Front‑Month, on Monday, October 30, settlement prices reached their weekly maximum, reaching €50.55/MWh. For the rest of the week, settlement prices remained below €50/MWh. On November 1, settlement prices reached their weekly minimum, €47.76/MWh. This price was 4.3% lower than the previous Wednesday.

Higher than usual temperatures for the season and high levels of European reserves kept prices below €50/MWh in the first week of November. In addition, Israel resumed its gas exports to Egypt, which also led to a downward influence on prices.

Settlement prices of CO2 emission rights futures in the EEX market for the reference contract of Dec. 2023 remained below €80/t during the first week of November. On Wednesday, Nov. 1, these futures reached their weekly maximum settlement price, reaching €79.51/t. Prices declined on Thursday and Friday, which resulted in a settlement price on Friday, Nov. 3, of €77.65/t, the weekly minimum This price was 2.1% less than the same day of the previous week and the lowest since mid‑January.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Instead of land which can be use as forest or agriculture the roof top of houses,office,hospitals,school should be use for the shake of environment

I have noticed which land is fertile for forest or agriculture is used to solar panel

It is not good for environment thank you