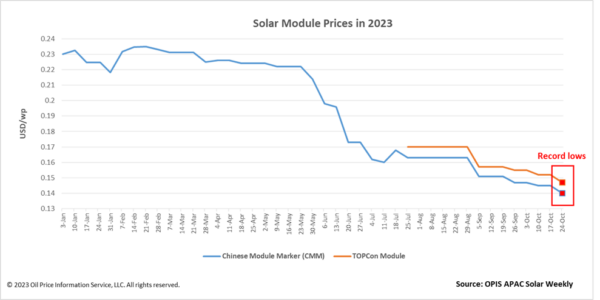

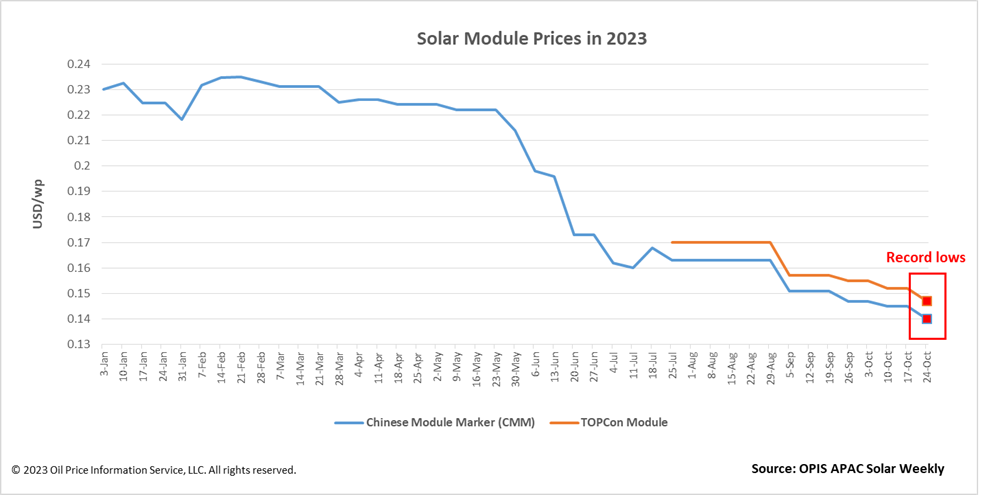

The Chinese Module Marker (CMM), the OPIS benchmark assessment for Mono PERC modules from China, and TOPCon module prices, declined this week by the same amount of $0.005 per Wp to $0.140/wp and $0.147/wp respectively. With falling upstream prices and weak demand in China with its key export markets these are the lowest prices ever recorded, according to OPIS data.

Upstream prices across the supply chain in China continue to slide, weighing on module prices. China polysilicon prices extended losses by falling 3.33 yuan/kg, or 4.19%, to 76.17 yuan/kg this week. The wafer and cell segments saw prices fall for a third consecutive week, with Mono G12 cells seeing a 10.45% plummet to $0.0703/wp. Buyers and sellers of modules alike reported lower prices during OPIS’ weekly market survey. P-type modules are on the threshold of 1 yuan/W, while n-type modules are a little more than 0.10 yuan/W higher, a developer said.

Sentiment in China remains bearish. While domestic demand will come from fourth-quarter installations, this is typically a low-demand period, concurred multiple sources. As available land for projects is decreasing, demand will not be as high as hoped, one module manufacturer explained. Orders signed last quarter have been cancelled and buyers want to re-sign contracts at current low prices, another module manufacturer said. The supply picture is gloomy, too, as China’s module manufacturers are sitting on 1-2 months of inventory, according to one seller.

China’s key export markets continue to struggle, with inventories in the European distributed market so large that there’s “basically no need to replenish supply,” according to one source. Even with low prices, approvals for ground-mounted projects are slow and there is insufficient labor to set up projects, they said. Over in Latin America, Brazil’s market is also facing weakness. Brazil is “hoarding too much” inventory, a seller said.

Looking ahead, module prices are expected to continue falling as we reach the end of the year, OPIS learned during its weekly market survey. Many sources pointed to how the 1 yuan/W era has arrived already, with a recent major China procurement tender seeing P-type module bids of as low as 0.993 yuan/W. There is “brutal competition” coming, and “industry consolidation may see more momentum,” according to one solar market veteran.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

We all complain about the Chinese monopolising the PV marketplace. Their competition with other countries is absolutely brutal, but we need to remember that the Chinese are just as ruthless competitively with each other too. Who ultimately wins in this game ? I don’t know